Import News

Import News

19-12-2024

19-12-2024

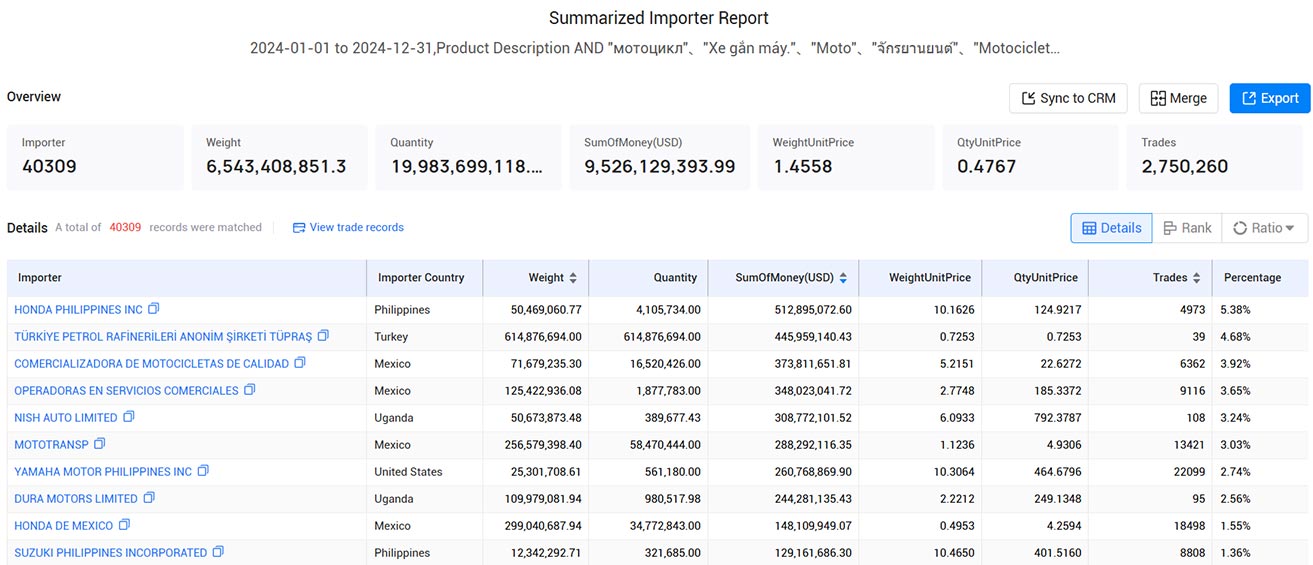

The global motorcycle industry in 2024 continues to experience robust growth, driven by demand from various regions around the world. As motorcycle sales rise, both in developed and emerging markets, a variety of motorcycle buyers contribute significantly to the global market share. According to Tendata's latest data, the total value of the motorcycle market in 2024 is an impressive $9.53 billion USD, with over 2.75 million trades conducted across the globe. In this blog, we are going to discuss about global motorcycle buyers. Also, whether you are looking for information on countries that import motorcycle, global motorcycle importers or top destinations for motorcycle imports from around the world, please contact us through Tendata for better import data.

Motorcycle Market Statistics

In 2024, the global motorcycle market saw total transactions valued at $9,526,129,393.99 USD, with an enormous 2,750,260 trades taking place. This highlights the massive scale of the global motorcycle trade, with motorcycles being a key mode of transportation and recreation in many parts of the world.

The motorcycle buyers involved in this market represent a diverse range of companies from various countries. These motorcycle buyers are playing an essential role in fueling the demand for motorcycles, both domestically and internationally.

Top Global Motorcycle Buyers in 2024

The largest motorcycle buyer in 2024 was HONDA PHILIPPINES INC, which accounted for 5.38% of the global market share, with purchases amounting to $512.9 million USD. Honda, a global leader in motorcycle manufacturing, continues to dominate the market in Southeast Asia, where motorcycles are an essential form of transportation due to traffic congestion and affordability.

Following closely is TÜRKİYE PETROL RAFİNERİLERİ ANONİM ŞİRKETİ TÜPRAŞ from Turkey, which secured the second spot, spending $445.96 million USD and representing 4.68% of the global motorcycle market. Turkey has long been an important market for motorcycles, with demand driven by both domestic consumption and export opportunities to neighboring countries.

COMERCIALIZADORA DE MOTOCICLETAS DE CALIDAD from Mexico holds the third spot with purchases totaling $373.81 million USD, which accounts for 3.92% of the global market share. This company has been crucial in expanding motorcycle ownership in Mexico, where motorcycles are often used for personal transportation and delivery services.

Other notable motorcycle buyers include OPERADORAS EN SERVICIOS COMERCIALES, which accounted for 3.65% of the global market, with purchases worth $348.02 million USD, and NISH AUTO LIMITED from India, contributing $308.77 million USD to the market, representing 3.24% of the global share. These companies underscore the growing demand for motorcycles in regions such as Latin America and South Asia.

MOTOTRANSP from Argentina, YAMAHA MOTOR PHILIPPINES INC, and DURA MOTORS LIMITED round out the top buyers in the motorcycle market. Yamaha's presence in the Philippines and the strong growth of local motorcycle producers like Dura Motors are indicative of the expanding motorcycle culture in emerging economies.

We have mentioned the top global motorcycle importers above. Apart from this, many other importers also play a vital role in the global import of motorcycle from all over the world. Also, explore our motorcycle import data at Tendata to get the complete list of all the active motorcycle importers from around the globe and overseas.

Key Insights and Trends in the Global Motorcycle Market

1. Southeast Asia Dominance

HONDA PHILIPPINES INC and YAMAHA MOTOR PHILIPPINES INC highlight the dominant role of Southeast Asia in the global motorcycle market. Motorcycles are not only a cost-effective mode of transport in these densely populated countries, but they also play a crucial role in the informal economy, particularly for delivery services.

2. Rising Demand in Latin America

COMERCIALIZADORA DE MOTOCICLETAS DE CALIDAD and OPERADORAS EN SERVICIOS COMERCIALES reflect the increasing motorcycle consumption in Latin American countries like Mexico and Argentina. Motorcycles are becoming a more accessible and practical mode of transport in these regions, particularly in areas with poor public transportation infrastructure.

3. Growth in South Asia

NISH AUTO LIMITED in India signals the growing role of motorcycles in South Asia, a region where motorcycles are increasingly being used for both personal and commercial purposes. This market is expected to continue expanding as the region's middle class grows, along with rising disposable incomes.

4. Strong Performance in Turkey

Turkey's position as a major buyer, exemplified by TÜRKİYE PETROL RAFİNERİLERİ ANONİM ŞİRKETİ TÜPRAŞ, reflects a stable demand for motorcycles, driven by both domestic needs and the export market to neighboring regions such as the Middle East and Eastern Europe.

5. Expanding Market in Africa

While not explicitly mentioned in the top 10 buyers, the growing demand for motorcycles in Africa presents a key opportunity for manufacturers. Motorcycles are becoming a preferred option for urban and rural transport due to their low cost, fuel efficiency, and ability to navigate congested roads.

Conclusion

The global motorcycle market in 2024 continues to thrive, driven by demand from key regions such as Southeast Asia, Latin America, South Asia, and Eastern Europe. Leading the way are motorcycle buyers like HONDA PHILIPPINES INC and TÜRKİYE PETROL RAFİNERİLERİ ANONİM ŞİRKETİ TÜPRAŞ, who are contributing significantly to the overall market value of over $9.53 billion USD. The market is characterized by diverse motorcycle buyers, including both large multinational corporations and local importers catering to regional needs.

With the total number of trades surpassing 2.75 million and transactions reaching over $9.5 billion USD, the motorcycle industry is poised for continued expansion. For businesses looking to tap into the motorcycle market, this dynamic environment offers vast opportunities, especially in emerging markets where the demand for motorcycles is on the rise.

Tendata is the premium solution for finding global motorcycle buyers. Through Tendata, you can access a list of active motorcycle buyers and their historical purchasing data, along with detailed insights into the motorcycle market. With our platform, you can view the latest global motorcycle import data and gain access to the full list of motorcycle HS codes.

If you have any questions about motorcycle buyer data, market trends, or any other aspects of the motorcycle trade, feel free to contact Tendata. Our team of experts is ready to assist you. Get a free live demo today!

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship