Trade Data

Trade Data

17-12-2024

17-12-2024

Almonds are one of the world’s most popular and nutritionally beneficial nuts, used widely in snacking, baking, and various food products. As global demand for almonds continues to rise, the trade in almonds has become a significant aspect of international commerce. Several countries and companies dominate the almond trading industry, positioning themselves as leaders in production, export, and supply. Tendata explores the top 5 almond traders in the world, examining their market shares, export strategies, and key insights into the almond trade.

1. California (USA): The Worlds Leading Almond Producer and Exporter

The United States, particularly California, is by far the largest almond producer globally. California’s almond industry produces over 80% of the world’s almonds, and the state generates over $6 billion annually from almond production.

Top Export Markets: The U.S. exports almonds to more than 90 countries, with key markets including India, China, Germany, the UAE, and the UK.

Exports and Value: In 2022, the U.S. exported over 1.5 billion pounds of almonds, valued at approximately $4 billion.

Several key companies dominate the global almond market in California.

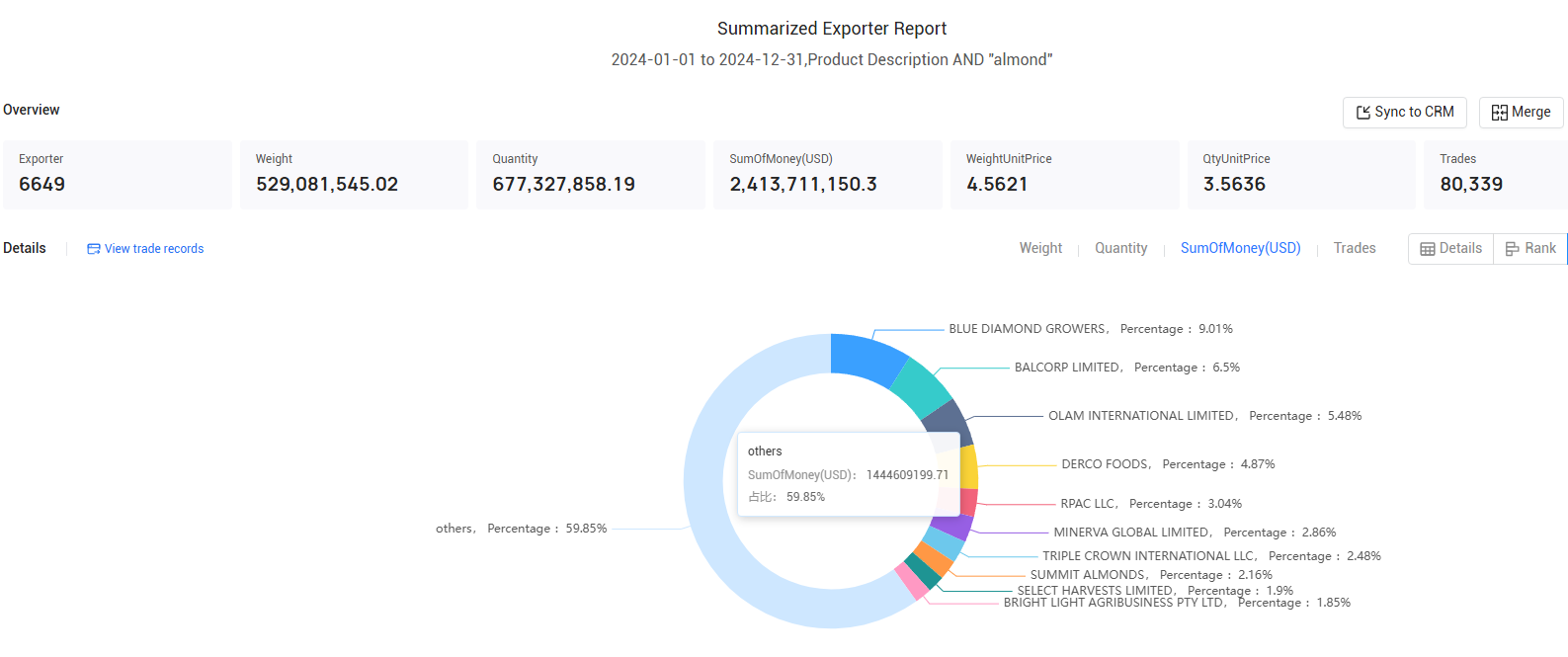

Blue Diamond Growers: As the world's largest almond cooperative, Blue Diamond Growers controls around 20% of the global almond exports. They work with over 3,000 growers and export to more than 90 countries. Blue Diamond Growers reported over $1 billion in annual revenues in 2023.

Wonderful Pistachios & Almonds: This company, part of the Wonderful Company, is one of the most recognized names in almonds, known for its high-quality almonds sold in both domestic and international markets.

2. Australia: A Growing Almond Exporter

Australia has become a significant player in the global almond market, with almond production concentrated in South Australia and Victoria. In recent years, the country’s almond industry has experienced rapid growth due to favorable climate conditions and increasing demand for healthy snacks.

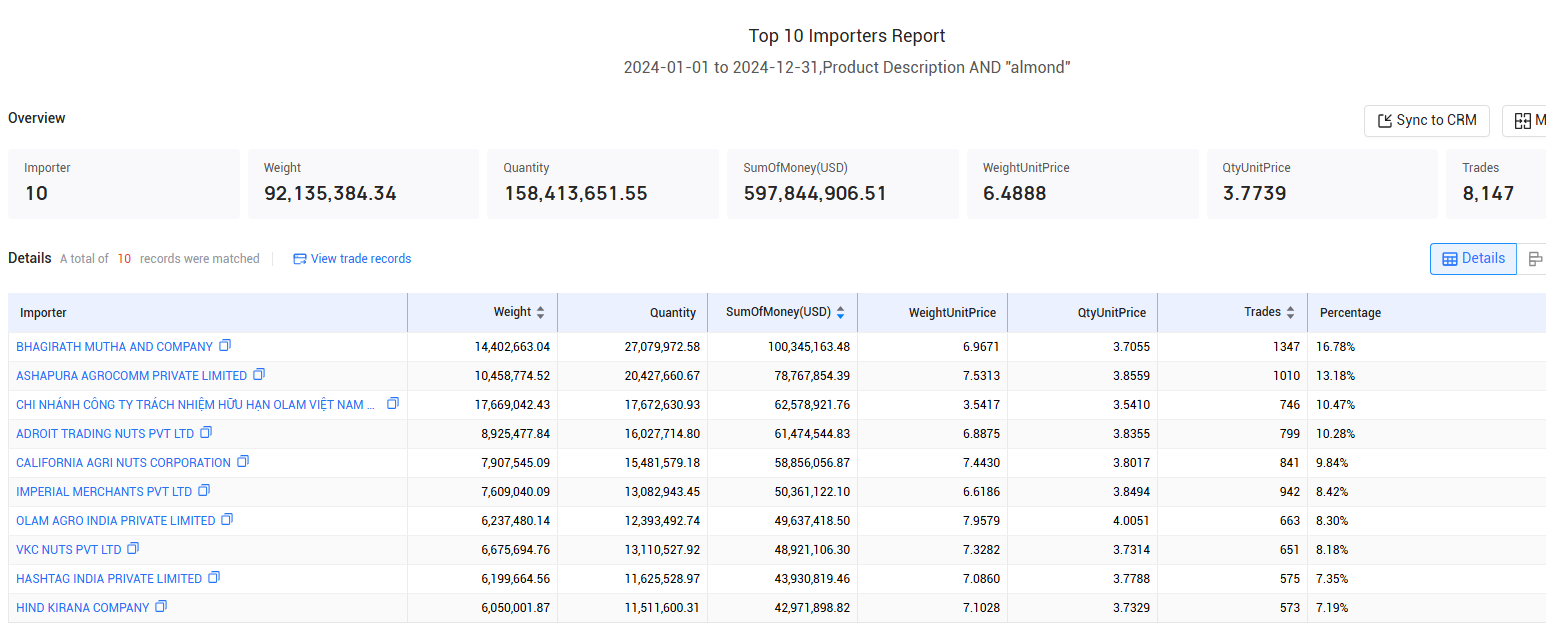

Production and Export: Australia produces around 140,000 to 150,000 tons of almonds annually, making it the second-largest exporter worldwide.

Top Export Markets: Australia's major export destinations include India, China, Japan, and the Middle East.

Market Share: In 2022, Australia accounted for around 15% of global almond exports.

Notable Companies:

Select Harvests: A leading Australian almond producer, Select Harvests has extensive operations and exports to markets in Asia, the U.S., and Europe.

Data Snapshot: Select Harvests reported revenues of over $400 million in 2023, with a substantial portion derived from almond exports.

Australian Almonds: This organization is a key player in promoting Australian almonds abroad, focusing on Asia and the Middle East.

>>Click Here to Get Information of the Top 5 Almond Traders in the world<<

3. Spain: Europe's Leading Almond Producer

Spain is Europe's largest almond producer, with significant production in regions like Valencia, Murcia, and Catalonia. Almonds are a crucial export product for Spain, and the industry contributes significantly to the country's agricultural economy.

Production and Export: Spain produces approximately 80,000 to 90,000 tons of almonds annually.

Top Export Markets: Spain's top almond export destinations include France, Germany, the United States, and the Middle East.

Market Share: Spain accounts for roughly 7-8% of global almond exports.

Notable Companies:

Almendrera del Sur: Almendrera del Sur is a major almond processor in Spain, catering to both domestic and international markets.

Reina de las Almendras: This family-owned company has been in operation for over 30 years and exports almonds to more than 25 countries, including the U.S. and countries in Europe.

4. Turkey: A Growing Force in Almond Production

While historically more known for hazelnuts, Turkey has increasingly become an important player in the global almond trade. Its almond industry is expanding rapidly, thanks to favorable weather conditions and growing domestic and international demand.

Production and Export: Turkey produces around 50,000 to 60,000 tons of almonds annually.

Top Export Markets: Key markets for Turkish almonds include Germany, the United States, and other European countries.

Market Share: Turkey accounts for approximately 4-5% of global almond exports.

Notable Companies:

Tariş: One of the largest almond cooperatives in Turkey, Tariş exports almonds to multiple international markets, contributing significantly to the country's almond export sector.

Yıldız Holding: A major player in the Turkish almond industry, Yıldız Holding processes and exports almonds to markets in Europe and the Middle East.

>>Contact Tendata for Online Free Demo<<

5. Iran: A Smaller but Important Almond Exporter

Although Iran's almond industry is smaller compared to California or Australia, it plays an important role in the regional market, particularly in the Middle East and Central Asia.

Production: Iran produces approximately 50,000 tons of almonds annually, mostly in the provinces of Kerman, Fars, and Yazd.

Top Export Markets: Iran's key almond export markets include neighboring countries like Iraq, Afghanistan, and the UAE.

Market Share: Iran holds about 3-4% of global almond exports.

Notable Companies:

Kerman Almonds: A leading almond producer in Iran, Kerman Almonds exports its products to neighboring countries and beyond.

Shadmehr: Another significant almond exporter in Iran, Shadmehr has been focusing on expanding its presence in the Middle Eastern market.

About Tendata

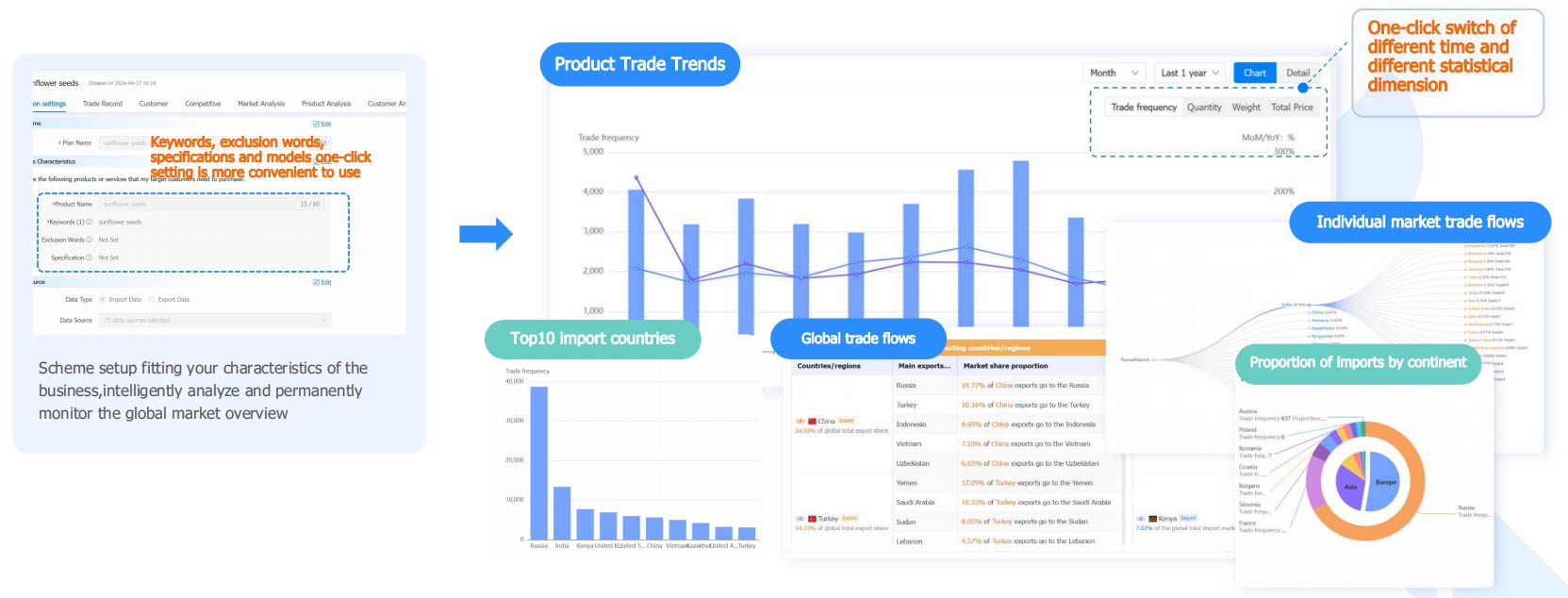

Tendata iTrader has 210 million global enterprise information, 10 billion data scrolling every day, can quickly and intelligently screen out 700 million executives, decision makers contact information, including email, phone, social media, etc., but also can synchronize the display of the company's yellow pages, product images and web site. At the same time, Tendata provides 19 visualization reports to help foreign trade enterprises accurately locate and analyze the market, so that you can quickly find the precise buyers and suppliers you need.

Key Insights and Trends in the Almond Market

The almond market has experienced significant growth in recent years, driven by factors such as increasing health-consciousness among consumers, rising demand for plant-based diets, and the popularity of almonds as a snack food and ingredient in various products.

Growing Demand for Healthy Snacks: Almonds, known for their high nutritional value, have become a popular choice among consumers seeking healthier snack options. This trend is particularly strong in markets like North America, Europe, and Asia.

Expansion of Plant-Based Products: Almonds are a core ingredient in plant-based milk, butter, and other dairy alternatives, a growing segment of the food industry. This has led to an increase in almond consumption, especially in regions like Europe and the U.S.

Sustainability Concerns: As almond farming requires significant water resources, sustainability is becoming a major focus in the industry. Companies are increasingly investing in water-efficient farming techniques and other sustainable practices to mitigate environmental impacts.

Trade Diversification: While traditional markets like the U.S. and Europe continue to be strong, Asian markets—particularly China and India—are growing rapidly, providing new opportunities for almond traders.

Supply Chain Disruptions: The almond market, like many other agricultural sectors, has faced challenges due to climate change, labor shortages, and supply chain disruptions. However, industry players have been adapting by adopting new technologies and expanding their production capabilities.

>>Learn More About the Top 5 Almond Traders in the World<<

Conclusion: The Top 5 Almond Traders in the World

The top 5 almond traders in the world—California (USA), Australia, Spain, Turkey, and Iran—play a pivotal role in the almond industry. These countries lead in production, export, and market influence, making them key players in the global almond trade. With global demand continuing to rise, especially in emerging markets in Asia and the Middle East, these top exporters are well-positioned to continue shaping the future of the almond industry. By understanding the key insights and trends, almond traders can adapt to shifting consumer preferences and market conditions, ensuring their position in the ever-expanding global almond market.

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship