Trade Trends News

Trade Trends News

01-04-2025

01-04-2025

Last Wednesday, U.S. President Donald Trump followed through on his weeks-long threat to impose new tariffs on imported vehicles, announcing a 25% import tax on non-U.S.-manufactured cars, set to take effect this week.

The tariff increase will be implemented starting at 12:01 AM Eastern Time (04:01 GMT) on April 3, applying an additional 25% duty on imported vehicles, on top of existing tariffs. The base tariff rate for U.S. auto imports currently stands at 2.5%.

Impact on Automakers: From Least to Most Affected

According to research firm GlobalData, half of all cars sold in the U.S. last year were imported. Among major automakers, General Motors (GM.N) relied on imports for 46% of its sales, while Ford (FORD.O) had a lower dependency at 21%.

Many components used by GM and Ford originate outside the U.S., with a significant portion sourced from Mexico. These companies could face pressure as the impact on fully assembled vehicles and auto parts becomes clearer by April 2.

Tesla (TSLA.O), however, will be minimally affected since all its production and assembly operations are domestic. In response to the tariffs, automakers may increase localized production to offset costs, benefiting U.S.-based suppliers in the long run.

This shift in manufacturing and sourcing strategies is likely to disrupt global supply chains as companies restructure procurement and production operations.

Tariffs to Affect Key U.S. Trade Partners

The 25% tariff will apply to cars and trucks manufactured in countries that have free trade agreements with the U.S., including Canada, Mexico, and South Korea, which will be heavily impacted. Additionally, Japan and European automakers—notably from Germany, Italy, and the UK—will also be affected.

25% Tariff on Auto Parts Delayed

The 25% tariff will also cover key imported auto parts, as specified in Trump's announcement, including:

· Engines and engine components

· Transmissions and drivetrain components

· Electrical parts

However, the implementation of tariffs on auto parts may be delayed by one month, with the exact start date to be announced in an upcoming Federal Register notice—but no later than May 3.

This notice will also specify the exact tariff codes for affected components, which were not disclosed in Trump's announcement.

Partial USMCA Exemptions

Under the plan, vehicles and parts that meet the USMCA rules of origin will qualify for partial tariff exemptions, but only based on the value of their U.S.-made content.

For example, a truck manufactured in Mexico with 45% U.S.-made components would still face a 25% tariff on the remaining 55% of its value. The same principle applies to auto parts that comply with USMCA origin requirements—any non-U.S. content will be taxed.

However, determining these content levels will be a complex process. Until the U.S. Department of Commerce and U.S. Customs and Border Protection (CBP) establish a formal procedure for tariff calculations on non-U.S. content, USMCA-compliant auto parts will remain tariff-free, with no set deadline for finalizing this process.

Impact on Auto Retailers and Suppliers

With higher costs on imported vehicles and components, auto retailers will face increased expenses. This could lead to:

· Higher vehicle prices

· Weakened consumer demand

· Slower sales growth

Suppliers reliant on international markets may struggle to absorb tariff costs or pass them on to automakers, leading to profit margin compression.

However, analysts at JPMorgan suggest that dealerships' parts and service divisions may benefit from the tariffs, as higher vehicle costs could encourage consumers to keep their existing cars longer, increasing demand for repairs and maintenance services.

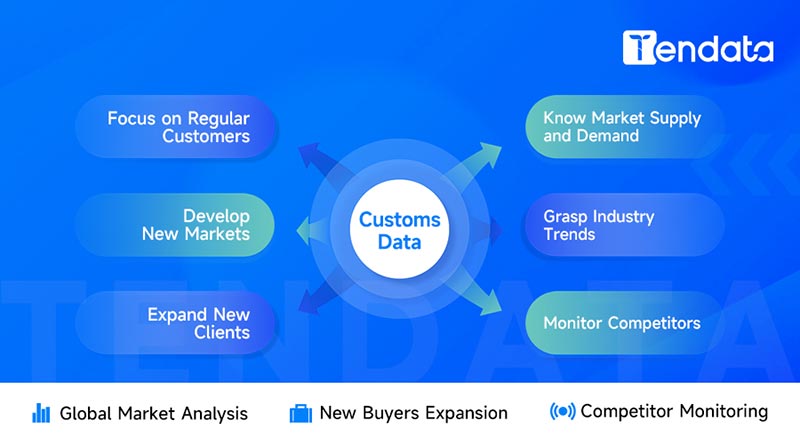

Tendata provides more than 10 billion trade data, covering 228 countries and regions, accumulating more than 10 billion trade transaction details, and a trade database of more than 230 sub-industries.

Searching product keywords or HS codes in Tendata iTrader will allow you to view tens of thousands of active potential customers in the past year, as well as customers' purchase records, including purchase amount, quantity, time, frequency, and their suppliers/buyers. These companies in the Customers List are all customers with needs, and can be used for foreign trade customer development.

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship