Trade Trends News

Trade Trends News

05-02-2025

05-02-2025

Just minutes after U.S. President Donald Trump's 10% additional tariff on Chinese goods took effect, China announced on February 4th that it would impose export controls on five metals critical for defense, clean energy, and other industries. These metals exports are essential to global supply chains, and the new restrictions could have significant implications on industries worldwide.

Here's what you need to know about these metals and their impact on metals exports:

1. Tungsten

Tungsten is an ultra-hard metal, second only to diamond in terms of strength, and is primarily used in the production of ammunition, armor plates, and cutting tools.

Around 60% of U.S. consumption is used to produce tungsten carbide, a highly durable material widely used in construction, metalworking, and oil and gas drilling.

Like many other critical minerals, China dominates the production and metals exports of tungsten, accounting for over 80% of global supply in 2023.

According to an analysis by the British consultancy Project Blue, China supplied 30% of tungsten to markets outside of China, primarily in powder form for tool applications.

Other major producers include Vietnam, Russia, South Korea, and Spain.

According to the U.S. Geological Survey (USGS), the U.S. has not conducted commercial tungsten mining since 2015.

China has imposed restrictions on eight types of tungsten products and their manufacturing processes, affecting global metals exports.

2. Indium

Indium is a key component of smartphone screens and television displays, with its refined product being indium tin oxide. Another indium product is used in fiber optic technology.

The expansion of 5G cellular networks has increased demand for indium.

According to the U.S. Geological Survey, like tungsten, China is the largest producer, accounting for 70% of global output. As of September 2024, a quarter of U.S. indium imports came from China, highlighting the importance of metals exports from China in the tech industry.

Other major buyers of Chinese indium include Japan and South Korea, according to Project Blue.

China's new restrictions target three indium-related products and their production technologies, potentially impacting global metals exports and supply chains.

3. Bismuth

Bismuth is used in solders, alloys, metallurgical additives, pharmaceuticals, and atomic research.

According to the U.S. Geological Survey, the U.S. stopped producing primary refined bismuth in 1997 and is heavily reliant on imports, making China's metals exports crucial for U.S. industries.

USGS data also shows that China produced over 80% of the world's bismuth, approximately 13,000 tons, last year.

Other major producers include South Korea and Laos.

China has imposed restrictions on bismuth and various bismuth-containing compounds, potentially limiting global metals exports and impacting industries reliant on these materials.

4. Tellurium

Tellurium is typically a byproduct of copper refining and is used in metallurgy, solar panels, storage chips, and other products.

According to the U.S. Geological Survey, by 2024, China will produce about three-quarters of the world's refined tellurium, reinforcing its dominant role in global metals exports.

Although the U.S. has two refineries that produce its precursor, copper telluride, this material is then sent overseas for further processing. Most products that use tellurium rely on imports, underscoring the significance of Chinese metals exports to the U.S. and other nations.

China has imposed export restrictions on tellurium and various tellurium-containing compounds, which could disrupt the global supply of this critical metal.

5. Molybdenum

Molybdenum is mainly used to strengthen and harden steel alloys, making them more heat- and corrosion-resistant. It is also used in lubricants, pigments, and catalysts in the oil industry.

According to the U.S. Geological Survey, by 2024, China will account for about 40% of global production, while the U.S. will account for 12%.

However, the new restrictions specifically target exports of certain molybdenum powders used in the manufacture of missile components. Customs data shows that China exported 287 tons of such molybdenum powder last year, with about half going to Japan. These metals exports restrictions could have a direct impact on industries that rely on molybdenum for high-performance applications.

In conclusion, China's restrictions on the metals exports of these five critical materials could significantly disrupt global supply chains, especially for industries in defense, technology, and energy. The impact on international markets will be substantial as nations look for alternative sources or work to adjust to the new trade environment.

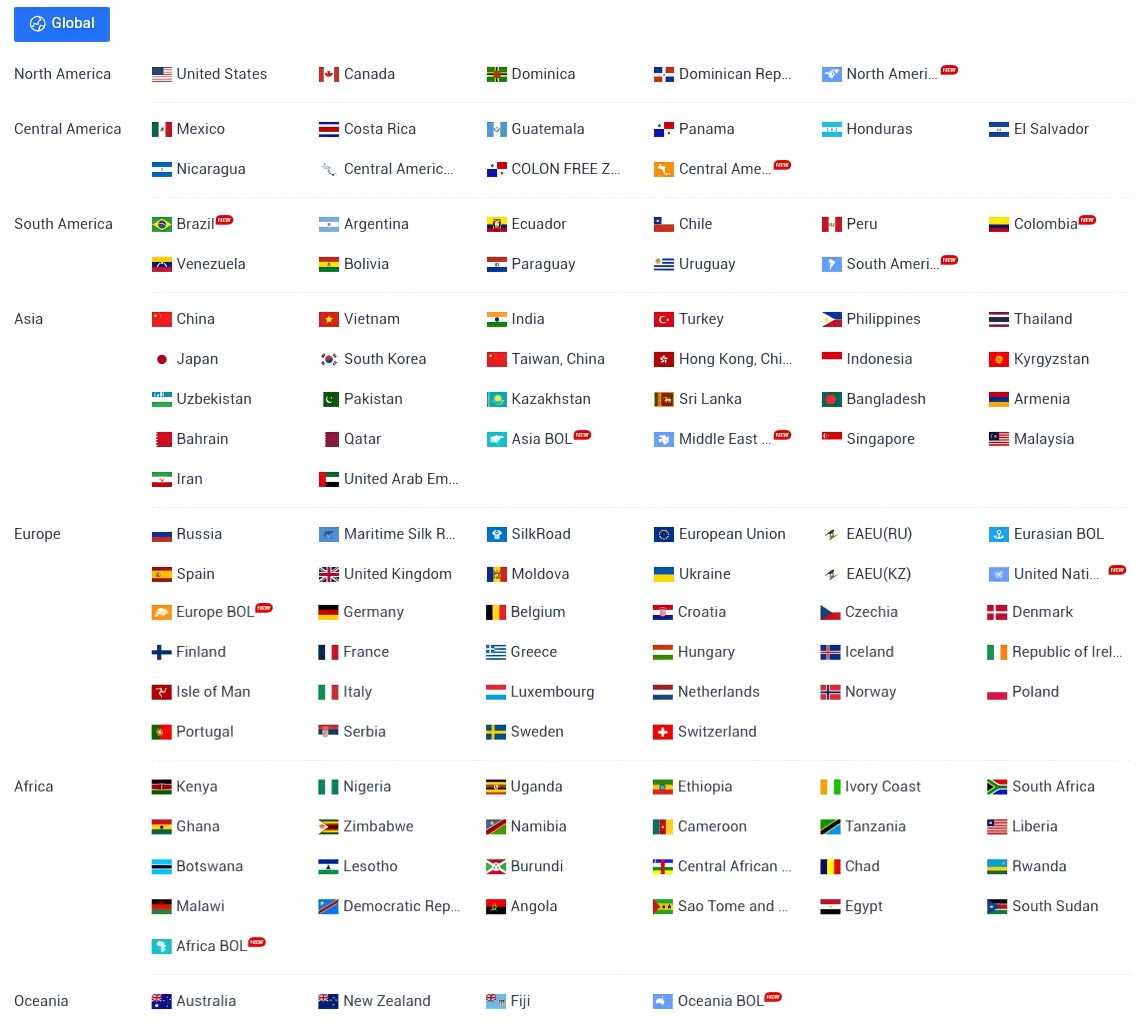

Tendata iTrader compiles trade data from 218 countries and provides detailed

information on over 130 million import-export enterprises worldwide.

With a daily influx of 10 billion trade records, Tendata efficiently delivers contact details for over 700 million top-level executives and decision-makers in the import-export industry through advanced filtering. This includes email addresses, phone numbers, social media profiles, and more. Additionally, we offer synchronized company profiles, product images, and website links, along with 19 types of visual reports. These tools assist foreign trade enterprises in precise market positioning and thorough market analysis, enabling you to quickly find the exact buyers and suppliers you need.

(>> Visit the Official Shanghai Tendata Website for More Details

<<)

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship