Trade Data

Trade Data

16-04-2024

16-04-2024

In 2023, Spain imported $470.4 billion worth of goods from the world. Compared to $499.1 billion in the same period in 2022, Spain's imports declined by -5.7%.

Spain's Best Import Partners

The latest country-specific data show that more than two-thirds (67.4%) of Spain's imports are supplied by exporters from Germany (12.6% of Spain's total), France (10.4%), Mainland China (8.4%), Italy (7.4%), the Netherlands (6.7%), the United States of America (5.7%), Portugal (4.2%), Belgium (3.5%), and the United Kingdom (3.5%), the United Kingdom (2.4%), Poland (2.2%), Morocco (2.03%) and Turkey (1.96%).

Spain's Top 10 Imports

Spain's top 10 imports accounted for 62.7% of the total value of products purchased by Spain from other countries:

1. Fossil fuels including oil: $68.8 billion (14.6%)

2. Vehicles: $52 billion (11.1%)

3. Electrical machinery and equipment: $43.3 billion (9.2%)

4. Machinery including computers: $43.1 billion (9.2%)

5. Pharmaceuticals: $22.9 billion (4.9%)

6. Plastics, plastic products: $16.4 billion (3.5%)

7. Organic chemicals: $12.8 billion (2.7%)

8. Iron and steel: $12.8 billion (2.7%)

9. Optical, technical, medical equipment: $11.9 billion (2.5%)

10. Clothing, accessories (not knitted or crocheted): $11.1 billion (2.3%)

Among the top 10 import categories, purchases of automobiles grew the fastest, by 24.7% from 2022 to 2023. The second highest growth in import sales was in the optical, technical and medical devices product category, which grew by 16.5%. Spanish machinery imports, including computers, ranked third, with a 13.1% increase.

The worst declines among Spain's top 10 imports were in mineral fuels, including oil (down -28% from 2022), organic chemicals (down -12.2%), and then steel and metal (down -10.9%).

At the more detailed 4-digit Harmonised Tariff System (HTS) code level, the largest products imported by Spain are crude oil (7.9%), automobiles (5%), automotive parts or accessories (3.5%), liquefied petroleum gas (3.2%), medicinal mixed doses (3.1%), processed petroleum (2.5%), telephone equipment (including smartphones) (1.6%), blood components (including antisera) (1.4%), computers (including optical readers) (1%), and then insulated wire or cable (0.9%).

All in all, this most valuable group of Spanish imports represents almost one third (30.2%) of total Spanish imports in 2023.

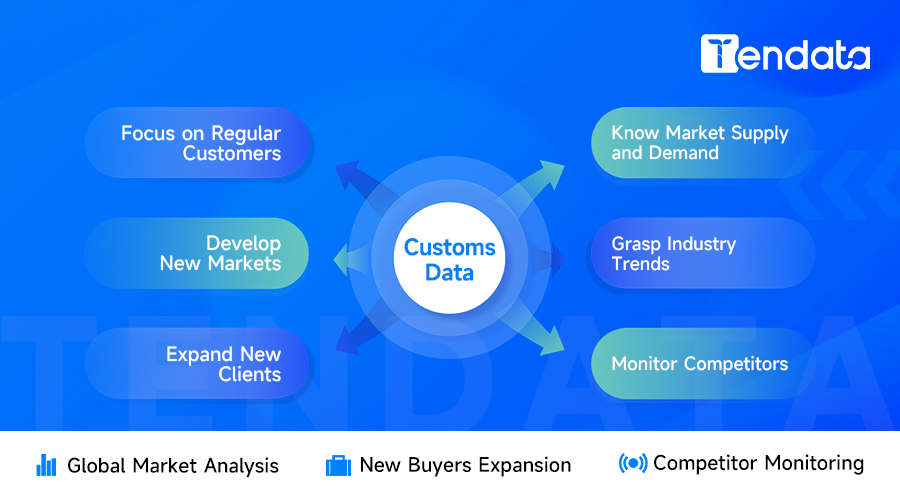

"Customs data contains vast information, and extracting relevant customer contact details can be time-consuming, often yielding results that fall short of expectations. Is it really the case? Or is it because customs data is being utilized incorrectly, resulting in wasted effort and time?

Developing customers using customs data involves precisely characterizing all buyers and their procurement systems in the target market. This allows for the quick identification of the most compatible customers, discerning their credit systems and procurement details. It aids in defining high-quality customers and profit margins, enhancing development efficiency, and improving overall effectiveness. When using customs data to develop new customers, consider the following three approaches. (>>>Click to Get Free Access to Customs Data for 90+ Countries)

I. Establish Customer Resource Database by Country

The establishment of a customer resource database is akin to a personalized work record. Start by using trade tracking functionality to compile a list of all customers in a country. Then, analyze each buyer's purchase volume, procurement cycle, product specifications, and supplier system. Pay special attention to the diversification or singularity of a buyer's supply channels, as buyers with diverse supply sources are preferable. Finally, filter out 30% of the potentially high-quality customers from that country and record them in your customer resource database. The database can be flexibly organized by country, time, customer name, follow-up steps, contact phone, email, contact person, etc. (>>>Click to Develop New Customers)

II. Establish Customer Resource Database by Peer Companies

Have a good understanding of the English names (including full names, abbreviations, etc.) of peer companies. Utilize the global supplier networking feature to compile a list of all customers associated with these peer companies. The critical step is to analyze customers from these peer companies based on purchase volume, procurement cycle, product models, etc. Finally, filter out key customers from your identified peers and record them in your customer resource database. (>>>Click to Apply for Free Trial)

III. Identify Newly Appeared Customers in Each Country

Use the trade search function to identify customers newly appeared in a country. Choose the country, set the date range, limit the product name or customs code, and check the "Newest" option. The search results will display high-quality customers that have newly emerged in that country within the specified time frame. Since these customers are new, they may have just started transactions, and the stability of their suppliers may be uncertain. It's essential to focus on following up with these new potential buyers and record them in your customer resource database. (>>>Click to Apply for Free Trial)

These three approaches for developing customers using customs data can be implemented based on the actual needs of the company and oneself. Consider the market environment, industry characteristics, strategic requirements, etc., to find a suitable method. The ultimate goal is to establish and organize a categorized archive of high-quality customers. Once you identify suitable customers, the next step is to precisely contact them through various channels, such as phone calls, emails, and online communication.

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship