Import News

Import News

20-12-2024

20-12-2024

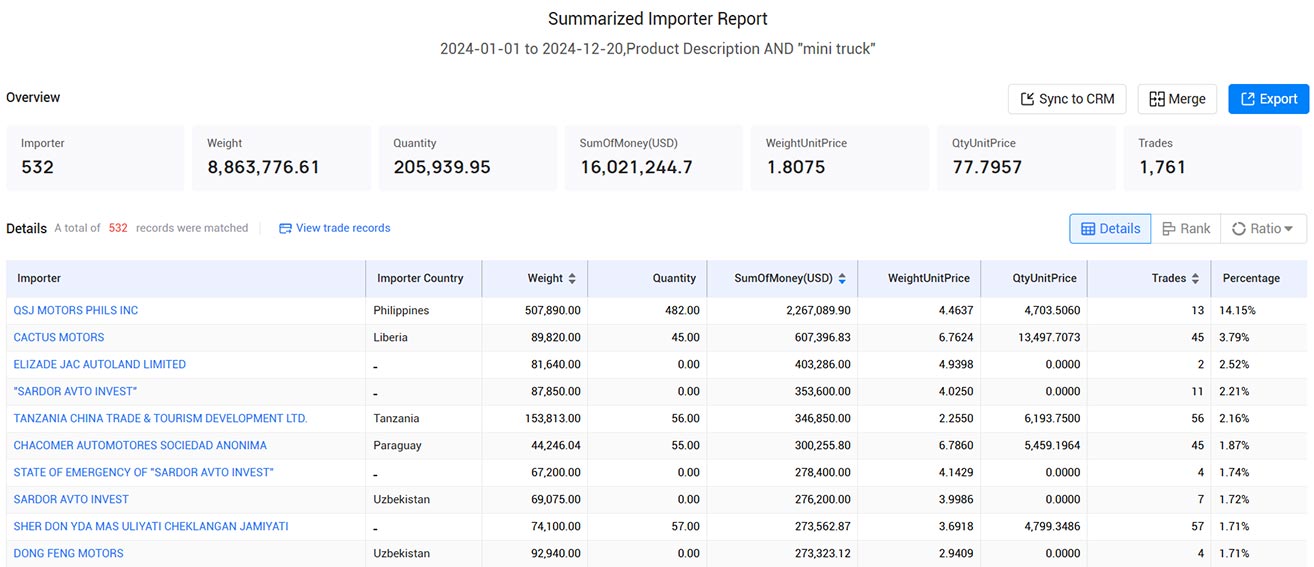

In 2024, the global mini truck market has witnessed significant growth, driven by an increasing demand for compact, efficient, and versatile transportation solutions. According to the latest data, mini truck buyers have been making substantial purchases across various regions, contributing to a total import value of approximately $16.02 million USD. In this blog, we are going to discuss about mini truck buyers across the globe. Also, whether you are looking for information on countries that import mini truck, global mini truck importers or top destinations for mini truck imports from around the world, please contact us through Tendata for better import data.

Mini Truck Market Overview

In 2024, a total of 532 importers participated in the mini truck market, conducting 1,761 trades globally. The total value of these transactions amounted to $16,021,244.7 USD. The relatively low cost and high utility of mini trucks have made them a popular choice, particularly in emerging markets and developing economies. Small businesses, logistics companies, and local transport services are increasingly adopting these vehicles for their efficiency, affordability, and ability to navigate narrow streets and rural roads.

Mini trucks are now seen as a vital component in the transport infrastructure of many countries, particularly in regions where cost-effective solutions are needed for local deliveries and agricultural transport.

>>>Get Global Trade Data Online<<<

Top Global Mini Truck Buyers in 2024

1.QSJ MOTORS PHILS INC (14.15%, $2.27 Million)

Leading the charge in 2024, QSJ MOTORS PHILS INC in the Philippines ranks as the top global mini truck buyer. With 14.15% of the global market share and spending $2.27 million USD, this company reflects the rapidly growing demand for mini trucks in Southeast Asia. The rise in small-scale logistics and urban delivery systems in the Philippines is a key driver of this growth.

2.CACTUS MOTORS (3.79%, $0.61 Million)

CACTUS MOTORS, a major buyer from Latin America, holds 3.79% of the global market, with a total expenditure of $0.61 million USD. The company’s presence in the top ranks underscores the increasing demand for mini trucks in regions that require efficient transportation for goods and services in both urban and rural areas.

3.ELIZADE JAC AUTOLAND LIMITED (2.52%, $0.4 Million)

In third place is ELIZADE JAC AUTOLAND LIMITED, with 2.52% of the market share and a total purchase value of $0.4 million USD. Based in Nigeria, this company is a significant player in the West African market, where mini trucks are increasingly used for transportation across difficult terrain and in urban areas with limited infrastructure.

4."SARDOR AVTO INVEST" (2.21%, $0.35 Million)

SARDOR AVTO INVEST, operating in Central Asia, holds 2.21% of the global mini truck market, spending $0.35 million USD. This company represents the growing demand for mini trucks in regions with challenging road conditions, where compact and durable vehicles are essential for transporting goods.

5.TANZANIA CHINA TRADE & TOURISM DEVELOPMENT LTD. (2.16%, $0.35 Million)

TANZANIA CHINA TRADE & TOURISM DEVELOPMENT LTD. ranks fifth, contributing 2.16% of the global mini truck imports with $0.35 million USD. The demand for mini trucks in Tanzania and other parts of Africa is driven by the need for affordable, durable vehicles to support growing small businesses and agriculture.

6.CHACOMER AUTOMOTORES SOCIEDAD ANONIMA (1.87%, $0.3 Million)

CHACOMER AUTOMOTORES SOCIEDAD ANONIMA, a key player in South America, holds 1.87% of the market share, spending $0.3 million USD. The company’s success reflects the rising demand for mini trucks across South America, where small enterprises and logistics companies are seeking cost-effective transportation solutions.

7.STATE OF EMERGENCY OF "SARDOR AVTO INVEST" (1.74%, $0.28 Million)

Another entity under SARDOR AVTO INVEST holds 1.74% of the market share, with $0.28 million USD spent on mini truck imports. Central Asia continues to be an emerging market for mini trucks, where the need for compact vehicles is crucial for local transport.

8.SARDOR AVTO INVEST (1.72%, $0.28 Million)

SARDOR AVTO INVEST maintains another strong position with 1.72% of the market and $0.28 million USD in purchases. The company highlights the significance of mini truck buyers in regions with limited infrastructure and difficult terrain.

9.SHER DON YDA MAS ULIYATI CHEKLANGAN JAMIYATI (1.71%, $0.27 Million)

Based in Uzbekistan, SHER DON YDA MAS ULIYATI CHEKLANGAN JAMIYATI is another key player in the mini truck market, holding 1.71% of the market share and spending $0.27 million USD. The company’s purchases indicate the increasing need for efficient and affordable transport solutions in Central Asia.

10.DONG FENG MOTORS (1.71%, $0.27 Million)

DONG FENG MOTORS, one of China's prominent automotive companies, rounds out the top 10 with 1.71% of the market share, spending $0.27 million USD. China’s mini truck market is expanding, with both domestic consumption and export opportunities driving the demand for these vehicles.

We have mentioned the top global mini truck importers above. Apart from this, many other importers also play a vital role in global import of mini truck from all over the world. Also, explore our mini truck import data at Tendata to get the complete list of all the active mini truck importers across the globe and overseas.

Market Trends and Insights

1. Rising Demand in Southeast Asia

The Philippines stands out as the largest global mini truck buyer in 2024, reflecting the broader economic growth in Southeast Asia. With companies like QSJ MOTORS PHILS INC driving this trend, the region is seeing an increasing shift toward small, cost-efficient vehicles to meet the needs of local businesses, logistics companies, and agricultural operations.

2. Central Asia's Emerging Market

Central Asia continues to be a significant region for mini truck buyers, with companies like SARDOR AVTO INVEST leading the way. The demand for mini trucks in this region is fueled by their ability to navigate challenging road conditions and serve areas with limited infrastructure.

3. Africa's Growing Demand

The demand for mini trucks in Africa is on the rise, particularly in countries like Tanzania and Nigeria. These vehicles are increasingly being used for agricultural transport, local deliveries, and small-scale logistics, driven by the need for affordable, reliable transportation in both urban and rural areas.

4. Cost-Effectiveness and Versatility

One of the main drivers behind the growing demand for mini trucks globally is their affordability and versatility. These vehicles are ideal for small businesses and industries that require cost-effective solutions for transportation in both developed and emerging markets.

Conclusion

In 2024, the global mini truck market continues to thrive, with QSJ MOTORS PHILS INC leading the charge as the largest mini truck buyer. Other key buyers from regions such as Southeast Asia, Central Asia, and Africa are also playing pivotal roles in driving the growth of the mini truck market. With total imports valued at $16.02 million USD, the market is poised for continued expansion, offering rich opportunities for manufacturers and suppliers.

The global mini truck market remains a dynamic and evolving space, with mini truck buyers across the world continuing to seek efficient, affordable, and versatile transportation solutions. For businesses looking to tap into this market, the opportunities are abundant, particularly in emerging economies where mini trucks are becoming an integral part of local transport systems.

Tendata is the premium solution for finding mini truck buyers worldwide. One can easily get the list of global mini truck importers and their previous shipment value with Tendata. Simply check out the latest mini truck import data from across the globe on our platform and you can view the entire list of mini truck HS codes. It is the leading source of import data, providing import and export data for more than 218 countries/territories.

In addition, if you have any questions about importer data, HS codes or mini truck import data, please feel free to contact Tendata.Our professionals will do their best to help you. Get a free live demo today!

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship