Market Insights

Market Insights

05-12-2024

05-12-2024

In 2023, the global trade of items under HS Code 8309900000 (which covers caps, lids, and other closures made of metal, plastic, and other materials) demonstrated significant patterns, particularly in the import and export of these essential packaging components. These closures are used extensively in beverage, food, and cosmetic industries, among others, serving as key components for product safety and preservation.

Top Importers of Caps, Lids, and Closures (HS Code 8309900000) in 2023

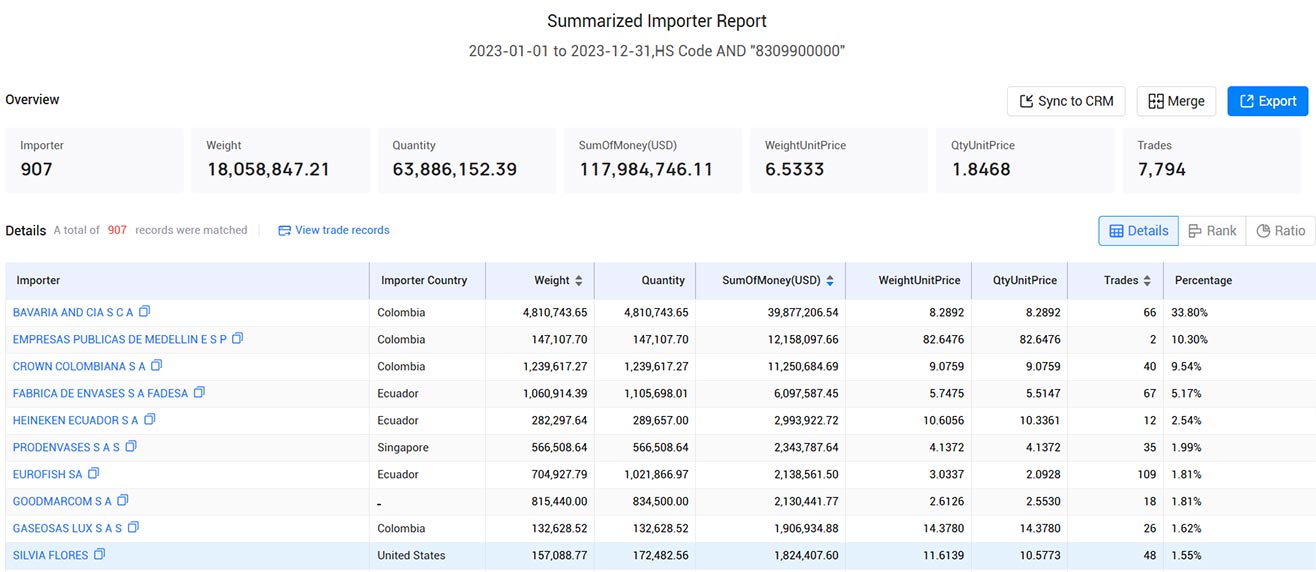

The import market for closures was led by Bavaria and Cia S.C.A., which accounted for 33.8% of total imports, translating to $39.88 million in 2023. The company's significant share underscores the demand for closures in the beverage industry, particularly in countries like Colombia, where Bavaria operates as a major player in the beer and soft drink sectors.

Other leading importers of closures included:

· Empresas Publicas de Medellin E.S.P. – $12.16 million (10.3%)

· Crown Colombiana S.A. – $11.25 million (9.54%)

· Fabrica de Envases S.A. FADESA – $6.1 million (5.17%)

· Heineken Ecuador S.A. – $2.99 million (2.54%)

· Prodenvases S.A.S. – $2.34 million (1.99%)

These importers are heavily involved in industries ranging from beverages to packaging, with major players like Crown Colombiana S.A. and Heineken Ecuador reflecting the strong demand for closures in the beverage sector. Smaller but notable importers include Eurofish S.A., Goodmarcom S.A., and Gaseosas Lux S.A.S., indicating the widespread usage of closures across various sectors.

The diverse import portfolio reflects the global nature of the trade in closures, with companies spanning from large beverage corporations to packaging specialists, all seeking these essential components to seal their products securely and preserve their quality.

>>>Get A Free Demo from Tendata<<<

Top Exporters of Caps, Lids, and Closures (HS Code 8309900000) in 2023

On the export side, the market was dominated by Canpack S.A., a leader in the manufacturing of aluminum packaging, which accounted for 19.54% of global exports, valued at $23.06 million. Canpack's strong position is driven by the high demand for metal closures, particularly in the beverage and food industries, where aluminum is the material of choice for cans and bottle closures.

Other top exporters included:

· DCN Diving B.V. – $12.16 million (10.3%)

· Can Pack Brasil Industria de Embalagens Ltda. – $10.4 million (8.81%)

· Fabrica Monterrey – $8.46 million (7.17%)

· Eviolys Embalajes España S.A.U. – $6.39 million (5.41%)

· Easy Open Lid Industry Corp Yiwu – $6.12 million (5.19%)

Companies like Can Pack Brasil and Fabrica Monterrey serve as significant exporters in Latin America, particularly for beverage packaging, while Eviolys Embalajes España S.A.U. reflects the growing importance of Europe in the global closure market. Guala Closures Deutschland GmbH and Metalpren S.A. also represent key players in the production and export of closures, particularly in Europe and South America.

Regional Trade Patterns

The trade in closures is strongly linked to the beverage and food packaging industries, which are concentrated in certain regions. European countries, in particular, are key suppliers of closures, with major exporters like Eviolys Embalajes España and Guala Closures showing Europe’s central role in the global market for packaging.

Latin American exporters like Can Pack Brasil and Fabrica Monterrey also have a strong presence in the market, capitalizing on the demand for high-quality closures in both local and international markets. Meanwhile, Asia, particularly China, continues to be a key player in the production of inexpensive yet high-quality plastic and metal closures, as demonstrated by Easy Open Lid Industry Corp Yiwu.

Key Insights from the 2023 Trade Data

· Dominance of Beverage Sector: The leading importers of closures, including Bavaria, Crown Colombiana, and Heineken Ecuador, are all major players in the beverage industry, underscoring the importance of closures in packaging liquid products.

· Strong Export Market in Europe and Latin America: European and Latin American exporters dominate the market, reflecting both the high demand for closures in these regions and the advanced manufacturing capabilities of companies like Canpack and Guala Closures.

· Rising Demand for Sustainable Packaging: With increasing attention to sustainability, manufacturers of closures are also looking to innovate in terms of material and design, pushing for more environmentally friendly solutions in the packaging sector.

Conclusion

The global trade of closures under HS Code 8309900000 continues to show robust activity, driven by the demand from the beverage, food, and cosmetic industries. Leading importers such as Bavaria and Cia S.C.A. and exporters like Canpack S.A. dominate the market, highlighting the essential role that closures play in packaging and product preservation. As the world shifts towards more sustainable packaging solutions, the industry is likely to see further growth and innovation in both the materials and technologies used in the production of caps, lids, and closures.

Tendata iTrader aggregates trade data from 218 countries and detailed

information on over 130 million import-export enterprises worldwide.

With a daily provision of 10 billion trade records, Tendata swiftly offers contact details of over 700 million top-level executives and decision-makers of import-export enterprises through intelligent filtering, including email addresses, phone numbers, social media profiles, and more. Additionally, we synchronize company profiles, product images, and website links, while providing 19 types of visual reports to assist foreign trade enterprises in precise market positioning and in-depth market analysis, helping you quickly locate the precise purchasers and suppliers you need.

(>>Check the Official Shanghai Tendata Website for More Details <<)

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship