Import News

Import News

20-12-2024

20-12-2024

The global tray import market has continued to thrive in 2024, with substantial trade volumes and diverse players contributing to a rapidly growing industry. From electronics to foodservice and packaging, trays are essential components across a wide range of sectors, and their demand has surged globally. In this blog, we are going to discuss about global tray buyers. Also, whether you are looking for information on countries that import trady, global trady importers or top destinations for global trady imports, please contact us through Tendata for better import data.

Global Tray Import Market Overview

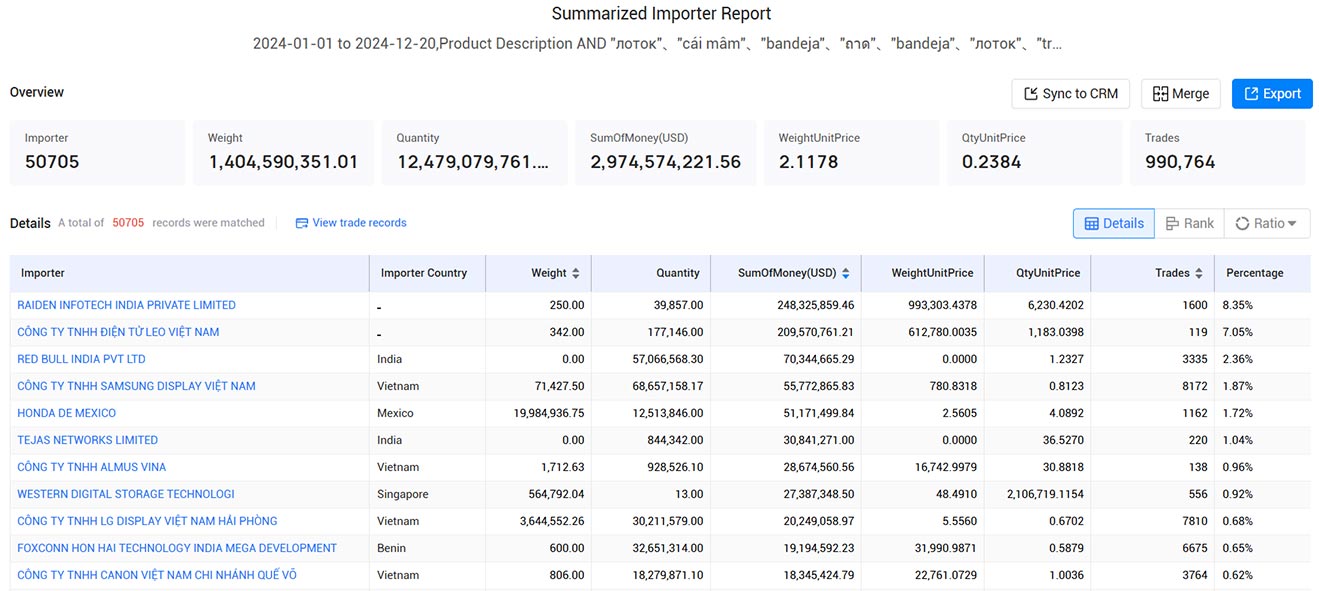

In 2024, the total import value for trays reached an impressive $2.97 billion USD, with a total quantity of 12.48 billion trays traded globally. With 50,705 active tray importers, the market is vibrant and diverse, encompassing industries ranging from consumer electronics to manufacturing and logistics. The average unit price for trays stands at $0.2384 USD per tray, indicating that trays are sourced across a broad price range, serving different needs and industries.

These numbers reflect an ongoing trend of growth in the tray import industry, fueled by demand in packaging, consumer goods, industrial sectors, and emerging markets.

>>>Get A Free Demo from Tendata<<<

Top 10 Global Tray Importers in 2024

1. RAIDEN INFOTECH INDIA PRIVATE LIMITED (8.35%, $248.33 Million)

RAIDEN INFOTECH INDIA PRIVATE LIMITED leads the global tray import market in 2024 with $248.33 million USD, accounting for 8.35% of the market share. The company imports trays primarily for the electronics industry, where they are used for packaging and transportation of components. India's booming tech sector has increased the demand for high-quality trays, and Raiden Infotech is a key player in this space.

2. CÔNG TY TNHH ĐIỆN TỬ LEO VIỆT NAM (7.05%, $209.57 Million)

CÔNG TY TNHH ĐIỆN TỬ LEO VIỆT NAM comes in second with $209.57 million USD in imports, representing 7.05% of the global market. Based in Vietnam, Leo Electronics imports trays primarily for its electronic goods packaging and production processes. As the electronics sector continues to grow in Southeast Asia, Leo Electronics plays a crucial role in fulfilling the rising demand for specialized trays.

3. RED BULL INDIA PVT LTD (2.36%, $70.34 Million)

RED BULL INDIA PVT LTD ranks third with $70.34 million USD in tray imports, holding 2.36% of the market share. The company uses trays for packaging its energy drink products, especially in bulk orders and logistics operations. Red Bull's position highlights the significance of trays in the beverage industry, which requires efficient and secure packaging solutions.

4. CÔNG TY TNHH SAMSUNG DISPLAY VIỆT NAM (1.87%, $55.77 Million)

CÔNG TY TNHH SAMSUNG DISPLAY VIỆT NAM follows with $55.77 million USD in tray imports, comprising 1.87% of the global market. Samsung Display Vietnam uses trays for transporting and packaging its delicate electronic screens and displays, which require careful handling during manufacturing and shipping.

5. HONDA DE MEXICO (1.72%, $51.17 Million)

HONDA DE MEXICO imported $51.17 million USD worth of trays, making up 1.72% of the market share. The company uses trays for a variety of purposes, including automotive parts packaging and distribution. Mexico's automotive sector remains one of the largest consumers of trays, and Honda's import activities contribute to the market's demand.

6. TEJAS NETWORKS LIMITED (1.04%, $30.84 Million)

TEJAS NETWORKS LIMITED ranks sixth with $30.84 million USD in tray imports, which represents 1.04% of the global market. Tejas Networks, based in India, requires trays for the packaging and shipment of telecommunications equipment and network components, which require protection during transport.

7. CÔNG TY TNHH ALMUS VINA (0.96%, $28.67 Million)

CÔNG TY TNHH ALMUS VINA from Vietnam imported $28.67 million USD worth of trays, holding 0.96% of the global market share. The company uses trays in the manufacturing process of electronics and components, as well as for packaging purposes.

8. WESTERN DIGITAL STORAGE TECHNOLOGIES (0.92%, $27.39 Million)

WESTERN DIGITAL STORAGE TECHNOLOGIES imported $27.39 million USD worth of trays, accounting for 0.92% of the market share. Western Digital's use of trays primarily revolves around the packaging and transportation of storage devices and hard drives, which require specialized protective solutions.

9. CÔNG TY TNHH LG DISPLAY VIỆT NAM HẢI PHÒNG (0.68%, $20.25 Million)

CÔNG TY TNHH LG DISPLAY VIỆT NAM HẢI PHÒNG imported $20.25 million USD worth of trays, representing 0.68% of the global tray import market. LG Display uses trays for the delicate handling of display panels and screens during production and shipping.

10. FOXCONN HON HAI TECHNOLOGY INDIA MEGA DEVELOPMENT (0.65%, $19.19 Million)

FOXCONN HON HAI TECHNOLOGY INDIA MEGA DEVELOPMENT completes the top 10 with $19.19 million USD in tray imports, making up 0.65% of the global market. As a major player in electronics manufacturing, Foxconn uses trays for the packaging and safe transportation of tech components and assembled devices.

Above we have mentioned the top global tray importers. Apart from this, many other importers also play a vital role in global import of trady from all over the world. Also, explore our trady import data at Tendata to get the complete list of all the active trady importers across the globe and overseas.

Market Insights and Trends

1. Electronics Industry Drives Tray Demand

A significant portion of the tray import market is driven by the electronics and tech sectors, with companies like RAIDEN INFOTECH, LEO VIETNAM, and SAMSUNG DISPLAY VIETNAM importing trays for packaging and shipping high-value, fragile components. As the global electronics industry expands, particularly in emerging markets like India and Vietnam, the demand for specialized packaging solutions like trays continues to grow.

2. Packaging Solutions for Beverages and Automotive

Industries like beverages and automotive manufacturing also play a key role in the global tray import market. Companies like RED BULL INDIA and HONDA DE MEXICO highlight the importance of trays in the transportation and storage of goods, where efficiency and protection are critical.

3. Southeast Asia's Growing Role

Southeast Asia, particularly countries like Vietnam and India, is becoming an increasingly important hub for tray imports. Companies in these countries are involved in sectors such as electronics manufacturing, automotive production, and telecommunications, where trays are essential for protecting products during transport.

4. Increasing Focus on Efficiency and Sustainability

As sustainability becomes more important, businesses are focusing on more eco-friendly tray solutions, including recyclable or reusable options. This trend is likely to shape the future of the global tray import market, as industries adopt more environmentally responsible packaging methods.

Conclusion

The global tray import market in 2024 is diverse, with key players across multiple industries such as electronics, automotive, and beverages. The leading importers, including RAIDEN INFOTECH INDIA PRIVATE LIMITED, CÔNG TY TNHH ĐIỆN TỬ LEO VIỆT NAM, and RED BULL INDIA, showcase how trays are an essential part of packaging, shipping, and manufacturing processes worldwide. With a total import value of nearly $3 billion USD, the tray import market continues to grow, driven by demand from emerging markets and expanding industries.

Tendata is the premium solution for finding trady buyers worldwide. One can easily get the list of global tray importers and their previous shipment value with Tendata. Simply check out the latest global trady import data on our platform and you can view the entire list of trady HS codes. It is the leading import data source providing import and export data for more than 218 countries/territories.

Moreover, if you have any questions about importer data, HS codes or tray import data, please feel free to contact Tendata.Our professionals will do their best to help you. Get a free live demo today!

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship