Trade Trends News

Trade Trends News

18-02-2025

18-02-2025

The sharp rise in global gold prices has cast a shadow over jewelry purchases during India's wedding season. Chinese dealers are offering discounts to attract buyers.

Last week, the benchmark gold price reached a record high of $2,942.70 per ounce, as investors flocked to safe-haven assets amid concerns that new tariffs in the U.S. could trigger a global trade war.

Due to the price hike, customers are hesitant to buy gold during the wedding season. B. Muthuvenkatram, a jeweler in Coimbatore, stated, "They keep calling to ask when prices will drop and when would be the best time to buy."

In India, weddings are the main reason for purchasing gold. Gold bars in the form of jewelry are an essential part of bridal attire and are also highly popular gifts.

The jewelry market is currently experiencing a significant downturn, with a decline of 70-80%. Surendra Mehta, the Secretary of the All India Gems and Jewellery Trade Federation, said that jewelers across the country are facing sluggish sales.

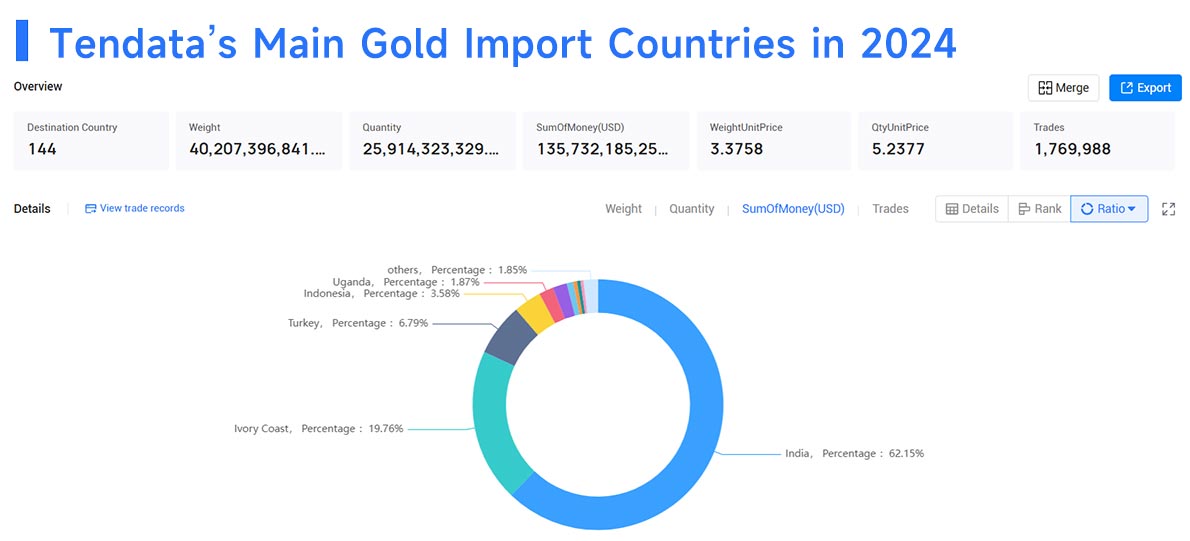

India is the world's second-largest consumer of gold and a major gold importer. On February 12, domestic gold prices in India hit a historic high of 86,360 INR per 10 grams ($993.81). Gold prices have risen by more than 10% in 2025, following a 21% increase last year.

As demand is subdued by recent price hikes, Indian dealers have started offering discounts. In the last four months, official domestic prices have fallen by $30 to $38 per ounce (including 6% import duty and 3% sales tax) compared to a few weeks ago.

"The demand for the product is almost negligible," said a dealer. Normally, discounts would exceed $100 per ounce, but due to supply shortages, the price is currently around $25 per ounce. "Consumers need time to adjust to these record high prices."

Last week, China, the world's largest consumer of gold, sold gold at prices $7 to $10 per ounce lower than the spot price. The record prices have suppressed demand for gold.

"We saw a spike in demand before the Lunar New Year, but that was likely due to the holiday season," said a Chinese trader. "Now, with prices rising, demand has weakened."

According to the World Gold Council (WGC), India's jewelry demand is expected to surpass China's in 2024, reaching 563.4 tons.

Together, China and India account for more than half of global gold consumption.

Marex analyst Edward Meir stated that high gold prices have definitely affected physical demand, particularly in China and India. However, he noted that ETF purchases and central bank buying are offsetting this impact.

Independent analyst Ross Norman added, "Now that the Lunar New Year is over, we are seeing a noticeable decline in demand, with China's gold purchases dropping sharply."

He further commented, "Reflecting the overall decline in physical gold demand, gold prices have dropped from a $20 premium during the Lunar New Year period to an 18% discount to international market prices."

Tendata provides more than 10 billion trade data, covering 218 countries and regions, accumulating more than 10 billion trade transaction details, and a trade database of more than 230 sub-industries.

Searching product keywords or HS codes in Tendata iTrader will allow you to view tens of thousands of active potential customers in the past year, as well as customers' purchase records, including purchase amount, quantity, time, frequency, and their suppliers/buyers. These companies in the Customers List are all customers with needs, and can be used for foreign trade customer development.

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship