Trade Trends News

Trade Trends News

12-12-2024

12-12-2024

Recently, U.S. corn and soybean oil export volumes have been astonishing, prompting the USDA to raise its 2024-25 export projections on December 10.

The Results?

The U.S. soybean oil stocks-to-use ratio has hit a historic low, and contrary to previous forecasts, U.S. corn ending stocks are now lower than in the prior marketing year.

Despite historically tight soybean supplies, soybean oil exports could see further growth, though the outlook for corn exports remains uncertain.

Soybean Oil Prices Soar

As of November 28, U.S. soybean oil exports for the 2024-25 marketing year have reached 416,356 metric tons, an eight-year high. The marketing year began on October 1.

At least another 30,000 tons were sold last week, making the USDA's November forecast for 2024-25 exports—just 272,000 tons—appear far too low.

The USDA sharply raised this estimate in its December 10 update, increasing it by 83% to 499,000 tons (1.1 billion pounds). This marks a three-year high but remains well below the 10-year average.

Known sales already account for at least 90% of this target. From 2014 to 2021, an average of only 40% of annual export volumes had been sold by early December.

While the USDA seems overly conservative about boosting U.S. soybean oil exports, this could suggest the agency expects the unusual price discount of soybean oil relative to palm oil to be relatively short-lived.

Falling palm oil production and subsequent price increases have been a boon for soybean oil exporters. However, tight inventories could limit further increases in U.S. soybean oil shipments.

The USDA's latest data shows the U.S. soybean oil stocks-to-use ratio for 2024-25 at 5.2%, the lowest level in 61 years of records, down from 5.4% last year.

Direct inventories, at 683,000 tons, are slightly higher than in 2023-24, which marked a 10-year low.

A few years ago, the U.S. was the world's third-largest soybean oil exporter, accounting for 10% of global exports. By 2024-25, its share is projected to drop to just 4%.

Corn Tightens

In February, the USDA's preliminary estimates indicated U.S. corn ending stocks for the 2024-25 marketing year would increase 17% year-on-year to 2.532 billion bushels, the highest level in decades.

As of December 10, however, U.S. corn ending stocks for 2024-25 are now projected at 1.738 billion bushels, a 1% decline from 2023-24.

Much of this change stems from a 19% drop in 2023-24 ending stocks since February, but reduced 2024-25 supplies also reflect stronger-than-expected demand as corn prices hit a four-year low this year.

The USDA's December 10 forecast for 2024-25 corn ending stocks came in far below all analysts' expectations, as exports surged 6% to 2.475 billion bushels. This would be the second-highest export volume on record, trailing only 2020-21, a year driven by massive Chinese purchases.

China has yet to purchase any U.S. corn for the 2024-25 marketing year, which began on September 1. However, some market observers are concerned about potential trade tariffs on corn with Mexico, the largest U.S. corn buyer, once President-elect Donald Trump takes office.

With total sales through November already at an above-average proportion of its new forecast, the USDA appears to have left some room for upward revisions in its corn export estimate.

Ethanol Drives Corn Supply Tightening

U.S. corn used for ethanol production also contributed to tighter supplies in the December 10 update. Record ethanol output for several weeks last month pushed U.S. corn use for ethanol up 1% to the highest level in seven years.

Despite record-high yields of 183.1 bushels per acre for U.S. corn in 2024-25, ending stocks projections still saw a sharp decline.

However, this figure will be reviewed next month, which could lead to further adjustments to the corn balance sheet.

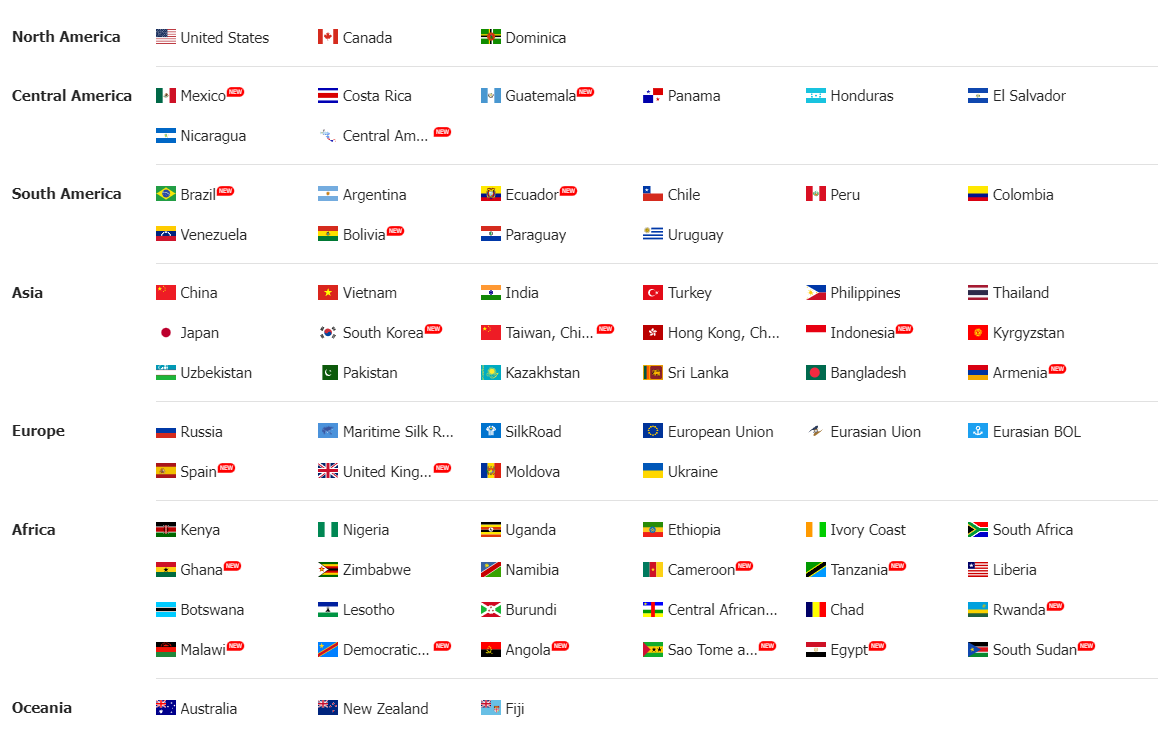

Tendata iTrader compiles trade data from 218 countries and provides detailed

information on over 130 million import-export enterprises worldwide.

With a daily influx of 10 billion trade records, Tendata efficiently delivers contact details for over 700 million top-level executives and decision-makers in the import-export industry through advanced filtering. This includes email addresses, phone numbers, social media profiles, and more. Additionally, we offer synchronized company profiles, product images, and website links, along with 19 types of visual reports. These tools assist foreign trade enterprises in precise market positioning and thorough market analysis, enabling you to quickly find the exact buyers and suppliers you need.

(>> Visit the Official Shanghai Tendata Website for More Details <<)

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship