Market Insights

Market Insights

27-02-2025

27-02-2025

I. Overall Situation of Vietnam's Imports and Exports in 2024

1. Import and Export Scale and Growth

(1)Total Forecast: Vietnam's total import and export value in 2024 is expected to reach $720 billion, with an annual growth of approximately 8% (compared to $666 billion in 2023).

(2)Trade Surplus: A trade surplus of about $12 billion is projected, continuing the recent export-oriented economic advantage.

2. Major Trading Partners

(1)China (25%): Imports machinery, equipment, and electronic components; exports agricultural products and textiles.

(2)United States (23%): Exports electronics, textiles, and footwear; imports semiconductors.

(3)South Korea (12%): Imports semiconductors and chemicals; exports mobile phone parts.

(4)European Union (10%): Exports footwear and seafood; imports high-end machinery.

(5)Japan (8%): Imports automotive parts; exports electronic components.

II. Analysis of Vietnam's Major Import and Export Products

1. Vietnam's Major Export Products

(1)Electronics (35%): Smartphones, computer parts (Samsung accounts for more than 25% of Vietnam's total exports); semiconductor capacity continues to expand.

(2)Textiles and Footwear (18%): Garments, sports shoes (Nike, Adidas manufacturing base); exports to Europe grow by 12% due to tariff reductions under the EU-Vietnam FTA.

(3)Machinery and Equipment (10%): Industrial machinery, motors; foreign-invested factories drive local production and exports.

(4)Agricultural Products (9%): Coffee (second-largest exporter globally), seafood (shrimp, basa fish), rice; prices are unstable due to climate fluctuations.

(5)Wood and Furniture (7%): Wooden furniture targets the US and EU markets; faces compliance pressure from the EU's deforestation regulations (EUDR).

2. Vietnam's Major Import Products

(1)Electronic Components and Semiconductors (30%): China (45%), South Korea (30%); used in the domestic electronics assembly industry.

(2)Machinery and Equipment (20%): Japan, Germany; supporting manufacturing upgrades (demand for automation equipment grows by 15%).

(3)Textile Raw Materials (12%): China (cotton yarn, synthetic fibers), India (cotton); dependency on imports makes costs sensitive.

(4)Chemical Products (10%): South Korea (petrochemical products), China (plastic pellets); used in plastic products and footwear production.

(5)Steel and Metals (8%): China (low-priced steel), Japan (high-end specialty steel); strong demand in infrastructure and manufacturing.

III. How to Effectively Develop Customers and Suppliers in Vietnam

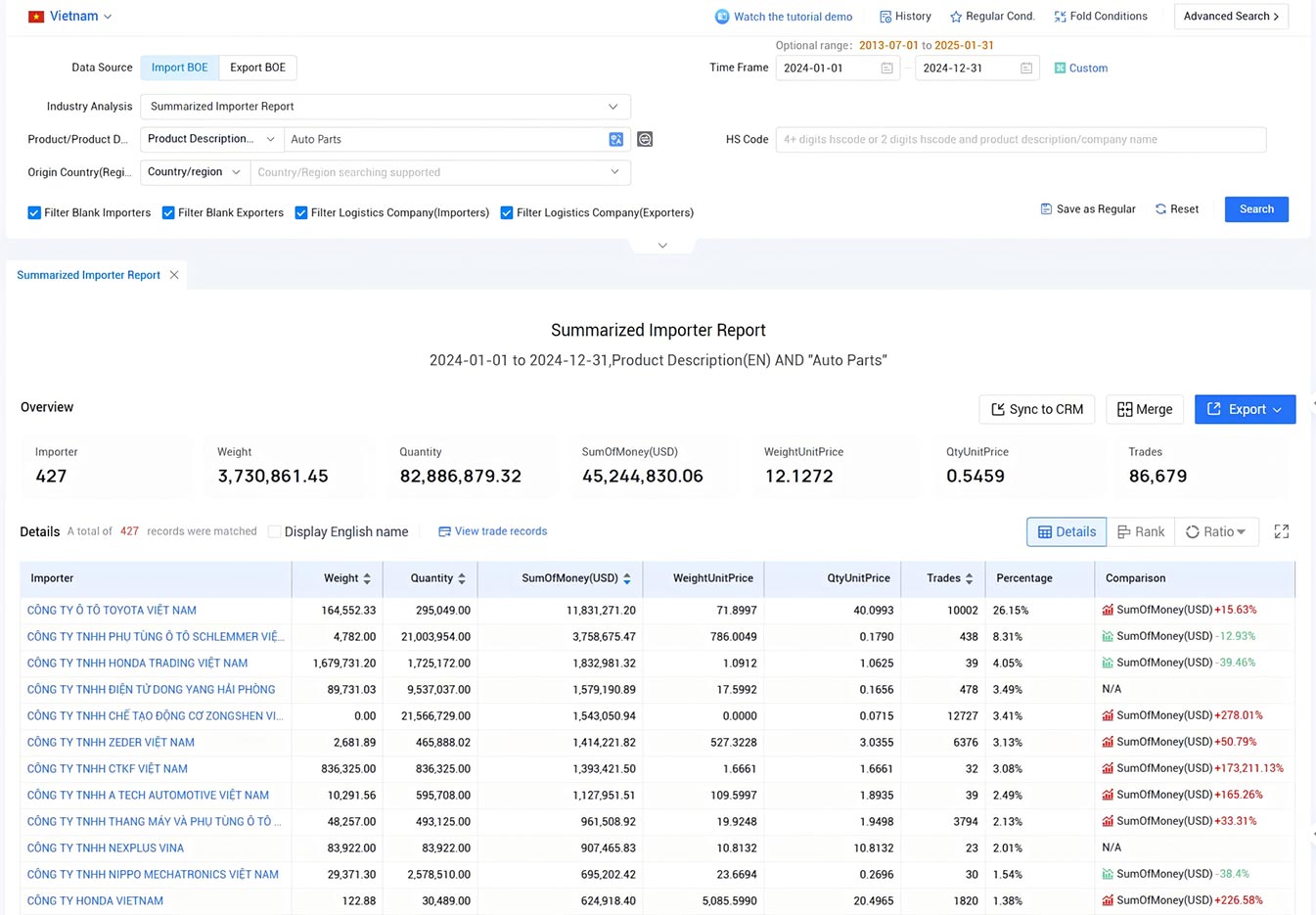

1. Use Customs Data and Vietnam Trade Data to Target Potential Clients

(1)Core Tools:

· Vietnam Customs Database (https://www.customs.gov.vn): Access import and export records (Vietnamese language required).

· TradeMap (ITC): Analyze import/export products, quantities, and trade partners of Vietnamese businesses using detailed Vietnam trade data.

· Tendata: Track global importers and exporters in trade with Vietnam.

Trade Data: Tendata has accumulated 10 billion+ trade transaction details from 228+ countries and regions, supporting one-click query of major import and export countries, customer distribution, product volume and price, etc., which helps import and export enterprises to accurately understand the global market and the trade environment of the target market.

Business Data: Tendata has a total of 500 million+ in-depth enterprise data, involving 198 countries and 230+ industry segments, covering the current operation status, financial information, product information, business relationships, intellectual property rights, etc. The data is fine, which makes it easy to assess the real strength of the target customers in depth, and expand the potential customer base.

Internet Data: Tendata's total of 850 million+ contact data, integrating social media, Collingwood, emails and other multi-channel contacts, helps to reach key contacts of enterprises with one click and improve the efficiency of customer development, as well as news and public opinion monitoring, which helps to grasp the Internet information in a timely manner.

(2)Selection Steps:

· Enter target product HS code (e.g., mobile phone parts = 85177010).

· Sort by import/export volume and identify companies suitable for development.

· Contact the procurement department via the company's website or LinkedIn.

2. Attend Local Exhibitions and Industry Associations in Vietnam

(1)Recommended Exhibitions:

· Vietnam Expo (Hanoi/Ho Chi Minh City): A comprehensive trade show covering electronics, machinery, consumer goods.

· Saigon Tex (Ho Chi Minh City): The largest textile and garment exhibition in Asia, gathering local manufacturing factories.

· Vietnam Wood & Furniture Fair: Connect with wooden product export businesses.

(2)Industry Associations:

· Vietnam Chamber of Commerce and Industry (VCCI): Provides business directories and matchmaking services.

· Vietnam Textile and Apparel Association (VITAS): Tracks trends and updates in the textile industry.

3. Utilize B2B Platforms and Social Media

(1)Mainstream Platforms:

· Alibaba International: Active Vietnamese suppliers; support filtering for “Gold Supplier” certified companies.

· Vietnam Local Platforms: VnTrade, Bizviet (communication in Vietnamese).

· LinkedIn: Directly contact procurement managers or CEOs of Vietnamese companies.

(2)Important Considerations:

· Preference for Face-to-Face Communication: Vietnamese businesses prefer in-person meetings, so it is advisable to visit after initial contact.

· SMEs' Short Decision-Making Chains: While decision-making processes are shorter in SMEs, verify production capacity (e.g., request factory videos or audit reports).

4. Vietnamese Client Collaboration Characteristics and Negotiation Strategies

(1)Cultural Preferences:

· Emphasize long-term relationships; multiple discussions are required to establish trust in first-time cooperation.

· Price-sensitive, but open to “installment payments” or “Letters of Credit (L/C)” to reduce risks.

(2)Risk Control:

· Use local Vietnamese banks or third-party payment platforms (e.g., Escrow.com) to ensure transaction security.

· Clearly define quality standards in contracts (Vietnamese companies often adhere to “Vietnam Standard TCVN”).

By using Vietnam trade data through tools like Tendata, foreign businesses can access detailed insights into the Vietnamese market, identify reliable suppliers or buyers, and develop strategic partnerships for long-term success.

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship