Trade Trends News

Trade Trends News

11-11-2024

11-11-2024

China's export' growth reached its highest level in over two years this October, as factories moved inventory to key markets, expecting further tariffs from the U.S. and EU amid imminent trade war threats.

With Donald Trump's decisive victory in the U.S. presidential election, focus has shifted to his campaign promise to impose tariffs exceeding 60% on Chinese imports. This pledge could prompt Chinese suppliers to redirect stock to the U.S., China's largest export market.

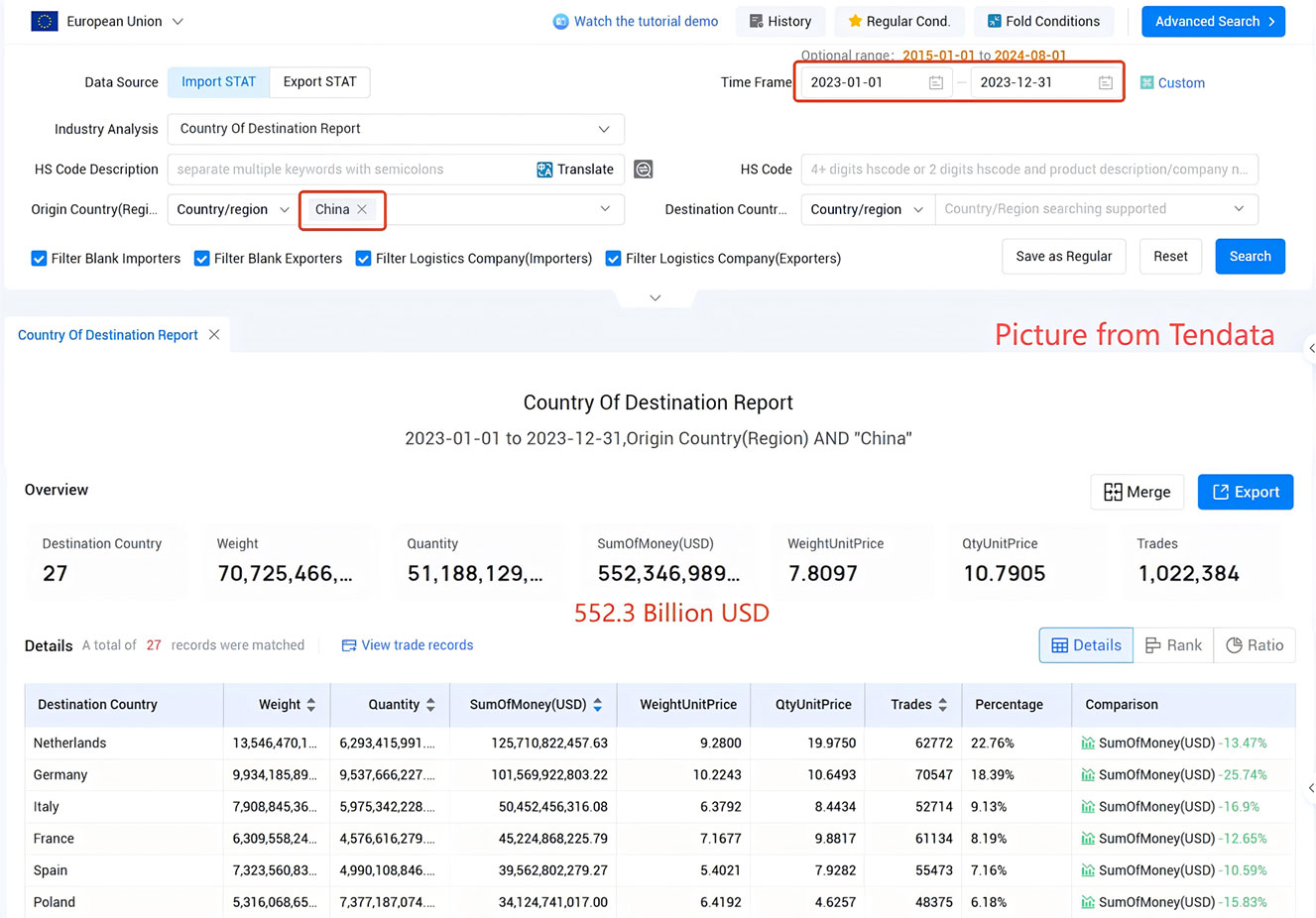

Trump's tariff threats have caused unease among Chinese factory owners and officials, as around $500 billion in China's exports are at stake annually. Meanwhile, trade tensions with the EU have also escalated, with the EU having imported $466 billion in Chinese goods last year.

>>Get More Trade Data from Tendata<<

As household and business confidence remains hit by a prolonged real estate debt crisis, China's export' momentum has been a bright spot for the struggling economy.

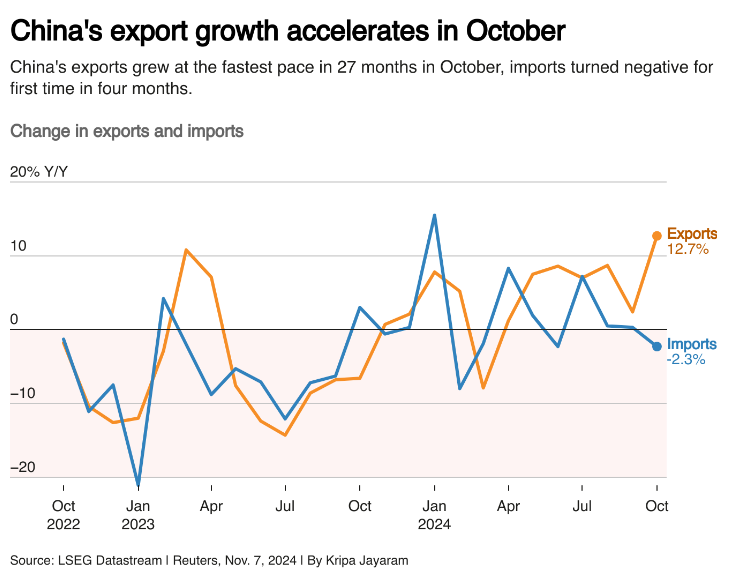

Data from China's General Administration of Customs, released on Thursday, shows a 12.7% year-over-year increase in China's exports last month, exceeding Reuters' forecast of a 5.2% rise and September's 2.4% gain.

Imports, however, fell by 2.3%, surpassing the expected 1.5% decrease, marking the first negative growth in four months.

China's trade surplus expanded from $81.71 billion in September to $95.27 billion in October, further underscoring China's export' strength.

Tianchen Xu, a senior economist at the Economist Intelligence Unit, stated, "We expect a surge of upfront investment in the fourth quarter before pressures begin to show in 2025."

"I think Trump is primarily responsible. The threats are becoming more tangible."

The "Trump Effect" on China's Export Market

Last month, China's exports to the U.S. rose 8.1% year-over-year, while exports to Europe grew by 12.7%.

In a report, Capital Economics' China economist, Zichun Huang, noted, "We expect China's export' shipments to remain strong over the coming months. Any potential drag from Trump's tariffs may only become apparent in the second half of next year."

She added, "Trump's return may stimulate China's export' volumes in the short term, as U.S. importers may increase purchases to counter tariffs."

According to China Customs data, China's primary exports to the U.S. last year included smartphones, tablets, and video game consoles, reminiscent of Trump's initial term when China's export' of electronics faced similar policies.

There are indications that demand for such products may be waning, affecting China's export' market.

Trade data from South Korea and Taiwan suggest a global demand slowdown, while German manufacturers report difficulty finding overseas buyers. Analysts conclude that Chinese producers may be discounting prices to attract buyers or transferring inventory out of China altogether, impacting China's export' strategy.

An official survey of factory activity in October highlighted that Chinese factories continue to struggle with finding overseas buyers, despite China's export' growth data.

Dan Wang, a Shanghai-based economist, stated, "If the PMI new export orders index is declining while China's export' data is rising, I think it's safe to say this is more of an inventory shift."

A lessening of weather-related impacts since September also aided China's exporters, enabling them to fulfill delayed orders.

China and Hong Kong's stock markets rose slightly on Thursday, buoyed by investor optimism around possible further stimulus measures, while the yuan rebounded from a three-month low against the U.S. dollar.

Analysts noted that the yuan's depreciation likely boosted China's exports, although it also increased the cost of imported goods.

Imports Impacted by Weak Domestic Demand as China's Export Volume Rises

Last month, imports from the EU and Southeast Asian economies fell by 6.1% and 7.3%, respectively, while imports from Japan saw only marginal growth.

Oil purchases by China, the world's largest crude importer, declined by 9%, marking the sixth consecutive month of year-over-year decreases.

"Import growth continues to slow, primarily due to weak domestic demand recovery, low import prices, and a high base effect," said Maohua Zhou, a macroeconomic researcher at China Everbright Bank.

However, China's soybean imports surged last month, as U.S. grain traders scrambled to deliver record harvests to the Asian nation ahead of the U.S. election.

Overall, with China's export engine under pressure, economists caution Beijing against over-relying on exports to drive growth, urging officials to introduce additional stimulus measures.

Analysts from ANZ Bank predict that policymakers will implement monetary and other measures to counter Trump's tariff actions, to protect China's export' interests.

Raymond Yeung, ANZ Bank's chief economist for Greater China, stated, "Authorities will also consider policies to offset tariff impacts, such as subsidies or financing."

"Policy measures may also include promoting domestic consumption and exploring new export markets within Belt and Road countries, ensuring China's export' sustainability."

Shanghai Tendata Information Technology Co., Ltd. (referred to as Tendata) is

headquartered in the Lujiazui Financial District. With 15 years of deep

involvement in the foreign trade big data service industry, Tendata is a

comprehensive information service provider specializing in data collection,

mining, application, and services in the field of international trade based on

big data and artificial intelligence. Additionally, it extends its services to

industry consulting and trade facilitation.

Since its establishment in 2005, the company has grown to have over 500 professionals, providing effective market expansion and customer management services to more than 70,000 domestic and foreign import-export enterprises. With Tendata, data security is assured, backed by an experienced product development team and after-sales support department. (>>>Click to Inquire about Tendata's Products<<<)

Shanghai Tendata was awarded the title of Shanghai High-Tech Enterprise in 2016 and has been recognized as a Shanghai Double Promotion Enterprise for two consecutive years in 2017 and 2018. In 2018, it was selected as one of the top 100 high-growth software companies in Shanghai, and in 2019, it became a member of the China Cross-border E-commerce 50 Forum and a Shanghai Science and Technology Commission-supported small and medium-sized enterprise. Throughout its development, Shanghai Tendata has received recognition and assistance from governments, industries, and professional departments. We appreciate the strong support from all sectors of society. (>>Visit the Tendata official website for more details)

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship