Trade Data

Trade Data

26-08-2024

26-08-2024

In 2022, the global sales of all paper exported from all countries amounted to approximately $210.9 billion.

Overall, this dollar amount reflects a 19% increase since 2018, when global paper exports were valued at $177.2 billion.

From 2021 to 2022, the total value of paper exports grew by 12.8%, rising from $187.0 billion in 2021.

The top five paper-exporting countries were Mainland China, Germany, the United States, Italy, and Sweden. This leading group accounted for 44.6% of global paper exports in 2022.

From a continental perspective, European countries dominated the paper export market in 2022, with sales reaching $115.5 billion, representing 54.8% of the global total. Asia followed with 28.1% of global paper deliveries, ahead of North America's 13.2%.

Smaller shares of paper exports came from Latin America (excluding Mexico but including the Caribbean) at 2.6%, Africa at 0.9%, and Oceania (mainly Australia and New Zealand) at 0.5%.

For research purposes, the 2-digit Harmonized Tariff System code prefix for paper and paperboard is 48. This category includes items made from pulp, paper, and paperboard, such as boxes.

Global Paper Export by Country

Below are the top 15 countries exporting the highest values of paper in 2022.

1. China: $31.6 billion (15%)

2. Germany: $25.4 billion (12%)

3. United States: $17.0 billion (8.1%)

4. Italy: $10.1 billion (4.8%)

5. Sweden: $9.9 billion (4.7%)

6. Canada: $8.5 billion (4%)

7. Finland: $8.0 billion (3.8%)

8. France: $7.7 billion (3.6%)

9. Poland: $7.0 billion (3.3%)

10. Netherlands: $6.5 billion (3.1%)

11. Austria: $6.1 billion (2.9%)

12. Belgium: $5.67 billion (2.7%)

13. Spain: $5.59 billion (2.7%)

14. Indonesia: $4.8 billion (2.3%)

15. United Kingdom: $3.2 billion (1.5%)

Collectively, these 15 countries accounted for roughly 74.5% of the global paper exports in 2022.

Among the major exporters, the fastest-growing paper export nations since 2021 were Mainland China (up 30.9%), Italy (up 24.4%), Canada (up 17.4%), and Austria (up 17.1%).

The Netherlands was the only major supplier to see a decline in paper export sales, down by -1.7% from 2021.

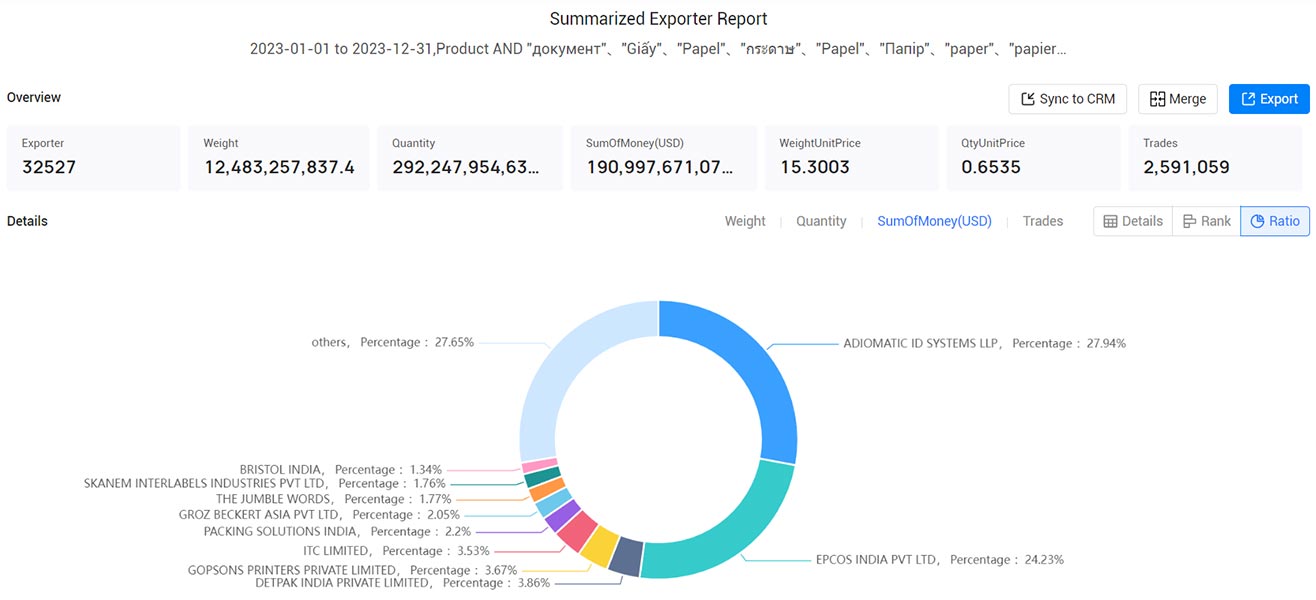

Paper Export Companies in 2023

Below are the leading paper processing groups globally in 2023, representing the largest participants in the international paper market trade.

1. ADIOMATIC ID SYSTEMS LLP (27.94%, $53,356.21 million)

2. EPCOS INDIA PVT LTD (24.23%, $46,278.7 million)

3. DETPAK INDIA PRIVATE LIMITED (3.86%, $7,374.56 million)

4. GOPSONS PRINTERS PRIVATE LIMITED (3.67%, $7,015.97 million)

5. ITC LIMITED (3.53%, $6,739.91 million)

6. PACKING SOLUTIONS INDIA (2.2%, $4,197.71 million)

7. GROZ BECKERT ASIA PVT LTD (2.05%, $3,907.6 million)

8. THE JUMBLE WORDS (1.77%, $3,389.86 million)

9. SKANEM INTERLABELS INDUSTRIES PVT LTD (1.76%, $3,365.59 million)

10. BRISTOL INDIA (1.34%, $2,554.14 million)

"Customs data contains vast information, and extracting relevant customer contact details can be time-consuming, often yielding results that fall short of expectations. Is it really the case? Or is it because customs data is being utilized incorrectly, resulting in wasted effort and time?

Developing customers using customs data involves precisely characterizing all buyers and their procurement systems in the target market. This allows for the quick identification of the most compatible customers, discerning their credit systems and procurement details. It aids in defining high-quality customers and profit margins, enhancing development efficiency, and improving overall effectiveness. When using customs data to develop new customers, consider the following three approaches. (>>>Click to Get Free Access to Customs Data for 90+ Countries)

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship