Market Insights

Market Insights

27-02-2025

27-02-2025

As a global trade hub and financial center, Singapore continues to attract multinational companies due to its advantageous geographical location, efficient customs system, and open economic policies. Based on the latest data from Singapore Customs, Enterprise Singapore, and the United Nations Comtrade database, this article analyzes singapore trade data that Singapore's market from the perspectives of import and export overview, core products, and customer development strategies for 2024.

I. Overall Situation of Singapore's Imports and Exports in 2024

1. Import and Export Scale and Growth

· Total Forecast: Singapore's total import and export value in 2024 is expected to reach $1.2 trillion, with an annual growth of about 5% (compared to $1.14 trillion in 2023), with re-export trade accounting for over 60%.

· Trade Surplus: A trade surplus of approximately $30 billion is projected, benefiting from exports of high-value-added products and the advantages of its financial services sector.

2. Major Trading Partners

(1) China (14%): Electronic components, chemicals, precision machinery.

(2) Malaysia (12%): Petroleum products, semiconductors, food processing.

(3) United States (10%): High-end machinery, pharmaceutical products, digital services.

(4) European Union (9%): Chemicals, luxury goods, green technology cooperation.

(5) Indonesia (8%): Energy minerals, palm oil, maritime equipment.

II. Analysis of Singapore's Major Import and Export Products in 2024

1. Singapore's Major Export Products

(1) Electronics and Semiconductors (32%): Integrated circuits, storage chips (Micron, TSMC local factories), data center equipment; growth of 8% driven by global AI demand.

(2) Chemicals and Petroleum Products (25%): Refinery products (ExxonMobil, Shell), specialty chemicals; green ammonia and hydrogen energy export pilot projects launched.

(3) Machinery and Equipment (15%): Industrial robots, medical devices (Siemens APAC center); significant growth in intelligent manufacturing solutions exports.

(4) Pharmaceuticals and Biotechnology (10%): Vaccines, innovative drugs (Pfizer, Sanofi local R&D centers); biopharmaceutical manufacturing's 2024 output expected to exceed 20 billion SGD.

(5) Financial Services (8%): Cross-border payments, supply chain finance, carbon credit trading; digital banking licenses boosting financial technology exports.

2. Singapore's Major Import Products

(1) Electronic Components (28%): China (chip packaging materials), Malaysia (semiconductor wafers); supporting the local high-end manufacturing supply chain.

(2) Mineral Fuels (22%): Middle East (crude oil), Australia (LNG); meeting refinery and energy storage needs.

(3) Machinery and Equipment (18%): Germany (precision instruments), Japan (automation equipment); driving the smart upgrade of manufacturing industries.

(4) Food and Agricultural Products (12%): Indonesia (palm oil), Brazil (meat); 90% of food is imported, with high demand for cold chain logistics.

(5) Luxury Goods and Consumer Products (8%): European Union (high-end watches, jewelry), Switzerland (luxury watches); re-exported to Southeast Asia's high-net-worth markets.

III. How to Effectively Develop Customers and Suppliers in Singapore

1. Use Trade Data Platforms for Precise Targeting

· Core Tools:

(1) Enterprise Singapore Database: Provides export qualifications and industry reports for local enterprises (https://www.enterprisesg.gov.sg).

(2) Singapore Customs Trade Statistics (https://www.customs.gov.sg): Access real-time import/export data by HS code.

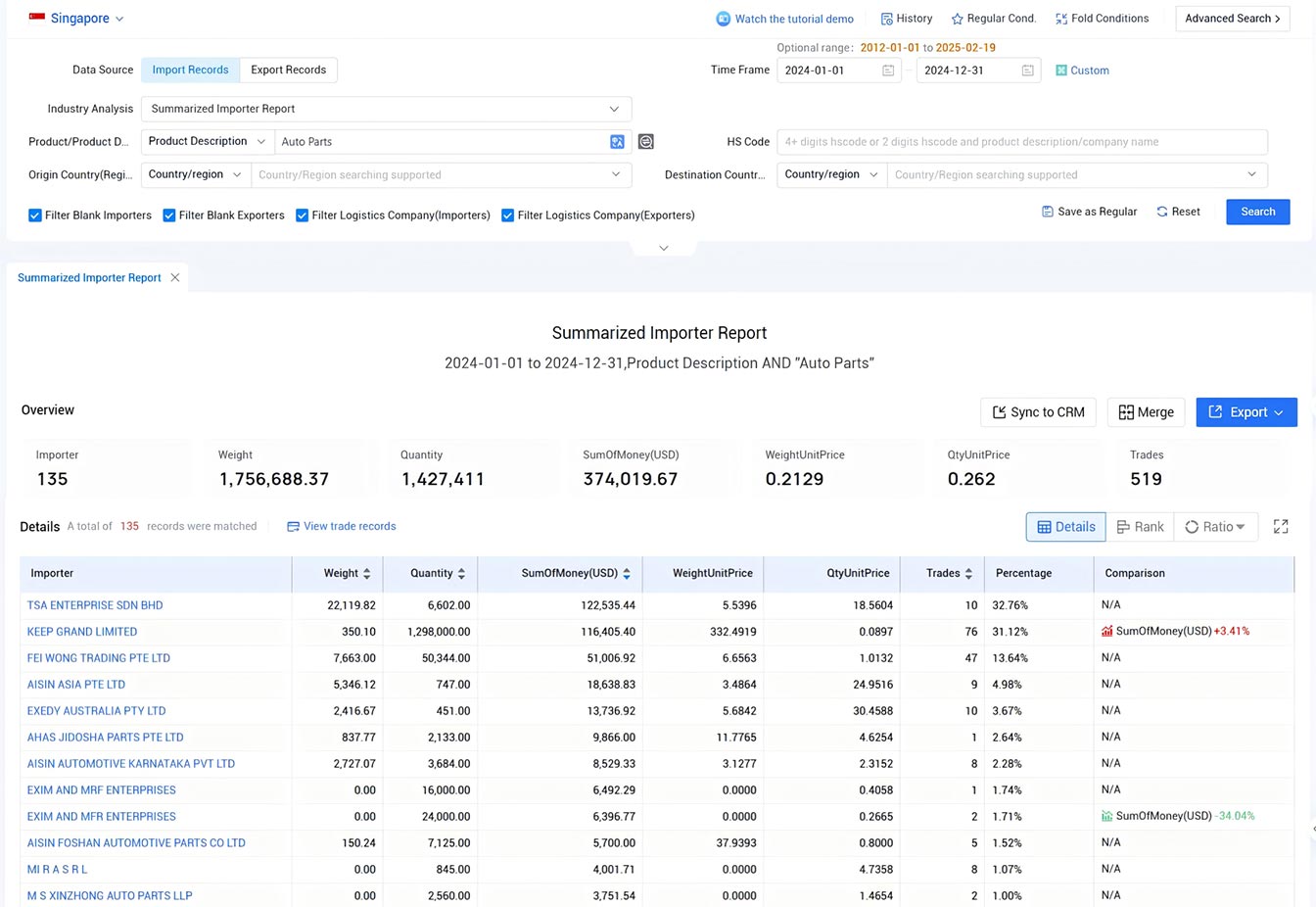

(3) Tendata (https://www.tendata.com/): Analyze Singaporean companies' trade behaviors and filter potential clients in industries such as chemicals and electronics.

By Tendata Singapore trade data, companies can efficiently identify trade patterns, assess the volume and frequency of imports/exports, and refine their market targeting strategies. This data allows businesses to make data-driven decisions when reaching out to potential clients in key sectors like electronics, chemicals, and machinery.

Find Big Buyers: Use Tendata to identify big buyers who frequently import a product. These buyers are usually large retailers, wholesalers or brand owners. You can learn about their purchasing habits, purchasing cycles and supplier distribution through their purchasing records.

Explore Potential Customers: In addition to existing big buyers, you can also use Tendata to discover some emerging small and medium-sized buyers. These buyers may not have been fully explored by their peers and are your potential customer resources.

· Selection Steps:

(1) Input the target product HS code (e.g., integrated circuits = 85423100).

(2) Filter by the top 20 importers (e.g., Flex Singapore, Venture Corporation).

(3) Contact procurement heads via LinkedIn or the company's official website.

2. Participate in Singapore's International Exhibitions and Summits

· Recommended Events:

(1) Singapore International Energy Week: Network with energy and chemical companies.

(2) Semicon Southeast Asia: The global semiconductor industry's major event, gathering chip manufacturers.

(3) Asia Tech x Singapore: Focus on digital services and fintech customers.

· Industry Associations:

(1) Singapore Manufacturers Federation (SMF): Covers 3,000 manufacturing companies.

(2) Singapore Chemical Industry Council (SCIC): Provides a directory of certified chemical enterprises.

3. Connect via B2B Platforms and Government Support Programs

· Main Channels:

(1) SGTrade: Singapore government's official B2B platform; businesses must be ACRA-certified.

(2) Tridge: A bulk commodity trading platform, ideal for energy and agricultural product procurement.

(3) Government Subsidy Programs: Such as the “Global Connect Programme,” which subsidizes overseas customer acquisition costs.

· Collaboration Considerations:

(1) Singapore companies prioritize compliance and require ISO certifications and ESG reports.

(2) SMEs tend to favor "light-asset" models, prioritizing FOB/CIF terms.

4. Localized Collaboration Strategy and Cultural Insights

· Negotiation Style:

(1) Efficient and pragmatic, with a preference for data-driven proposals (e.g., cost-saving calculations, ROI analysis).

(2) English contracts are accepted, but arbitration clauses should be clearly defined (typically choosing Singapore International Arbitration Centre).

· Payment and Risk Control:

(1) Recommended to use local banks (DBS, UOB) or digital platforms (Stripe Singapore).

(2) Use Singapore's Trustmark certification to filter quality suppliers.

IV. Trends and Risk Warnings in Singapore's Import and Export Market

1. Core Trends in 2024

(1) Expansion of Digital Trade: Blockchain cross-border payments and digital twin technology improving supply chain efficiency.

(2) Green Economy Dominance: Carbon trading centers and the promotion of new energy equipment exports (e.g., energy storage systems).

(3) Regional Manufacturing Hub: Attracting European and American companies to set up "nearshore supply chain" hubs (e.g., contract manufacturing for pharmaceuticals).

2. Potential Risks

(1) Geopolitical Instability: The security of the Malacca Strait shipping route is impacted by regional political conditions.

(2) Cost Pressures: Commercial real estate rents are among the highest globally, and warehouse costs have increased by 10% year-on-year.

(3) Technological Dependency: The semiconductor supply chain's high concentration and global chip cycle fluctuations may impact exports.

V. Data Sources and Recommended Tools

1. Official Channels:

(1) Singapore Statistics Bureau (SingStat): https://www.singstat.gov.sg

(2) Singapore Economic Development Board (EDB): https://www.edb.gov.sg

2. Industry Reports:

(1) Enterprise Singapore's "2024 Trade Outlook."

(2) McKinsey's "Singapore's Role in Southeast Asia's Supply Chain Restructuring."

Singapore's market, with its core competencies in efficiency, compliance, and innovation, requires companies to focus on high-value sectors (such as semiconductors and biopharma), leverage government resources and digital tools, and strengthen ESG practices to align with global supply chain regulations. Businesses should prioritize digital services, green technologies, and high-end manufacturing, building long-term partnerships.

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship