Market Insights

Market Insights

20-06-2024

20-06-2024

In 2022, the global export market for beer was valued at approximately US$16.4 billion. This figure represents a 4.1% increase over the five-year period beginning in 2018, when the total export value was $15.8 billion. However, from 2021 to 2022, there was a slight decline of 1.5% in the value of globally exported beer, dropping from $16.7 billion.

The leading beer exporting nations—Mexico, the Netherlands, Belgium, Germany, and the United States—collectively accounted for over two-thirds (67.4%) of the global beer export market in 2022.

Europe was the dominant continent for beer exports in 2022, with shipments valued at $8.5 billion, making up 51.8% of the global total. North America followed, contributing 38.1%, with Asia coming in third at 6.3%. Smaller contributions came from Latin America (1.82%) excluding Mexico, Africa (1.78%), and Oceania (0.3%), led by Australia and New Zealand.

The 4-digit Harmonized Tariff System (HTS) code for beer made from malt is 2203.

Leading Beer Exporters

The following are the top 15 beer-exporting countries by value in 2022:

1. Mexico: US$4.3 billion (28.4% of total beer exports)

2. Netherlands: $2.1 billion (14.1%)

3. Belgium: $2 billion (13.3%)

4. Germany: $1.3 billion (8.4%)

5. United States: $645.6 million (4.3%)

6. United Kingdom: $525.5 million (3.5%)

7. France: $386.4 million (2.6%)

8. Czech Republic: $297 million (2%)

9. Ireland: $289.9 million (1.9%)

10. Spain: $285.2 million (1.9%)

11. Denmark: $255.8 million (1.7%)

12. Italy: $254.5 million (1.7%)

13. China: $242.8 million (1.6%)

14. Poland: $239.1 million (1.6%)

15. Portugal: $151.1 million (1%)

These 15 countries were responsible for 88.2% of global beer exports in 2022. Among them, the fastest-growing exporters from 2021 to 2022 included Spain (up 17.3%), Poland (up 15.8%), France (up 10.1%), and the Netherlands (up 4.5%). Conversely, the countries experiencing the most significant declines in beer exports were the United States (down 19.9%), the United Kingdom (down 17.7%), Ireland (down 15.8%), the Czech Republic (down 10.4%), and Denmark (down 7.3%).

Countries with the Largest Beer Trade Surpluses

The countries with the highest positive net exports (exports minus imports) for beer in 2022 were:

1. Mexico: US$5.5 billion (net export surplus up 9.5% from 2021)

2. Belgium: $1.6 billion (down 14.8%)

3. Netherlands: $1.5 billion (down 4.3%)

4. Germany: $765 million (down 18.1%)

5. Czech Republic: $297.1 million (down 5.3%)

6. Denmark: $231.2 million (up 2.4%)

7. Poland: $152.9 million (down 16.3%)

8. Brazil: $107 million (down 7.5%)

9. Portugal: $91.8 million (down 3%)

10. Namibia: $77.5 million (up 38.9%)

11. Ireland: $76.6 million (up 82.2%)

12. Thailand: $72.5 million (down 12.8%)

13. Vietnam: $53.2 million (down 27.6%)

14. Turkey: $42.7 million (up 30.8%)

15. India: $38.4 million (up 8.7%)

Mexico's substantial trade surplus underscores its dominant position in the global beer market.

Countries with the Largest Beer Trade Deficits

The countries with the highest negative net exports (imports minus exports) for beer in 2022 were:

1. United States: -US$6.4 billion (net export deficit up 4.9% from 2021)

2. France: -$660.9 million (up 5.7%)

3. Italy: -$388.9 million (down 0.1%)

4. China: -$323 million (down 25.2%)

5. Canada: -$310.7 million (up 6.9%)

6. Taiwan: -$222.6 million (up 1.6%)

7. Chile: -$207.1 million (down 23.6%)

8. Australia: -$202.9 million (down 4.5%)

9. United Arab Emirates: -$168.9 million (up 72.2%)

10. Paraguay: -$147.3 million (up 710.7%)

11. Russia: -$135.1 million (down 46.9%)

12. Cuba: -$126.4 million (up 355.9%)

13. South Korea: -$125.6 million (down 23%)

14. Honduras: -$115 million (up 41.7%)

15. Switzerland: -$109.5 million (down 3.5%)

The United States faced the largest trade deficit, indicating a significant demand for imported beer.

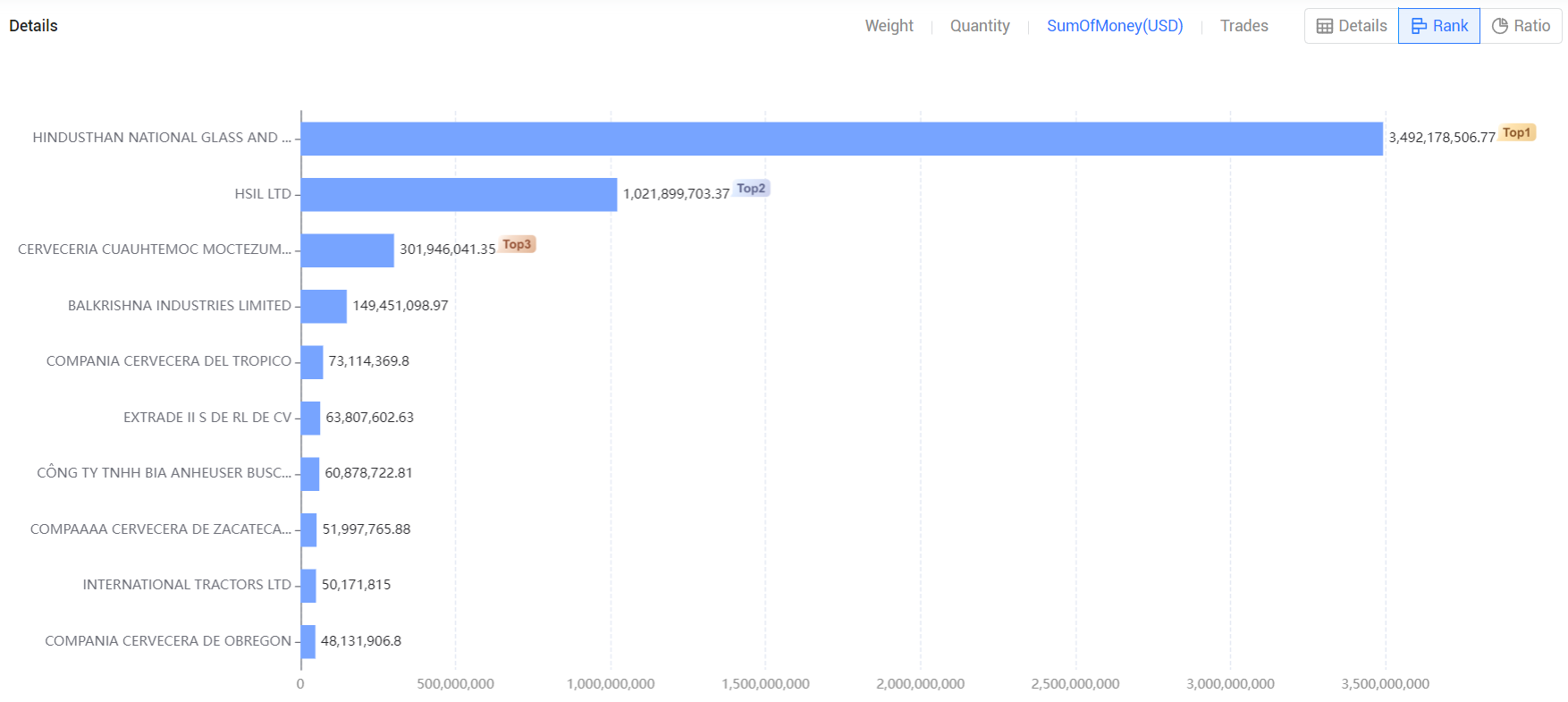

Leading Beer Exporting Companies

Below are some prominent companies engaged in the global beer trade:

1. Hindusthan National Glass and Industries Ltd: 57.27%, $3,492.18 million

2. HSIL Ltd: 16.76%, $1,021.9 million

3. Cervecería Cuauhtémoc Moctezuma: 4.95%, $301.95 million

4. Balkrishna Industries Limited: 2.45%, $149.45 million

5. Compañía Cervecera del Trópico: 1.2%, $73.11 million

6. Extrade II S de RL de CV: 1.05%, $63.81 million

7. Công Ty TNHH Bia Anheuser Busch InBev Việt Nam: 1%, $60.88 million

8. Compañía Cervecera de Zacatecas: 0.85%, $52 million

9. International Tractors Ltd: 0.82%, $50.17 million

10. Compañía Cervecera de Obregón: 0.79%, $48.13 million

These companies are significant players in the international beer export market.

Global Market Analysis

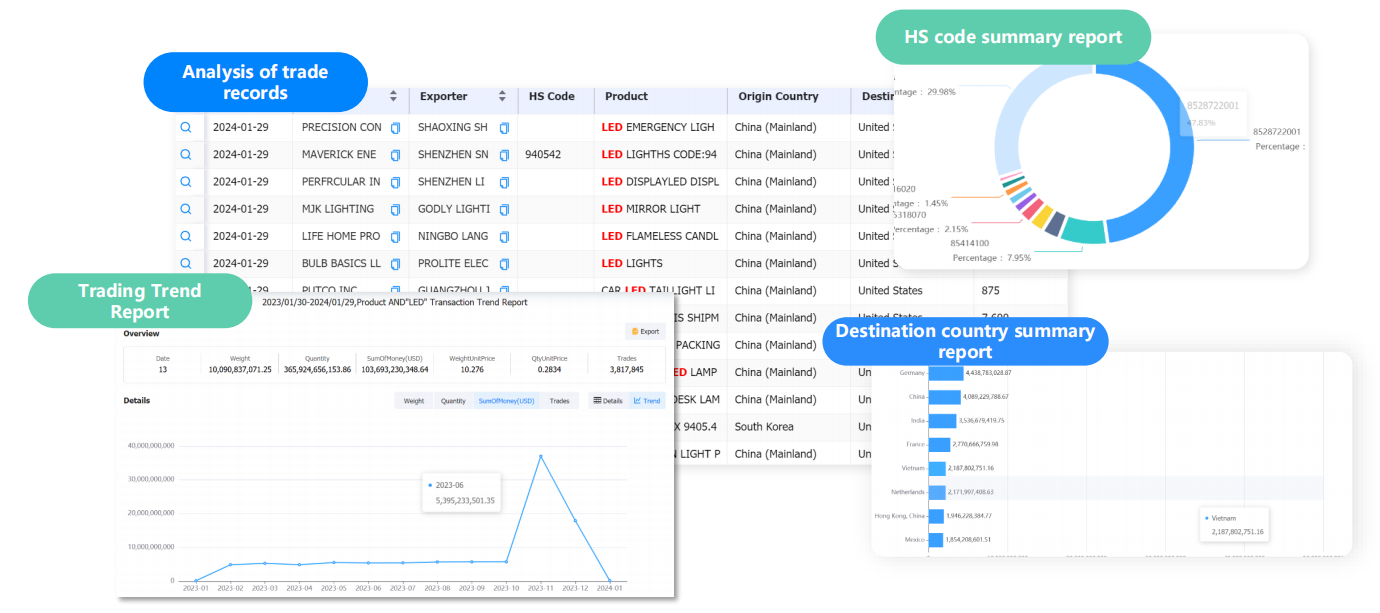

Analysis of the Overall Trade Situation and Trends in the Industry

Through its powerful digital platform and in-depth reporting services, Tendata helps users to analyse the overall situation and future trends of the industry, so as to achieve more accurate market positioning and strategic planning.

Analysis of Specific Product Trade Trends in the Target Market

Tendata can provide comprehensive data support and analytical reports for analysing trade trends for a product in a single market, helping you to understand how that product is being traded in that market and identify business opportunities.

>>Get A Free Demo<<

Category

Leave Message for Demo Request or Questions

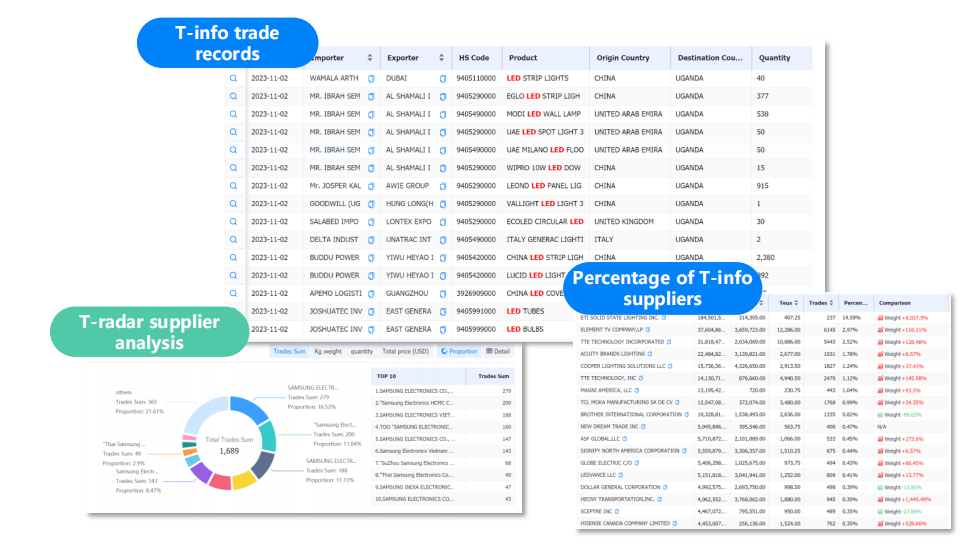

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship