Import News

Import News

23-12-2024

23-12-2024

The global brick market has witnessed dynamic shifts in demand and purchasing patterns between 2023 and 2024. As infrastructure projects, construction, and industrial developments continue to rise, the demand for building materials like bricks remains steady. This article delves into the leading brick buyers of 2024, comparing them to their 2023 counterparts and analyzing key trends driving the market.

2024 Global Brick Buyers: Overview

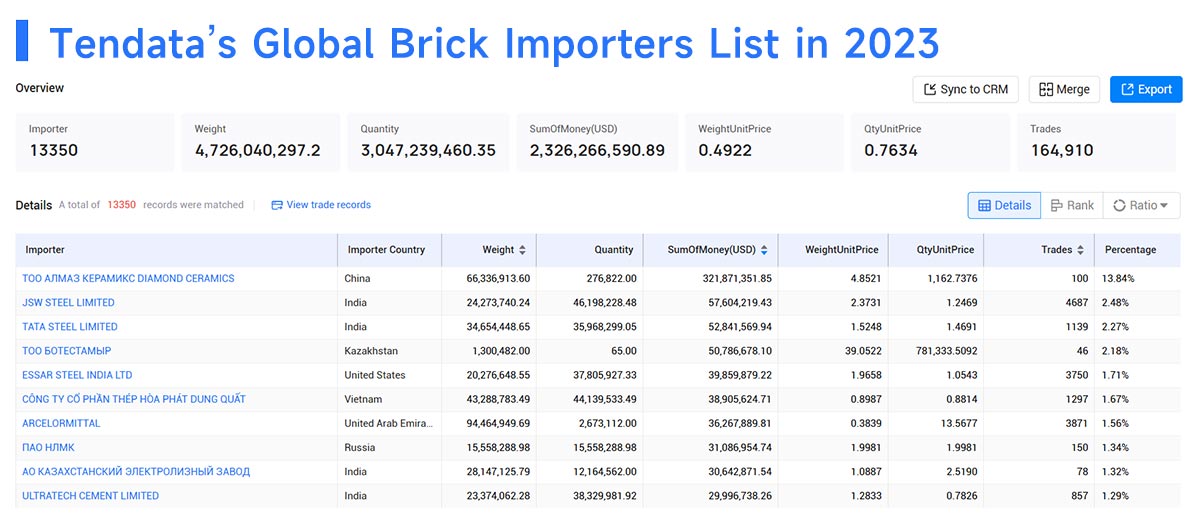

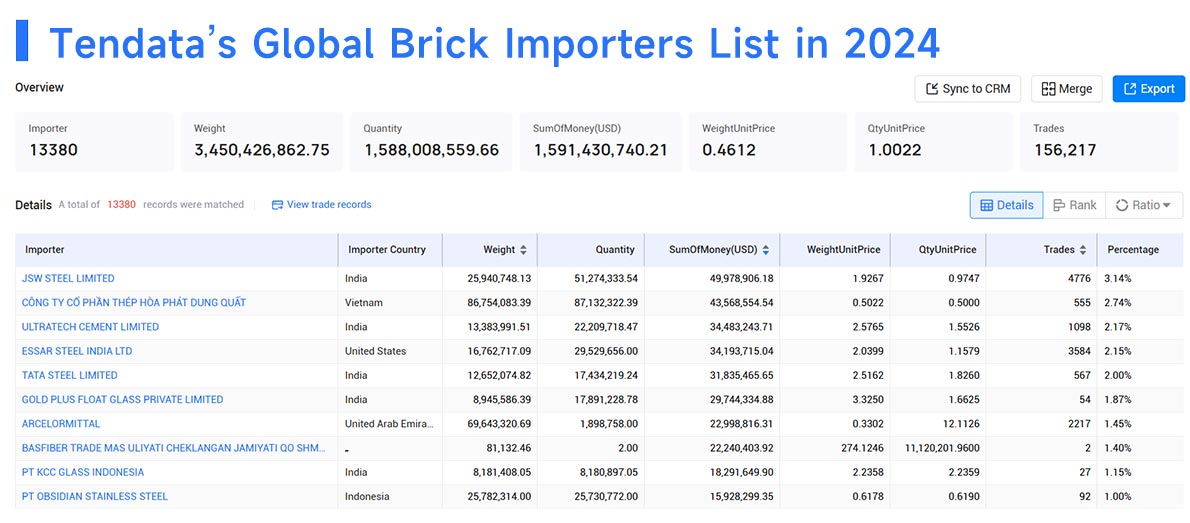

In 2024, the total value of brick imports globally was $1.59 billion USD, with 13,380 importers involved in over 156,217 trades. This represents a noticeable decline from 2023, where the value of brick imports was $2.33 billion USD, with 13,350 buyers and 164,910 trades. Despite the slight drop in total value, 2024 saw significant shifts among the top brick buyers, both in terms of purchasing volumes and strategic importance within the global market.

>>Access to more global brick buyers & importers from Tendata<<

Top Brick Buyers in 2024

1. JSW Steel Limited

· 2024: $49.98 million (3.14%)

· 2023: $57.6 million (2.48%)

JSW Steel Limited, a leading steel manufacturer in India, has remained a prominent brick buyer in 2024, maintaining its position as one of the largest players in the market. While the company's share of the global market increased to 3.14%, its absolute spending on bricks decreased slightly from $57.6 million in 2023 to $49.98 million in 2024. This reduction could be linked to the company’s efforts to optimize construction costs and materials usage as part of its broader strategy.

2. CÔNG TY CỔ PHẦN THÉP HÒA PHÁT DUNG QUẤT

· 2024: $43.57 million (2.74%)

· 2023: $38.91 million (1.67%)

Công Ty Cổ Phần Thép Hòa Phát Dung Quất, a major steel producer in Vietnam, has seen a significant rise in brick imports, increasing its market share from 1.67% in 2023 to 2.74% in 2024. The company’s growth in purchasing power reflects its expanded production capacity and investments in infrastructure projects, likely driven by the growing demand for steel and cement in construction projects.

3. UltraTech Cement Limited

· 2024: $34.48 million (2.17%)

· 2023: $30 million (1.29%)

UltraTech Cement, one of the largest cement manufacturers in India, has shown a noticeable increase in brick imports, from $30 million in 2023 to $34.48 million in 2024. This increase in purchases indicates UltraTech's expanding involvement in large-scale construction and infrastructure projects, where bricks are used extensively in building foundations, walls, and facades.

4. Essar Steel India Ltd

· 2024: $34.19 million (2.15%)

· 2023: $39.86 million (1.71%)

Essar Steel India, a key player in the steel sector, has seen a decline in brick purchases from $39.86 million in 2023 to $34.19 million in 2024. Despite this decrease, the company remains a significant buyer of bricks, likely continuing to focus on strategic infrastructure development within its steel production facilities.

5. Tata Steel Limited

· 2024: $31.84 million (2%)

· 2023: $52.84 million (2.27%)

Tata Steel, another leader in India’s steel industry, experienced a drop in its brick imports from $52.84 million in 2023 to $31.84 million in 2024. The decline could be a result of a slowdown in major construction projects or a shift towards more efficient materials sourcing strategies. Despite the decline in total expenditure, Tata Steel continues to be a key player in the global brick market.

Key Trends and Shifts: 2023 to 2024

· Shift to Industrial and Infrastructure Construction: Many of the top buyers, such as JSW Steel, Tata Steel, and UltraTech Cement, have maintained their position as dominant brick buyers due to the increasing demand for construction materials in industrial and infrastructure projects. This reflects broader global trends in construction, particularly in rapidly developing regions.

· Emerging Buyers: New entrants like Gold Plus Float Glass and PT KCC Glass show that the brick market is expanding beyond traditional construction to include sectors like glass production and manufacturing. These new buyers suggest that industries requiring heavy-duty construction materials are increasingly becoming involved in the global brick trade.

· Consolidation in the Steel and Cement Sectors: Companies like JSW Steel and UltraTech Cement continue to dominate the market, though there have been slight fluctuations in their purchase volumes. The trend reflects the ongoing consolidation in the steel and cement industries, as they continue to dominate infrastructure and housing projects, which require significant amounts of bricks.

· Increased Regional Focus: The market saw an increase in brick imports from countries in Asia and the Middle East, reflecting the growing demand for construction materials in emerging markets. This is particularly evident in the rise of Công Ty Cổ Phần Thép Hòa Phát Dung Quất and PT KCC Glass, which highlight the increased construction activities in Vietnam and Indonesia.

Conclusion

The global brick buyer landscape in 2024 reflects both continuity and change. While traditional industries such as steel and cement remain key drivers of brick demand, new buyers from emerging sectors like glass production are contributing to the growth of the market. Additionally, shifts in purchasing patterns among established buyers signal the evolving needs of the construction and manufacturing sectors worldwide. As the global demand for bricks continues to grow, these trends suggest a robust and dynamic market for the coming years.

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship