Export News

Export News

25-12-2024

25-12-2024

The global export of magnets, including electromagnets, reached a total of $11.3 billion in 2023. This marks a notable rise of 31.1% from the 2019 figure, which stood at $8.64 billion. However, compared to 2022's figure of $12.75 billion, the export value saw a year-on-year decline of 11.1%.

Magnets, including both permanent magnets and electromagnets, are used in a variety of everyday applications, such as magnetic strips on cards, refrigerator magnets, compasses, and even devices that help pick up small metallic objects like nails and paper clips. In contrast to permanent magnets, the strength of electromagnets varies depending on the electrical current passing through them. These versatile devices are crucial components in several industrial and consumer applications, including motors, generators, hard drives, transformers, sensors, and battery chargers.

An example of an industrial electromagnet application is seen in scrap yards, where electromagnets are used to lift and move heavy iron or steel objects.

Exports by Magnet Type

In 2023, permanent magnets accounted for a significant 79.2% of global magnet exports, an increase from 66.2% in 2022. Meanwhile, electromagnets, as well as electromagnetic lifting heads and related parts (excluding those for medical uses), generated 29.2% of total export sales—up from 25.5% the previous year. The remaining 8.6% of exports came from electromagnetic couplings, clutches, and brakes, which saw a slight rise from 8.3% in 2022.

These magnets are classified under the Harmonized System code 8505, which covers permanent magnets, electromagnets, magnetic holding devices, and electromagnetic couplings, excluding medical applications.

Geographical Breakdown of Magnet Exports

In terms of export value, the top 5 countries for magnets and electromagnets in 2023 were China, Germany, Japan, the USA, and Vietnam. Together, these nations contributed over 70.8% of global magnet export revenue.

Asia led in terms of export value, contributing 65.6% of the global total, which amounts to approximately $7.4 billion in exports. Europe followed with 27%, and North America accounted for 6%. Smaller contributions came from Oceania (0.8%), Africa (0.5%), and Latin America (0.1%) excluding Mexico but including the Caribbean.

Leading Magnet Exporters by Country

The following countries were the top exporters of magnets and electromagnets in 2023:

1. China: $4.9 billion (43.5% of global exports)

2. Germany: $1.2 billion (11%)

3. Japan: $913.2 million (8.1%)

4. United States: $537.9 million (4.7%)

5. Vietnam: $389.1 million (3.4%)

6. France: $278.1 million (2.5%)

7. South Korea: $255.9 million (2.3%)

8. Philippines: $238.3 million (2.1%)

9. Italy: $228.1 million (2%)

10. Switzerland: $188.2 million (1.7%)

These 25 leading exporters accounted for 95.3% of global magnet exports in 2023.

Fastest Growing Exporters

Among the fastest-growing exporters since 2022 were:

· Turkey: +39.6% growth

· Romania: +22.9% growth

· United States: +15.3% growth

· Belgium: +14.7% growth

On the other hand, countries experiencing significant declines in magnet exports included:

· Thailand: -24.3% decrease

·Vietnam: -23.5% decrease

· Hong Kong: -22.4% decrease

· Japan: -21.9% decrease

· Taiwan: -19.9% decrease

· Spain: -17.3% decrease

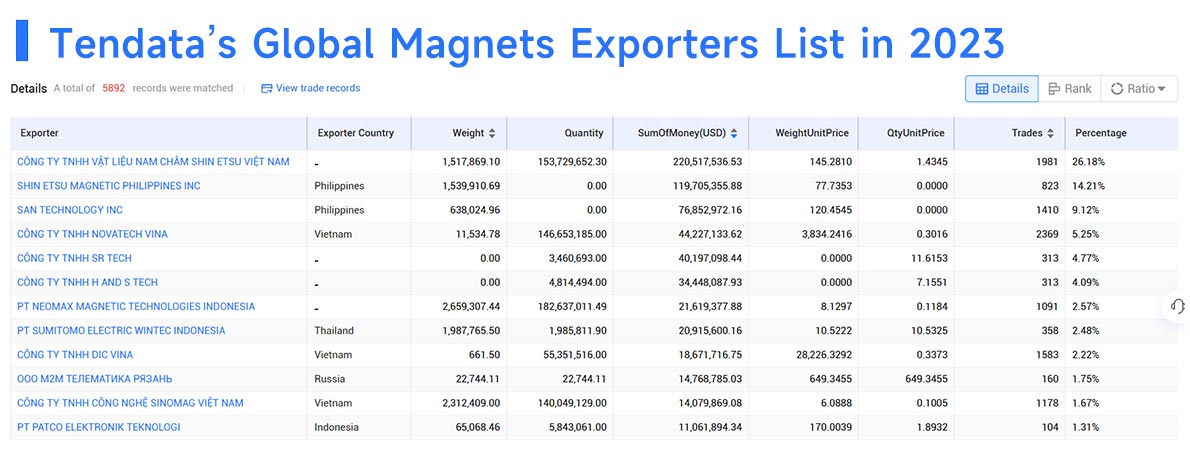

Leading Companies in Magnet Exports

Here are 10 prominent suppliers of permanent magnets, electromagnets, or both, actively involved in global trade from Tendata:

1. Shin-Etsu Materials Co., Ltd. (Vietnam): 26.18%, $220.52 million

2. Shin-Etsu Magnetic Philippines Inc.: 14.21%, $119.71 million

3. San Technology Inc.: 9.12%, $76.85 million

4. Novatech Vina Co., Ltd.: 5.25%, $44.23 million

5. SR Tech Co., Ltd.: 4.77%, $40.2 million

6. H and S Tech Co., Ltd.: 4.09%, $34.45 million

7. Neomax Magnetic Technologies Indonesia: 2.57%, $21.62 million

8. Sumitomo Electric Wintec Indonesia: 2.48%, $20.92 million

9. DIC Vina Co., Ltd.: 2.22%, $18.67 million

10. M2M Telematica Ryazan: 1.75%, $14.77 million

These companies play a significant role in global magnet trade, supplying products to various industries including electronics, manufacturing, and automotive.

>>>Get A Free Demo from Tendata<<<

Conclusion

The global magnet and electromagnet market in 2023 demonstrated significant growth despite a slight year-over-year decline in export value. Countries such as China, Germany, and Japan continue to lead the market, with Asia firmly establishing itself as the largest exporter of these critical components. As technological advancements continue to drive demand for electromagnets in various industrial applications, the trade in magnets is expected to remain a key part of global supply chains.

If you're looking to dive deeper into the world of magnet exports, or need detailed data on HS code classifications, export statistics, or company insights, feel free to reach out for more information.

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship