Market Insights

Market Insights

20-03-2025

20-03-2025

As a major manufacturing and resource-exporting country in Southeast Asia, Malaysia continues to strengthen its position as a global trade hub, leveraging its diversified industrial structure (electronics manufacturing, palm oil, energy) and strategic geographical location (Strait of Malacca). This article provides import and export overviews, key products, and customer development strategies.

I. Overview of Malaysia's Import and Export in 2024

1. Import and Export Scale and Growth

(1) Total Trade Forecast: Malaysia's total import and export volume is expected to reach RM 2.8 trillion (approximately USD 600 billion) in 2024, a year-on-year increase of about 6% (compared to RM 2.65 trillion in 2023).

(2) Trade Surplus: The surplus is projected to be around RM 180 billion, driven by exports of electronics and energy products.

(3) Key Growth Drivers:

· Recovery in global semiconductor demand, boosting the electronics supply chain;

· Rebound in palm oil prices (international average price increased by 12% in 2024);

· Deepening intra-ASEAN trade under the Regional Comprehensive Economic Partnership (RCEP).

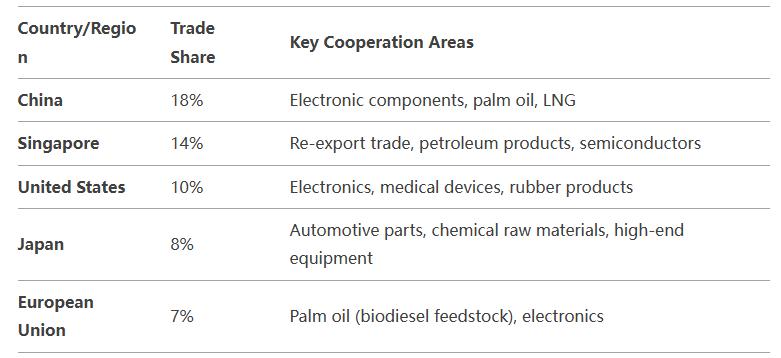

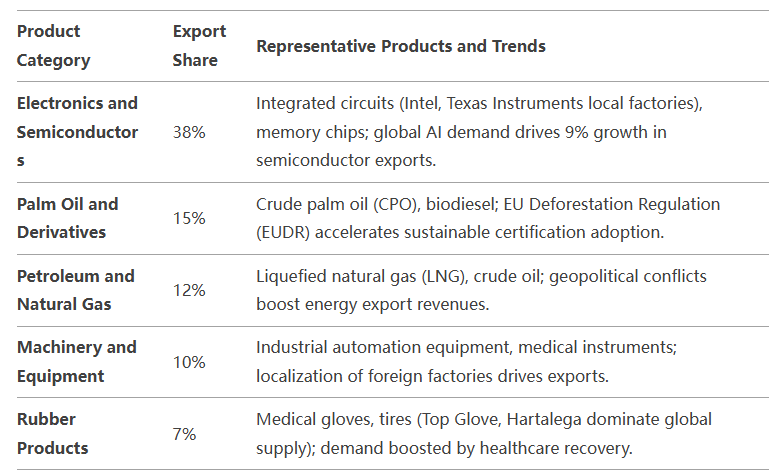

2. Major Trading Partners

II. Analysis of Malaysia's Major Import and Export Products (2024)

1. Malaysia's Major Export Products

2. Malaysia's Major Import Products

III. Strategies for Efficiently Developing Malaysian Customers and Suppliers

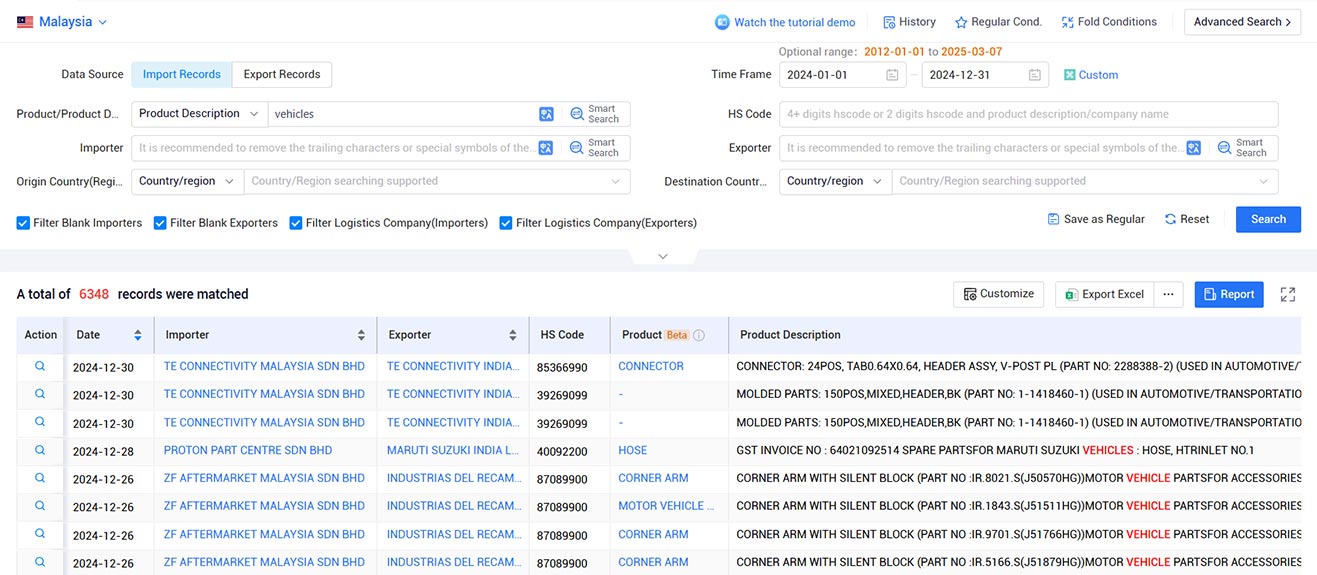

1. Using Malaysia Trade Data to Identify Target Companies

Tendata is a leading global trade data provider, offering coverage of 228+ countries and regions with a database containing over 10 billion trade transaction records. Businesses can leverage this trade data for precise global market analysis, helping them identify the most suitable target customers.

Tendata also conducts regular data cleansing and updates, standardizing details such as company names and unit measurements to eliminate redundant data and enhance decision-making accuracy.

With deep insights into over 500 million enterprises across 230+ industries, Tendata enables businesses to quickly assess potential clients by providing data on operational status, financials, product details, business relationships, media coverage, and intellectual property—helping users evaluate a company's true capabilities.

Additionally, Tendata offers access to 850 million+ business contacts, including key decision-makers' job titles, phone numbers, emails, LinkedIn, and Facebook profiles. This allows companies to connect with target customers instantly, eliminating the need to search for scattered online information.

>>Get A FREE DEMO from Tendata<<

2. Participate in Local Exhibitions and Industry Association Events

(1) Recommended Exhibitions:

· Malaysia International Trade Exhibition (MITE): Comprehensive trade show covering electronics, machinery, and consumer goods;

· Palm Oil Trade Fair: World's largest palm oil industry event, gathering plantations and processors;

· SEMICON Southeast Asia: Semiconductor industry summit, connecting chip manufacturers and equipment suppliers.

(2) Industry Associations:

· Federation of Malaysian Manufacturers (FMM): Covers 3,000 manufacturing companies;

· Malaysian Palm Oil Association (MPOA): Provides list of MSPO-certified sustainable palm oil companies.

3. Connect via B2B Platforms and Government Channels

(1) Main Platforms:

· Alibaba International: Active Malaysian suppliers, supports filtering "Verified Supplier" certified companies;

· MYExport (Malaysian official platform): Provides local exporter qualifications and product catalogs;

· Industry Buying: Suitable for industrial equipment and raw material procurement.

(2) Cooperation Notes:

· Malaysian companies value Islamic compliance (e.g., Halal certification), especially in food and chemical industries;

· SMEs prefer FOB terms; logistics responsibilities should be negotiated in advance.

4. Localized Cooperation Strategies and Cultural Insights

(1) Negotiation Style:

· Emphasize interpersonal relationships; multiple meetings are often needed to build trust;

· English communication is acceptable, but providing Malay documents can enhance goodwill.

(2) Payment and Risk Control:

· Recommended to use local banks (Maybank, CIMB) or third-party guarantees (e.g., Escrow Malaysia);

· Clearly specify applicable laws in contracts (usually Malaysian law).

IV. Trends and Risk Warnings in Malaysia's Import and Export Market

1. Key Trends in 2024

· Upgrading of Electronics Supply Chain: Attracts semiconductor packaging and chip design companies (e.g., Infineon's expansion in Kulim);

· Accelerated Green Transition: MSPO certification promoted in palm oil industry, biodiesel export share rises to 25%;

· Regional Logistics Hub: Expansion of Port Klang enhances throughput capacity, connecting RCEP and China's Belt and Road supply chains.

2. Potential Risks

· Commodity Price Volatility: Palm oil and crude oil prices significantly affected by global supply-demand dynamics and policies;

· Labor Shortages: Manufacturing sector relies on foreign labor; policy tightening increases labor costs;

· Intensified Regional Competition: Vietnam and Indonesia compete for market share in electronics and palm oil sectors.

Malaysia's market is driven by both resource exports and manufacturing. Companies should focus on high-potential sectors (e.g., semiconductors, green energy), leverage RCEP tariff benefits and localized channels, and prioritize ESG compliance to meet international regulations. It is recommended to prioritize investments in electronics manufacturing, sustainable palm oil, and industrial automation to establish long-term strategic partnerships.

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship