Import News

Import News

23-12-2024

23-12-2024

The global blanket market has experienced notable shifts from 2023 to 2024, with changes in both the number of blanket buyers and the overall market dynamics. As blanket imports continued to grow, we observed a significant increase in total trade volumes and value, signaling changing trends in demand across different industries. This article highlights the top global blanket buyers, analyzing the shifts from 2023 to 2024 and identifying key trends driving the market.

Market Overview: 2023 vs. 2024

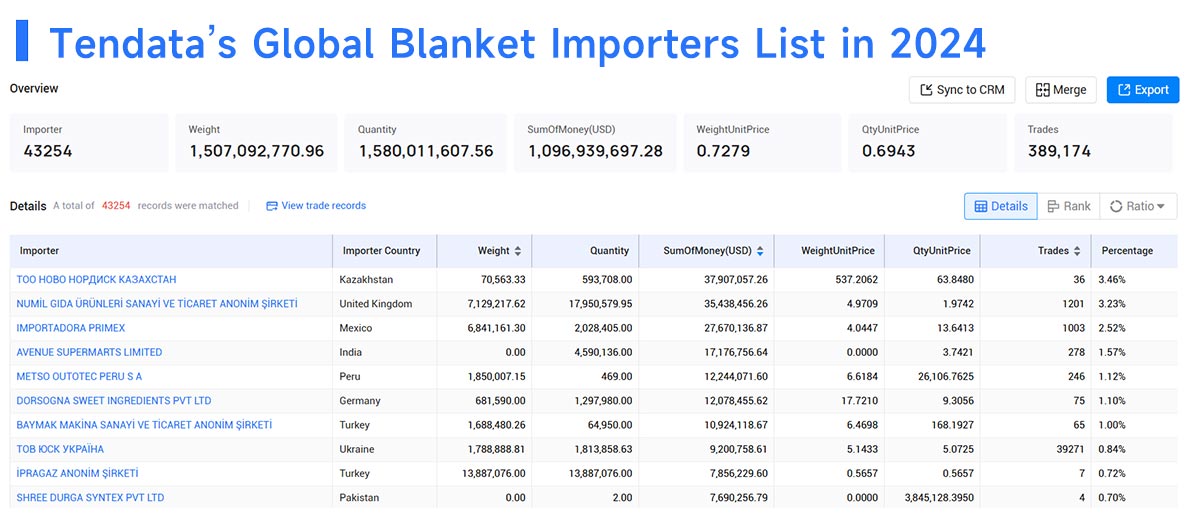

In 2023, global blanket imports were valued at $964.7 million USD, with 28,534 blanket buyers involved in 239,065 trades. By 2024, the total value of blanket imports rose to $1.1 billion USD, marking an increase of approximately 14% from the previous year. The total number of blanket buyers increased significantly, reaching 43,254 and 389,174 trades, showcasing a market that is growing both in volume and value.

While the total quantity of blankets imported in 2024 surged to over 1.58 billion units, this trend reveals a growing need for blankets in various sectors, including retail, food manufacturing, and industrial applications. Let's take a closer look at the top blanket buyers in both years to see how the market landscape has evolved.

>>Conatact with Tendata and Get More Data Sample<<

Top Blanket Buyers: 2023 to 2024 Comparison

1. ТОО НОВО НОРДИСК КАЗАХСТАН

· 2023: $21 million (2.18%)

· 2024: $37.91 million (3.46%)

Novo Nordisk Kazakhstan emerged as the leading blanket buyer in 2024, increasing its market share from 2.18% in 2023 to 3.46%. This represents a significant rise in purchasing power, which can be attributed to the company's expanding needs in healthcare and manufacturing. The rise in imports likely reflects Novo Nordisk's focus on maintaining efficient thermal insulation and comfort in its medical and manufacturing processes.

2. NUMİL GIDA ÜRÜNLERİ SANAYİ VE TİCARET ANONİM ŞİRKETİ

· 2023: $59.31 million (6.15%)

· 2024: $35.44 million (3.23%)

Numil Gida, a key player in the food industry, was the largest blanket buyer in 2023, but its market share dipped slightly in 2024. Despite this reduction in percentage share, the overall value remained substantial at $35.44 million. This drop could be attributed to changes in the food production process or shifting strategies in purchasing. Nonetheless, Numil Gida remains a significant player in the global blanket buyer market.

3. IMPORTADORA PRIMEX

· 2023: $24.62 million (2.55%)

· 2024: $27.67 million (2.52%)

Importadora Primex has seen a small yet notable increase in its blanket imports, from $24.62 million in 2023 to $27.67 million in 2024. This slight growth reflects an ongoing demand for blankets across various sectors, including retail and home goods distribution. Importadora Primex continues to be an essential blanket buyer in the global market.

4. AVENUE SUPERMARTS LIMITED

· 2023: $9.78 million (1.01%)

· 2024: $17.18 million (1.57%)

Avenue Supermarts, a retail chain, made one of the most significant leaps from 2023 to 2024, increasing its blanket imports by over 75%. From $9.78 million to $17.18 million, this rise demonstrates the growing retail demand for blankets, particularly in home goods. This shift aligns with the global retail trend, where consumer comfort and home goods have seen increased sales post-pandemic.

5. METSO OUTOTEC CHILE SPA

· 2023: $16.32 million (1.69%)

· 2024: $12.24 million (1.12%)

Metso Outotec Chile, an industrial machinery manufacturer, experienced a slight decline in blanket imports from $16.32 million in 2023 to $12.24 million in 2024. The drop in market share might reflect changes in industrial processes or reduced demand for blankets in certain manufacturing sectors. However, the company remains an important blanket buyer in the industrial market.

6. DORSOGNA SWEET INGREDIENTS PVT LTD

· 2023: $9.36 million (0.97%)

· 2024: $12.08 million (1.1%)

Dorsogna Sweet Ingredients has increased its blanket imports by about 29%, reflecting a growing need for temperature control in food manufacturing and packaging processes. This uptick highlights the expanding role of thermal protection in the food industry, especially for companies involved in ingredient processing and distribution.

Key Trends from 2023 to 2024

· Rising Demand from Retail Sectors: Companies like Avenue Supermarts have seen a sharp rise in blanket imports, driven by increasing consumer interest in home goods. Retail demand continues to be a dominant force in the blanket buyer market, especially as home comfort products grow in popularity.

· Stable Industrial Demand: While some industrial companies like Metso Outotec showed a slight decline, others like Baymak Makina are increasing their imports. This indicates that demand for blankets in industrial sectors, particularly for insulation, remains consistent despite market fluctuations.

· Food Industry Growth: Companies like Dorsogna and Numil Gida continue to drive blanket purchases in the food industry. As food manufacturing becomes more automated and temperature-sensitive, blankets are increasingly needed for temperature control, storage, and transportation.

· Regional Shifts: In 2024, we see a noticeable increase in blanket imports from countries in Central Asia, such as Kazakhstan and Turkey. These regions are investing more in healthcare, food manufacturing, and industrial sectors, all of which require substantial amounts of blankets.

Conclusion

The global blanket buyer market has experienced dynamic changes between 2023 and 2024, with rising demand in retail and industrial sectors, as well as a significant shift in the top buyers. While companies like Novo Nordisk Kazakhstan and Numil Gida remain key players, the growth of retailers like Avenue Supermarts and the entry of new industrial buyers such as Baymak Makina signal a transformation in the landscape. With the overall import volume and value on the rise, the blanket buyer market in 2024 reflects broader global trends in consumer behavior and industrial development. As the market continues to evolve, the demand for blankets across various sectors is expected to remain strong, offering opportunities for both new and established buyers.

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship