Import News

Import News

15-11-2024

15-11-2024

Flour confectionery is an important product in the Thai diet, consumed regularly by people regardless of their residence, income level, or age. As a result, Thailand has developed its own production of pastries, biscuits, cakes, and waffles. Moreover, Thailand has been a major exporter of flour-based products for many years. In 2023, the country's production of flour-based products was more than 1.5 times the domestic consumption.

The Thai flour milling industry and flour confectionery production rely heavily on the supply of imported wheat, as the crop is almost not grown in the country due to unfavorable climate conditions and poor seed production development. From 2019 to 2023, Thailand imported an average of about 2.8 million tons of wheat annually, primarily from Australia and the United States. In 2023, the import volume reached 3.7 million tons, valued at $1.3 billion (including wheat used for animal feed). Additionally, some confectionery products are made from rice and corn flour, adding diversity to the market. Furthermore, Thailand is also a net importer of wheat and wheat-rye flour. In 2023, the country imported 157,500 tons of such products, valued at $84 million.

From 2019 to 2023, Thailand's flour confectionery imports increased from 51,900 tons to 76,800 tons, with a significant portion of the purchases being semi-finished products, such as frozen pastries. At the same time, Thailand's exports of flour confectionery products increased from 137,500 tons to 150,100 tons, indicating that Thai flour confectionery products are becoming increasingly popular worldwide, especially in the United States and Southeast Asian countries. For example, Myanmar and Laos are the largest importers of Thai flour confectionery products, but domestic production of these products is relatively poor, necessitating increased imports, including from Thailand.

Baking is the most popular type of flour confectionery in Thailand. In 2023, these products accounted for 45.7% of total consumption (672,000 tons). Sandwich biscuits ranked second in popularity, with a 19.9% share of the consumption (293,000 tons). Cakes are also very popular in the country: in 2023, Thailand sold 193,000 tons of such products (13.1% of total consumption). Less popular flour confectionery products in 2023 included waffles (7.2%), sweet biscuits (6.1%), chocolate-coated biscuits (4.6%), dessert pies (2.1%), and sweet crackers (1.2%).

From 2019 to 2023, the per capita consumption of flour confectionery products in Thailand slightly increased, reaching 2.09 kg per person by the end of 2023. Overall, the consumption of flour confectionery products in Thailand is lower than the average for Southeast Asian countries (approximately 3.5 kg per year), but it is comparable to the consumption in Vietnam and the Philippines.

In 2023, Thailand imported 76,800 tons of flour confectionery products, valued at $309.1 million, a 3.0% increase in quantity (+22,000 tons) and an 11.1% increase in value (+$30.9 million) compared to 2022. From 2019 to 2023, the country's imports of flour confectionery products grew by an average of 10.3% annually in volume, and by 11.7% in value.

Sweet dry biscuits accounted for the largest share of Thailand's flour confectionery imports in 2023, making up 36.5% of total imports (280,000 tons). Other flour confectionery products (32.1%) and waffles and waffle wafers (30.5%) also accounted for substantial import volumes by the end of the year. By value, the largest share of Thailand's flour confectionery imports in 2023 came from other flour confectionery products (43.2% or $133.5 million), while waffles and sweet dry biscuits accounted for smaller shares (29.2% and 26.9%, respectively). Over the past few decades, Thailand's purchases of hard-shell flour confectionery, biscuits, and similar fried foods, as well as gingerbread, have remained minimal.

The main suppliers of flour confectionery products to Thailand are Indonesia, which accounted for 44.8% of Thailand's flour confectionery imports in 2023 (344,000 tons). Malaysia ranked second with 19.5% of imports (149,000 tons), and a large portion of imports came from China (13.3%). Overall, the top 10 countries exporting flour confectionery products to Thailand accounted for 93.4% of these imports by the end of the year.

In 2023, Thailand significantly increased its imports of flour confectionery products from Vietnam (+21.9% or +9,000 tons) and Malaysia (+4.2% or +6,000 tons) compared to 2022. At the same time, imports from the UK decreased (-5.9% or -1,000 tons).

By value, the major suppliers of flour confectionery products to Thailand in 2023 were Indonesia and Malaysia, with products from these two countries valued at $94.9 million (30.7% of total import value) and $94.7 million (30.6%), respectively. China also entered the top three exporters to Thailand by the end of the year, accounting for 11.1% of import value. Overall, the top 10 suppliers accounted for 90.3% of Thailand's flour confectionery imports in 2023.

In 2023, Thailand's flour confectionery product imports from Indonesia increased by 12.1% ($10.3 million), from Malaysia by 11.5% ($9.7 million), and from Vietnam by 28.1% ($3.4 million) compared to 2022. Meanwhile, imports from South Korea (-6.9% or -$0.3 million) and Germany (-3.9% or -$0.2 million) decreased.

In 2023, the average import price of flour confectionery products in Thailand rose by 7.9%, reaching $4,025 per ton. The most expensive products came from Germany, priced at $12,190 per ton (3 times higher than the average price), followed by Italy at $9,136 per ton (2.3 times higher) and South Korea at $7,342 per ton (82.4% higher). The most competitive prices were for candy products from Indonesia ($2,760 per ton, 31.4% lower than the average price) and India ($2,834 per ton, 29.6% lower).

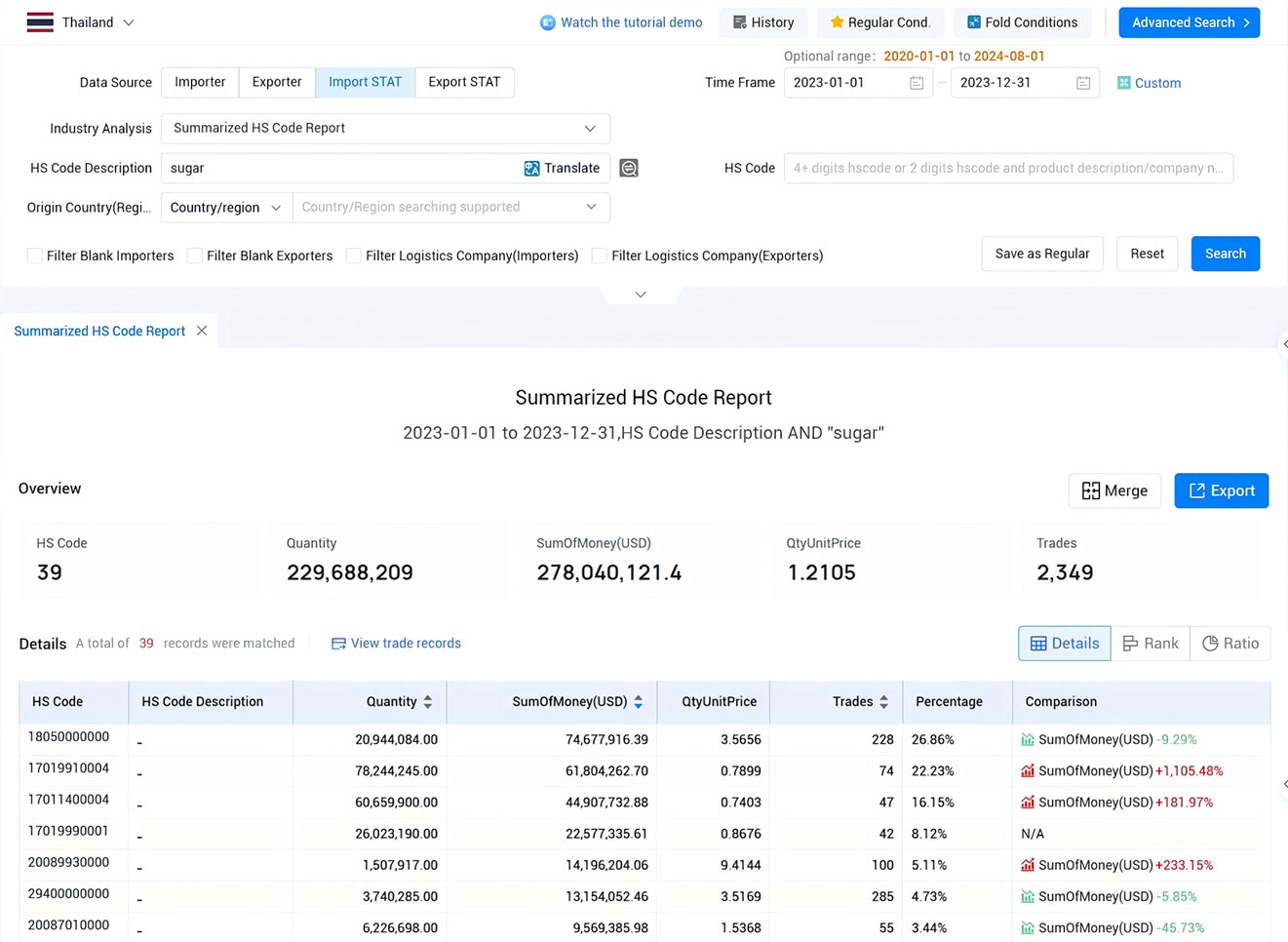

Do you want to know more about Thailand Data? Please check out the global import and export data provided by Tendata.

1. Obtain Customs Data from 100+ Countries to Find Suitable Buyers

Tendata Customs Data provides real-time access to customs data from over 218 countries, 42 countries along the Europe-Asia route, 10+ billion real-time trade data, and a database of 130 million importers and exporters. This assists you in understanding global market trade trends and distribution, allowing you to quickly, accurately, and scientifically target hot-selling countries and emerging markets for your products. >>>Inquire Customs Data Online

>>>Click to Get Free Access to Customs Data from 100+ Countries<<<

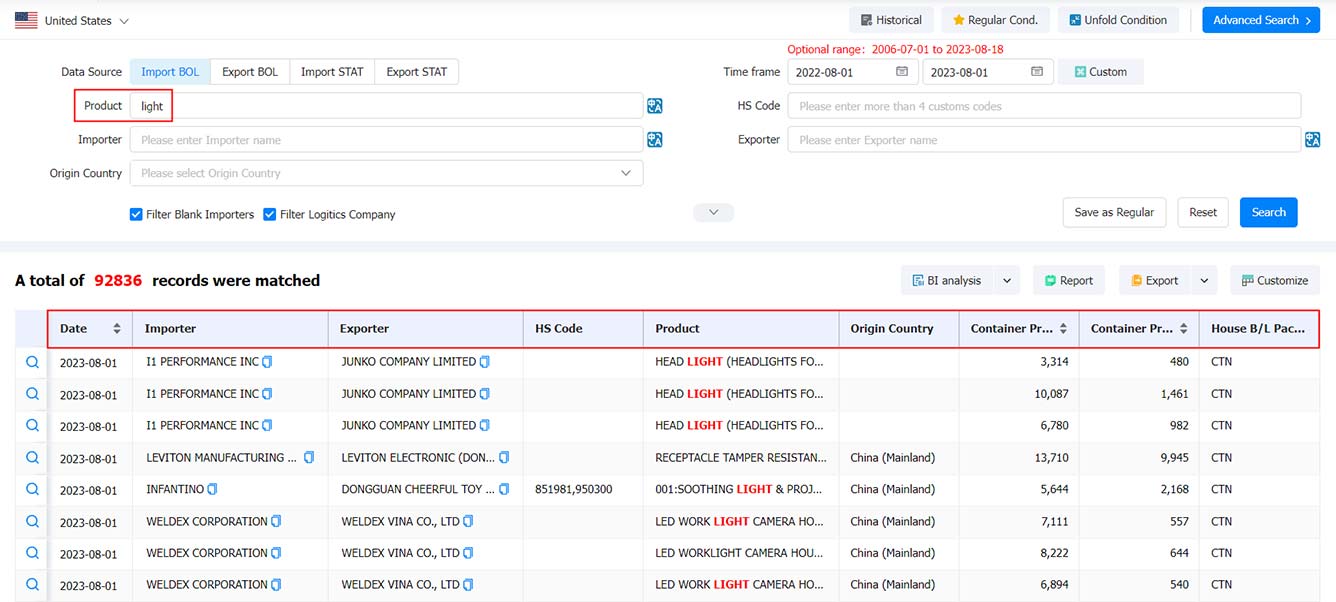

2. Present Trade Details and Directly Contact Buyers

Customs data is one of the fundamental tools for international traders to develop buyers, enabling you to move from market insights and competitor analysis to customer development.

Tendata iTrader offers various search criteria for detailed examination of each cross-border transaction, including exporter, importer, commodity type, transaction quantity, transaction amount, origin, carrier, departure port, arrival port, and more. Swiftly and comprehensively gather importers and exporters based on their procurement volume and preferences, pinpointing your target customers. By comparing historical import export data, you can quickly identify authentic importers and exporters, thereby providing you with accurate opportunities for successful transactions. >>>Click to Get Sample Online

3. Professional Market Analysis to Seize Opportunities for Closing Deals

Which website is good for customs data inquiries? This is a question that many international trade enterprises are highly concerned about!

Tendata Customs Data Platform offers nearly 20 types of market analysis reports (>>>Click to Use Data Analytics for Free Online) that can be customized and analyzed in a multi-dimensional, visual manner. This enables you to effortlessly identify your peers' primary export markets and buyers. Through analyzing transaction quantities, prices, and supply chains of target buyers, as well as examining bill of lading details of successful buyers and competitor information, various data analysis reports are intelligently generated to highlight your competitive advantages, aiding you in capturing a larger market share.

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship