Import News

Import News

14-03-2024

14-03-2024

In 2023, China's fruit imports continued to show a growth trend, with a total import volume of 7.52 million tons. The value of fruit imports amounted to $16.85 billion, representing year-on-year increases of 3% and 15% respectively compared to 2022.

According to the fruit import data provided by Tendata, the top ten fruit-exporting countries to China in 2023, ranked by export value, were Thailand ($7.06 billion, up 12% year-on-year), Chile ($3.2 billion, down 4% year-on-year), Vietnam ($2.84 billion, up 123% year-on-year), the Philippines ($640 million, down 4% year-on-year), New Zealand ($600 million, down 5% year-on-year), Peru ($500 million, down 12% year-on-year), Australia ($280 million, up 33% year-on-year), Malaysia ($270 million, up 29% year-on-year), South Africa ($250 million, down 4% year-on-year), and Indonesia ($220 million, up 5% year-on-year).

The Chinese fruit market is constantly evolving, and import trends change over time. Understanding and keeping up with these trends can help companies adapt to the pace of the market, identify popular products for procurement or production, and determine the direction of company development. Through careful planning, unique product supply, excellent marketing, and accurate Chinese fruit import data, import businesses can gain tremendous profits. If you are looking for Chinese fruit import data now, please contact Tendata for a free demonstration! (>> Contact Tendata now)

According to Tendata's Chinese fruit import data, ranked by import value, the best-performing fruit categories are fresh durians, fresh cherries, frozen durians, bananas, mangosteens, and coconuts. These six categories of fruits together account for 76% of China's total fruit imports.

1. Fresh Durians

As the top-ranked product, fresh durians had an import value of $6.72 billion in 2023 (up 66% year-on-year), with an import volume of 1.43 million tons (up 73% year-on-year). After obtaining formal market access to China in July 2022, Vietnamese fresh durians (493,000 tons, up 1,100% year-on-year) quickly captured about 35% of the market share, leading to a sharp decline in the market share of Thai fresh durians (929,000 tons, up 18% year-on-year) from 95% to 65%.

2. Fresh Cherries

In 2023, the import value of fresh cherries ranked second only to fresh durians, totaling $2.65 billion (down 4% year-on-year). Meanwhile, the import volume was 347,000 tons (down 5% year-on-year). Specifically, imports from Chile amounted to $2.55 billion (down 5% year-on-year) and 334,000 tons (down 7% year-on-year), accounting for 99% of China's fresh cherry imports.

3. Frozen Durians

In 2023, Thailand remained the main supplier of frozen durians to China, with a total shipment value of about $770 million (up 19% year-on-year) and 108,000 tons (up 12% year-on-year). Following Thailand is Malaysia, with an export value of $270 million (up 34% year-on-year) and an export volume of 25,000 tons (up 47% year-on-year). It has been reported that standards for Vietnamese frozen durian exports to China are expected to be introduced, leading to fiercer competition in the Chinese market.

4. Bananas

China's banana imports reached $1.08 billion in 2023 (down 7% year-on-year), with an import volume of 1.77 million tons (down 2% year-on-year). The Philippines (686,000 tons, down 5% year-on-year), Vietnam (506,000 tons, up 8% year-on-year), Ecuador (266,000 tons, up 33% year-on-year), and Cambodia (263,000 tons, down 22% year-on-year) were the main suppliers, accounting for approximately 97% of the total sales volume.

5. Mangosteens

In 2023, mangosteen imports totaled 242,000 tons (up 16% year-on-year) and $730 million (up 16% year-on-year), with Thailand (207,000 tons, up 13% year-on-year; $620 million, up 14% year-on-year) and Indonesia (35,000 tons, up 36% year-on-year; $110 million, up 31% year-on-year) being the main suppliers.

6. Coconuts

China's coconut imports totaled 1.18 million tons (up 10% year-on-year) and $580 million (up 2% year-on-year) in 2023, with Thailand (589,000 tons, up 13% year-on-year), Indonesia (364,000 tons, up 13% year-on-year), and Vietnam (223,000 tons, up 1% year-on-year) being the main suppliers.

Due to the presence of various fruit suppliers, the global Chinese fruit import business is full of competition and challenges. To maximize the chances of success, conduct market analysis of your target markets and formulate good market strategies. If you are looking for the latest referenceable Chinese fruit import data, consider obtaining reliable, authentic, and real-time updated information from platforms like Tendata, saving your time and achieving 200% efficiency. We provide authentic importer data, exporter data, HS codes, and more. (>> Contact Tendata now)

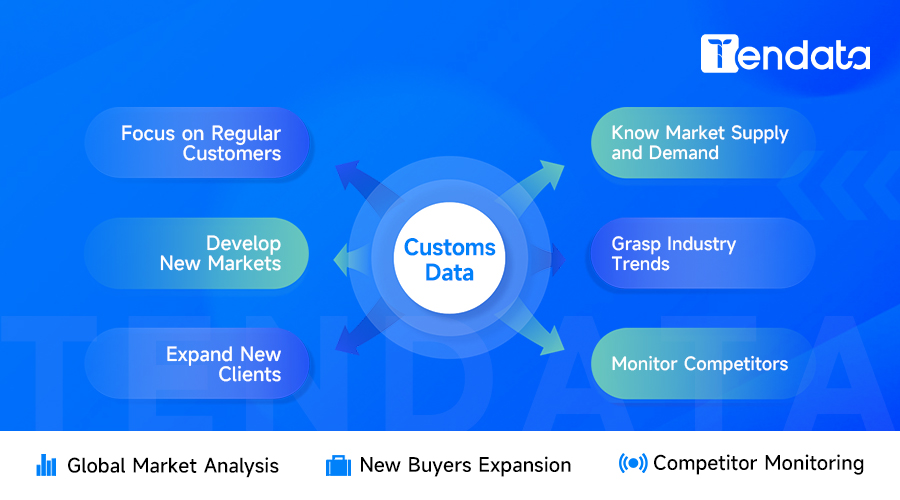

The Importance of Market Analysis

Analyze the market frontier trend by analyzing the market demand in different regions, plus comparing the price of the products, so as to choose the target market with high profit and high demand; at the same time, according to the import and export data query to understand the market distribution of the products and the trend of change, and adjust the market strategy in a timely manner.

Tendata iTrader has customs data of 70 countries (>>> Click to get free customs data of 220 countries), business data of 198 countries, 10+ billion trade data, 120 million in-depth enterprise data and 130 million buyer database, and provides various search methods, which can be queried by product, company name, hs code, SIC code, etc. Intelligent one-key query, and also provides 17 visualized reports to help enterprises accurately locate and analyze the market. (>>> Click to get sample online)

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship