Market Insights

Market Insights

04-12-2024

04-12-2024

HS Code 711719000 refers to a specific category of commodities, typically related to precious metals, including but not limited to items such as jewelry, ornamental articles, or precious metal alloys. The global trade data in Tendata for this HS code provides valuable insights into the dynamics of international trade, detailing the prices, quantities, trading partners, importers, and exporters involved in these commodities. In 2024, data reveals significant trends and trading patterns across various countries and companies. Here's a detailed breakdown of the key findings.

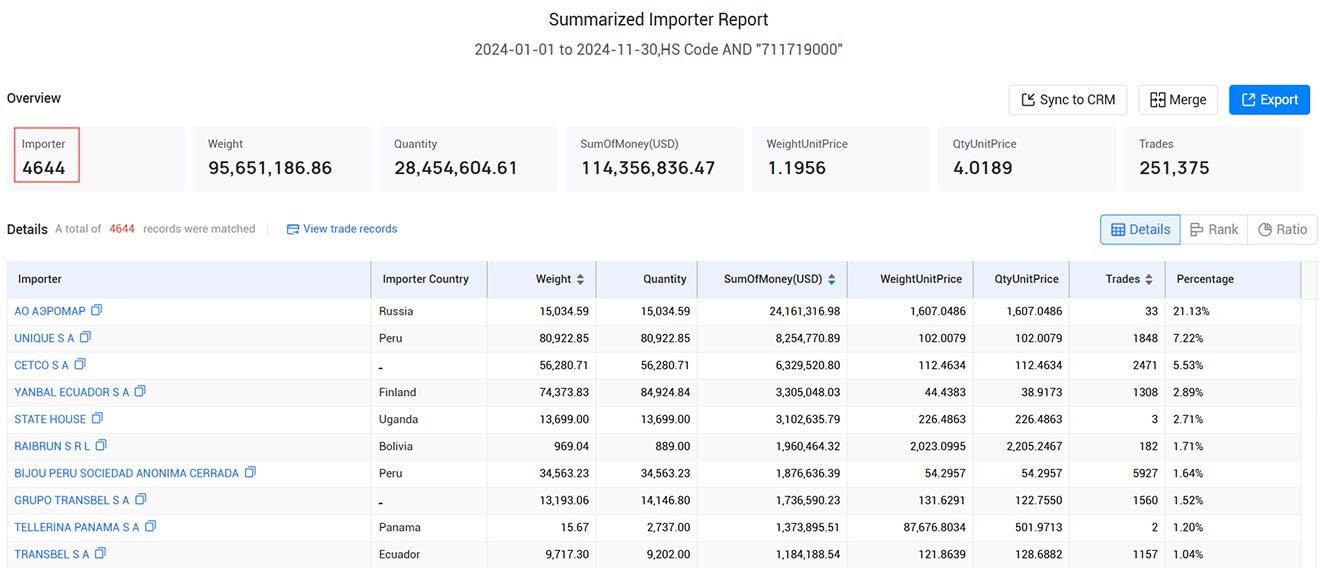

Import Data Overview for HS Code 711719000

In 2024, the import of goods under HS Code 711719000 worldwide is valued at several billion dollars, with various regions and countries playing a pivotal role. The commodities covered under this code are typically traded based on the quality and composition of the metal, as well as the intricate designs that appeal to luxury markets globally.

Top Importers of HS Code 711719000

The top importers in this category are companies that play a significant role in the jewelry and luxury goods market. Here are the leading importers by value:

1. АО АЭРОМАР (21.13% of imports, $24.16 Million)

This company leads the imports, highlighting a strong demand for high-quality precious metal items, likely related to the Russian luxury market.

2. UNIQUE S A (7.22% of imports, $8.25 Million)

A key player in the global trade of precious metals, UNIQUE S A has a significant share of the imports, signaling a growing demand in its region.

3. CETCO S A (5.53% of imports, $6.33 Million)

With its sizable share, CETCO S A underscores the importance of trade in this category, reflecting strong demand in its home country or market area.

4. YANBAL ECUADOR S A (2.89% of imports, $3.31 Million)

This company represents the growing importance of jewelry imports in Latin America, especially Ecuador.

5. STATE HOUSE (2.71% of imports, $3.1 Million)

A strong player in this sector, STATE HOUSE's share indicates continued interest in high-end goods in the luxury segment.

Other notable importers include RAIBRUN S R L, BIJOU PERU SOCIEDAD ANONIMA CERRADA, GRUPO TRANSBEL S A, and TELLERINA PANAMA S A, each contributing to the increasing demand for precious metal goods in their respective countries.

>>>GET A FEE Demo from Tendata<<<

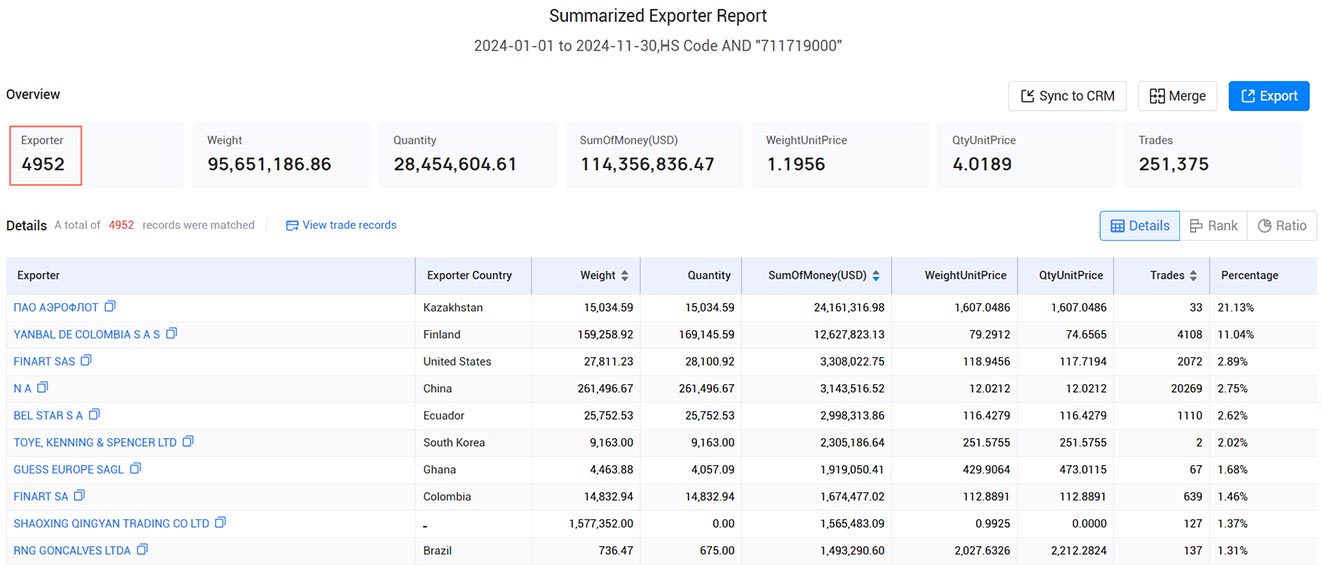

Top Exporters of HS Code 711719000

The exporters of HS Code 711719000 play a key role in meeting the international demand for precious metals and jewelry. The top exporters in 2024 include:

1. ПАО АЭРОФЛОТ (21.13% of exports, $24.16 Million)

Leading the export list, Aeroflot stands out as a major exporter, highlighting Russia’s importance in the global luxury and precious metal market.

2. YANBAL DE COLOMBIA S A S (11.04% of exports, $12.63 Million)

This Colombian company is a major exporter, underscoring Colombia’s significant role in the trade of jewelry and precious metals.

3. FINART SAS (2.89% of exports, $3.31 Million)

Based in Colombia, FINART SAS contributes to the growing trend of exports in South America, particularly to high-demand markets like Russia and Peru.

4. BEL STAR S A (2.62% of exports, $3 Million)

A key exporter based in the region, BEL STAR S A caters to international markets with a strong preference for high-quality metal and jewelry products.

5. TOYE, KENNING & SPENCER LTD (2.02% of exports, $2.31 Million)

This company is well-known for exporting luxury items and playing a key role in the high-end jewelry market.

Other notable exporters in this segment include GUESS EUROPE SAGL, FINART SA, and SHAOXING QINGYAN TRADING CO LTD, each of which has a considerable share of the market, particularly in European and Asian regions.

>>>Schedule A Demo from Tendata<<<

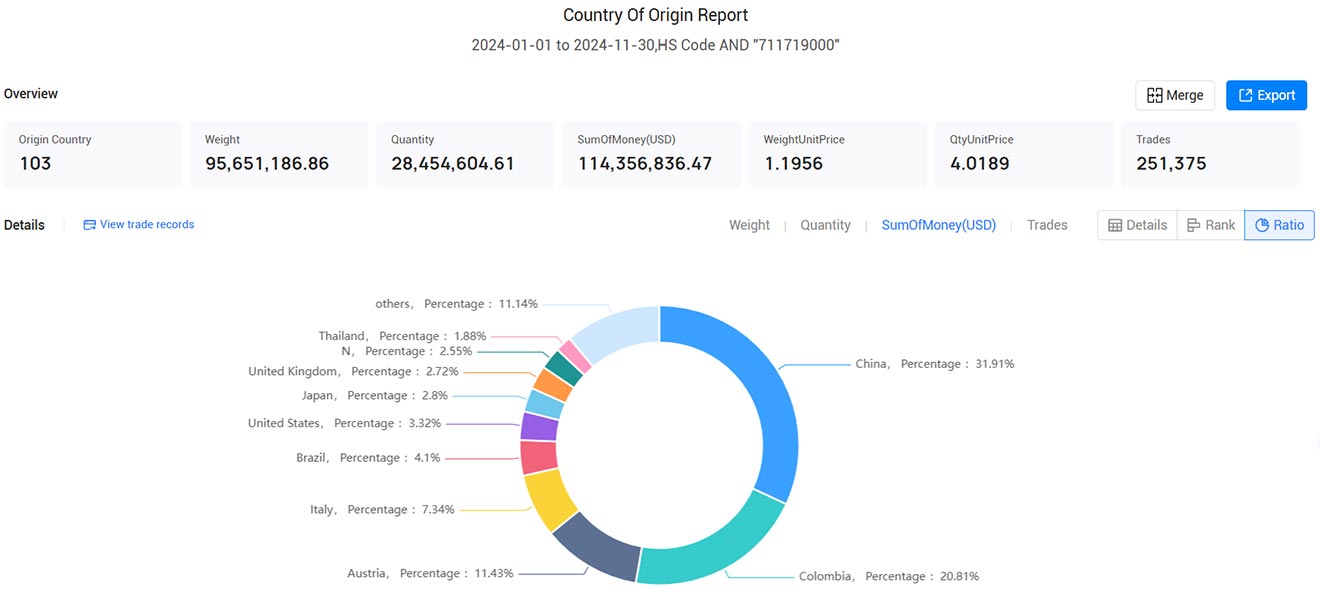

Origin and Destination Countries

The origin countries for goods under HS Code 711719000 are key to understanding the global supply chain for luxury goods and precious metals:

1. China (159.67%, $36.49 Million)

China is by far the largest origin of these goods, reinforcing its position as the world’s manufacturing powerhouse for precious metal goods and jewelry.

2. Colombia (5844.03%, $23.79 Million)

Colombia's presence as a top origin country is notable, with the country being home to several luxury jewelry producers, especially in the gold and silver markets.

3. Austria (649741.33%, $13.08 Million)

Austria's remarkable share is reflective of its strong legacy in producing fine jewelry and precious metal items.

4. Italy (3230.79%, $8.4 Million)

Italy remains a critical player in the global luxury goods market, particularly for high-end jewelry items, marking a significant portion of the exports.

5. Brazil (865.87%, $4.69 Million)

Brazil’s contribution emphasizes the role of Latin American countries in the precious metals trade, with Brazil being a prominent exporter of jewelry and gold.

Other origin countries like the United States, Japan, United Kingdom, Thailand, and Lithuania also contribute to the global flow of precious metal goods.

>>>Request A FREE Demo from Tendata<<<

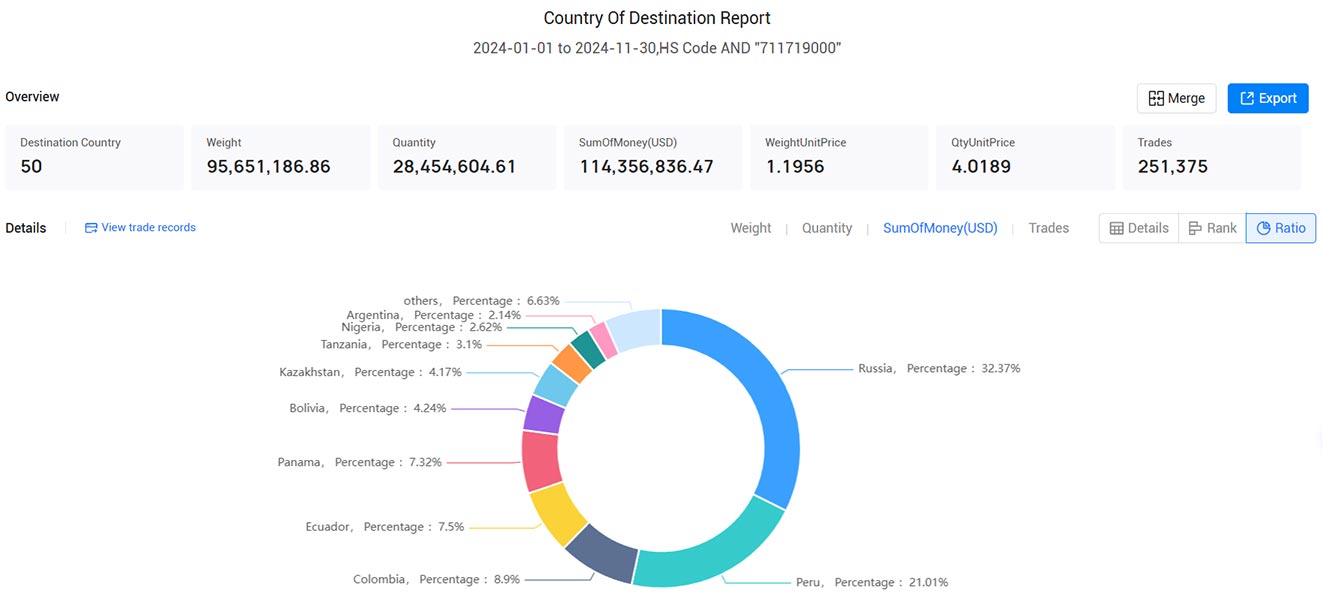

On the destination side, the major receiving countries include:

1. Russia (17610.58%, $37.02 Million)

Russia stands out as the largest destination country for these goods, a reflection of the strong domestic market for high-end jewelry and precious metals.

2. Peru (2927.63%, $24.03 Million)

Peru is another significant market, likely driven by both local demand for luxury goods and the country’s position as a producer of precious metals.

3. Colombia (1602.73%, $10.18 Million)

As both an exporter and importer, Colombia continues to be a key destination for these products in the South American region.

4. Ecuador (315.33%, $8.57 Million)

Ecuador's demand for high-quality jewelry and metal goods continues to rise, especially within the Latin American market.

5. Panama (190.24%, $8.38 Million)

Panama's strategic location in international trade routes makes it a critical hub for the movement of luxury items.

Other destinations, including Bolivia, Kazakhstan, Tanzania, Nigeria, and Argentina, indicate a growing demand for luxury goods and precious metals in various emerging markets.

>>>Schedule A Demo from Tendata<<<

Conclusion

The import and export data for HS Code 711719000 in 2024 reveals interesting trends in the global trade of luxury goods and precious metals. With significant imports and exports involving key players from countries like China, Colombia, Russia, and Peru, the demand for high-quality jewelry and metal products is clearly growing. The data also highlights the importance of trading relationships between specific countries, such as Russia's central role as a destination for luxury goods and Colombia's prominence both as an importer and exporter of these commodities. Understanding these trade patterns is essential for businesses engaged in the luxury goods market, offering insights into global demand, emerging markets, and potential growth opportunities.

How can Importers/Exporters Proactively develop Customers?

The standards for developing customers for import and export enterprises can be measured from the following data dimensions: purchase volume, profit margin, payment terms, product styles and quality matching, long-term procurement stability, loyalty, procurement potential, communication guidance intensity, local brand influence, risk resistance, and corporate credit rating, etc. Collecting sufficient import export data on high-quality customers and creating accurate "profiles" for them has become an indispensable choice for actively developing customers. (>>> Click to Apply for a Free Demo)

With precise customer "profiles" in hand, the next step is to proactively analyze and clarify the other party's needs. Customer development can follow the "5W+1H" principle: What (what does the customer want to purchase), Why (why do they want to purchase), When (when will the purchase take place), Where (from where to make the purchase), Who (who ultimately decides the purchase), and How much (what is the procurement budget). By addressing these six points with relevant questions in the communication process, progress can be made step by step, leading to the formulation of market and pricing strategies and reducing decision-making errors. (>>> Get A FREE DEMO)

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship