Market Insights

Market Insights

20-11-2024

20-11-2024

As the largest wine market in the world, the United States remains a pivotal destination for wine producers worldwide. However, evolving consumer preferences, economic factors, and shifting trade dynamics are reshaping the wine import landscape, presenting both challenges and opportunities for international wine brands seeking to enter or expand in the U.S. market.

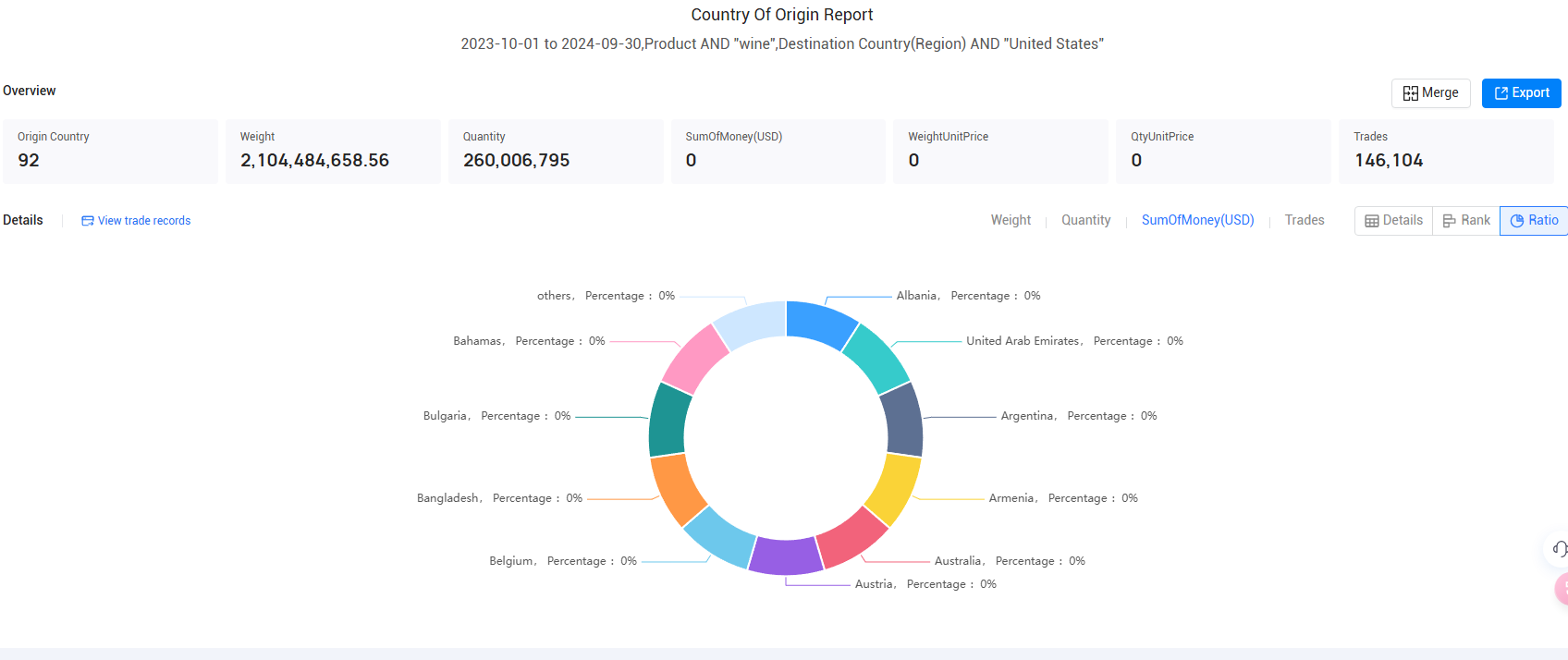

Landscape of Wine Import in the U.S.

In 2023, global wine production was historically low, with only 237 million hectoliters produced, marking a 10% drop from 2022 and the lowest output since 1961. Extreme climatic conditions and fungal diseases were significant factors contributing to this decline. As global wine consumption in 2023 was estimated at 221 million hectoliters (a decrease of 2.6% from 2022), higher production and distribution costs driven by inflation led to increased wine prices, affecting consumer purchasing power. This decline in consumption is mirrored by a decrease in import volumes, with health and economic considerations increasingly influencing these shifts.

For wine producers aiming to navigate these challenging conditions, partnering with U.S. wine importers is key. Understanding the needs of these importers is crucial for foreign wine brands looking to enter or expand in the U.S. market.

>>Click here for more information<<

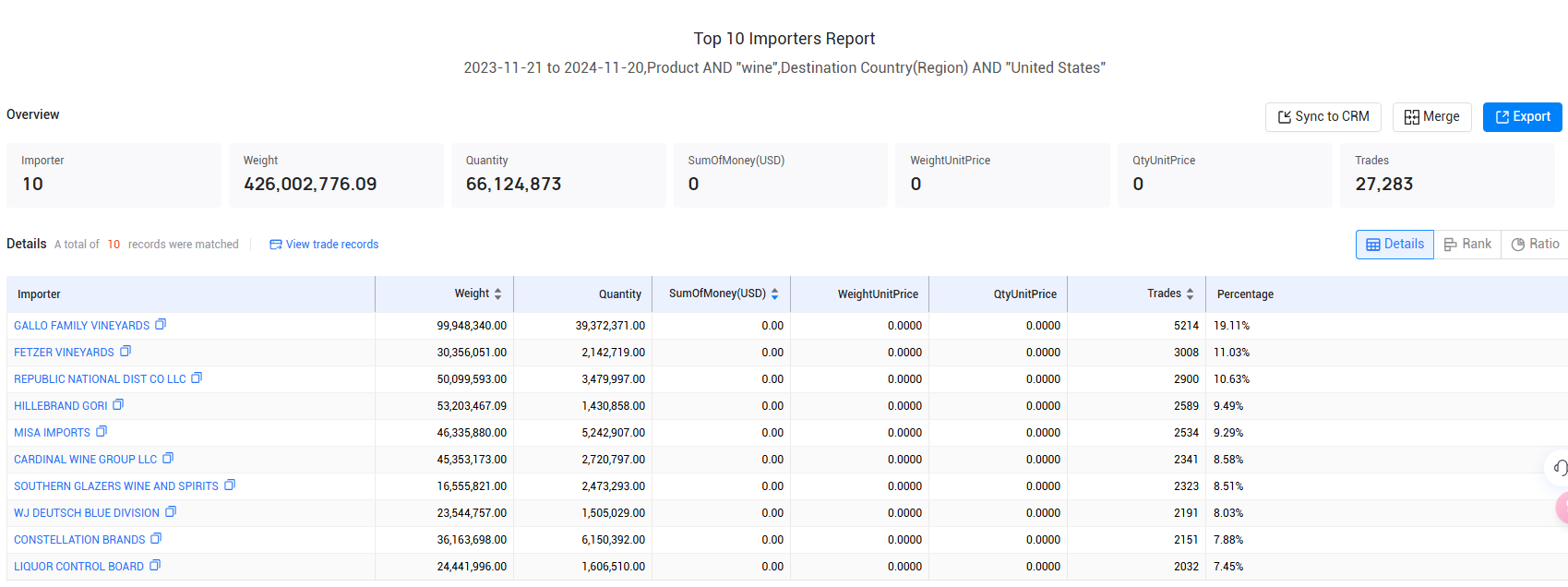

Top 10 U.S. Wine Importers in 2023-24

The U.S. wine import sector is highly competitive, with numerous players distributing a vast array of wine brands across the country. Here are the top 10 wine importers in the U.S. based on their market share:

· Gallo Family Vineyards (2.98%): One of the largest and most well-known wine producers in the U.S., Gallo Family Vineyards has established itself as a dominant force in both domestic and international wine markets.

· Fetzer Vineyards (1.73%): Known for its commitment to sustainability and high-quality wines, Fetzer Vineyards is a major player in the U.S. wine industry, blending tradition with ecological responsibility.

· Republic National Distributing Co LLC (1.66%): As one of the largest wholesale distributors of alcoholic beverages in the U.S., Republic National plays a key role in wine distribution, serving retailers, restaurants, and other outlets across the country.

· Hillebrand Gori (1.60%): Specializing in logistics and supply chain management for the wine, beer, and spirits industries, Hillebrand Gori provides critical infrastructure for wine importers and distributors.

· Southern Glazers Wine and Spirits (1.53%): A powerhouse in the alcoholic beverage distribution sector, Southern Glazers is one of the largest distributors of wine and spirits in the U.S., with an extensive portfolio of international and domestic wines.

· Misa Imports (1.45%): Specializing in premium and artisanal Tequila, Misa Imports has carved out a niche in the U.S. market for high-end alcoholic beverages.

· Cardinal Wine Group LLC (1.34%): Known for its premium and luxury wine portfolio, Cardinal Wine Group LLC has become an influential player in the U.S. wine industry, specializing in the marketing and distribution of high-end wines.

· W.J. Deutsch & Sons, Ltd. (1.25%): This established U.S. importer and distributor is renowned for its strong portfolio of international and domestic wines.

· Constellation Brands (1.23%): While Constellation is widely recognized for its beer brands, it also maintains a significant presence in the wine industry, with a portfolio of both iconic and emerging wine brands.

· Liquor Control Board (1.16%): Government-regulated entities such as the Liquor Control Board play a key role in the distribution of wine in certain states, managing both wholesale and retail distribution.

>>Click here for more trade data<<

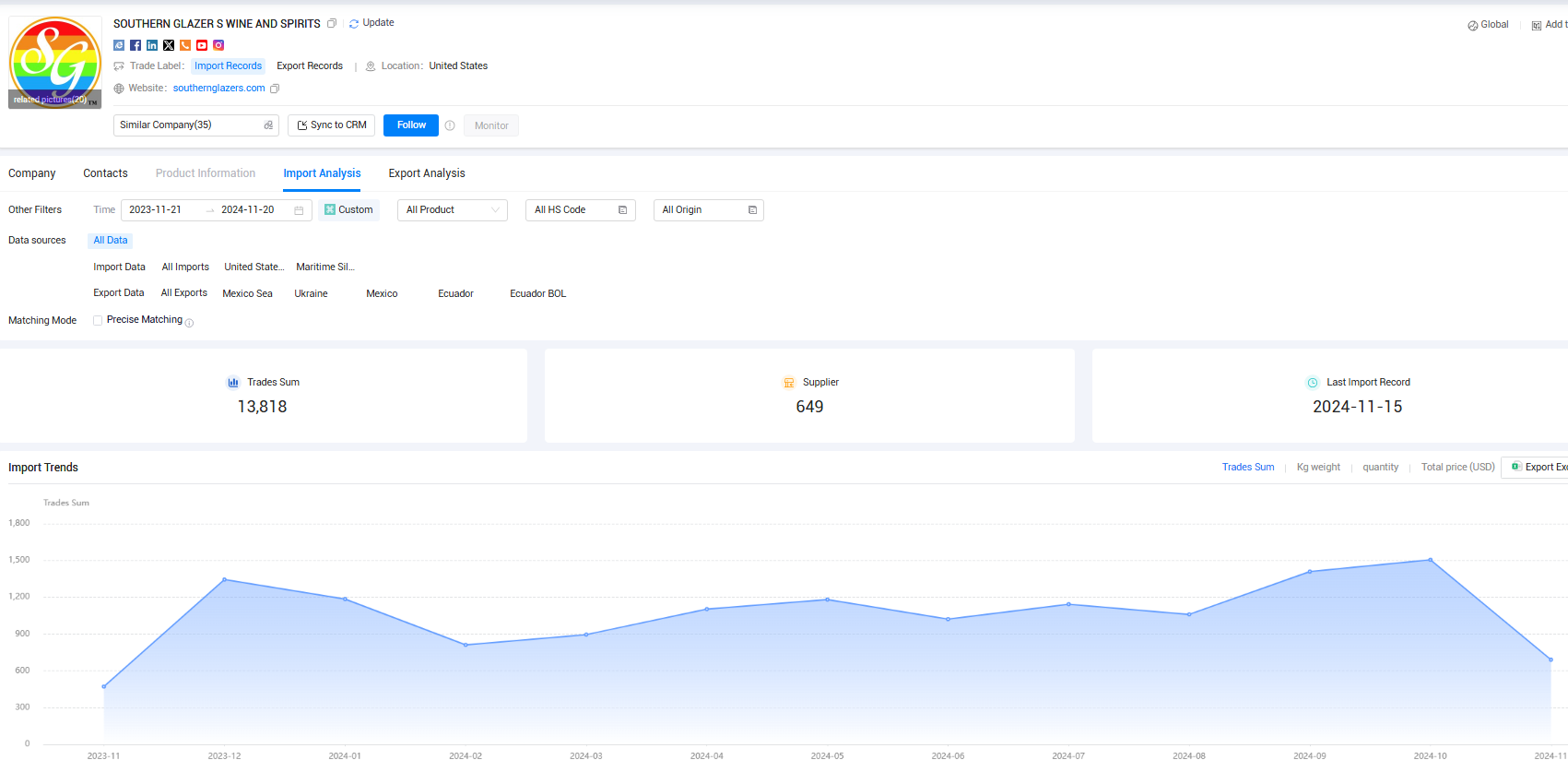

How Tendata Can Help You Find Wine Importers

For international wine producers, identifying reliable and reputable wine importers in the U.S. is a critical step toward market success. Tendata, a data-driven platform, can provide valuable insights into the U.S. wine import sector, helping wineries connect with top-tier importers and distributors. By using Tendata’s robust database, wine producers can gain access to a comprehensive list of wine importers, detailed market trends, and relevant contact information, allowing them to make informed decisions about whom to partner with for successful U.S. market entry. Using Tendata, wine brands can:

1. Find buyers in your target market who are purchasing your products.

2. Monitor competitors, information collection and analysis of the competitive environment and competitive strategy.

3. Old customer maintenance, seamlessly and quickly observe the latest purchasing dynamics of each old customer at any time.

4. Accurately screen the quality of buyers and give the most accurate offer.

>>Contact Tendata for more information<<

About Tendata

Tendata iTrader has 210 million global enterprise information, 10 billion data scrolling every day, can quickly and intelligently screen out 700 million executives, decision makers contact information, including email, phone, social media, etc., but also can synchronize the display of the company's yellow pages, product images and web site.

At the same time, Tendata provides 19 visualization reports to help foreign trade enterprises accurately locate and analyze the market, so that you can quickly find the precise buyers and suppliers you need.

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship