Export News

Export News

09-12-2024

09-12-2024

As one of the world's largest economies, the United States plays a pivotal role in global trade, with its export markets ranging from high-tech innovations to agricultural products. In 2023, the U.S. exported over $2.2 trillion in goods and services, with Canada and Mexico being its two largest trading partners. Given the complexities and opportunities in these massive trade flows, U.S. businesses are increasingly turning to advanced analytics to stay competitive. This is where Tendata comes in—helping American companies unlock their full export potential through data-driven insights and smart business strategies.

The U.S. Export Landscape

In 2023, Mexico surpassed Canada as America's largest export market, with exports totaling about $330 billion. And another America's largest export partner Canada, receiving approximately $300 billion in goods. These two nations alone account for nearly 40% of U.S. exports, highlighting the immense trade value between North America’s interconnected economies.

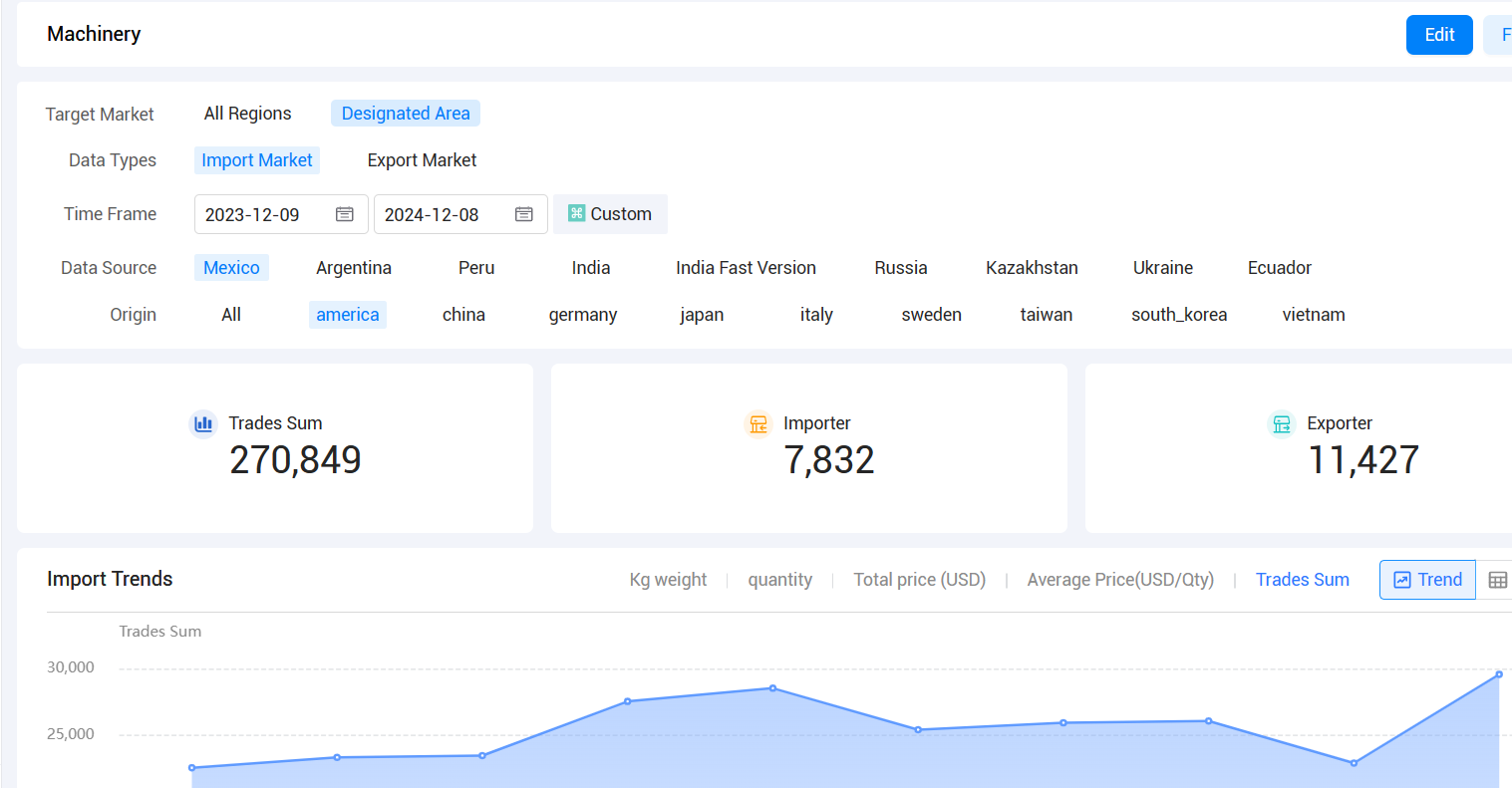

These numbers reflect the success of trade agreements such as the USMCA (United States-Mexico-Canada Agreement), which has facilitated smoother cross-border trade for goods like machinery, vehicles, agricultural products, and mineral fuels. However, navigating this dynamic landscape requires more than just understanding market trends—it requires actionable data.

America's Largest Export Markets: Key Players and Products

The top destinations for U.S. exports in 2023 showcase a diverse and expanding range of economies. Here's a closer look at America's largest export markets along with the product proportions that dominate exports to each country:

>>Learn More About the U.S. Export Market<<

1. Mexico – $330 billion

America's largest export market in 2023, with exports to Mexico accounting for nearly 19.5% of total U.S. exports.

Machinery & Electrical Equipment: 28% – Includes vehicles, computers, and telecommunications equipment.

Mineral Fuels: 23% – Oil and natural gas.

Agricultural Products: 18% – Corn, soybeans, meat products, and dairy.

Plastic and Rubber Products: 10% – Components for manufacturing and packaging.

Chemicals: 7% – Organic chemicals, plastics, and fertilizers.

2. Canada – $300 billion

America's largest export partner, receiving approximately 18% of all U.S. exports.

Vehicles & Automotive: 23% – Cars, trucks, and automotive parts.

Machinery: 21% – Power generating machinery, computers, and electrical equipment.

Mineral Fuels: 17% – Crude oil, natural gas, and coal.

Agricultural Products: 14% – Soybeans, wheat, corn, and fresh fruit.

Pharmaceuticals: 8% – Medicinal and pharmaceutical products.

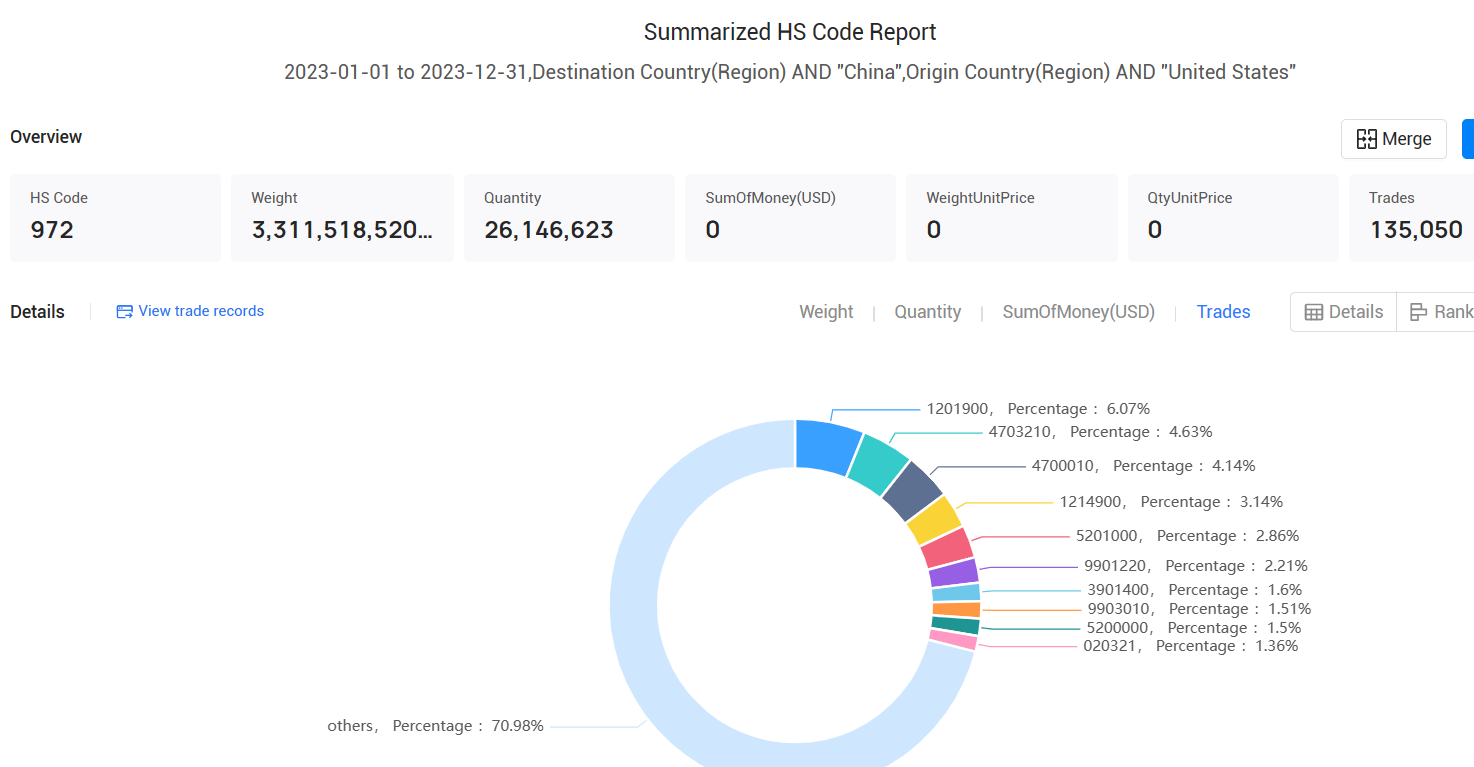

3. China – $170 billion

Despite trade tensions, China remains one of the largest export markets for U.S. goods.

Machinery & Electrical Equipment: 32% – Computer chips, telecommunications equipment, and aircraft.

Soybeans: 13% – China is a major importer of U.S. soybeans for its growing agricultural sector.

Aircraft: 10% – Aircraft engines and parts.

Automotive Parts: 8% – Automotive components used in the growing Chinese car industry.

Optical and Medical Instruments: 7% – Diagnostic and surgical equipment.

>>Click for Detailed HS Code Report<<

4. Japan – $75 billion

A key market for advanced technology and machinery.

Vehicles: 20% – Includes cars, trucks, and automotive parts.

Machinery: 18% – Power equipment, engines, and generators.

Aerospace Products: 14% – Aircraft, aircraft parts, and engines.

Electrical Equipment: 12% – Semiconductors, electronic components.

Pharmaceuticals: 8% – Medicines and medical devices.

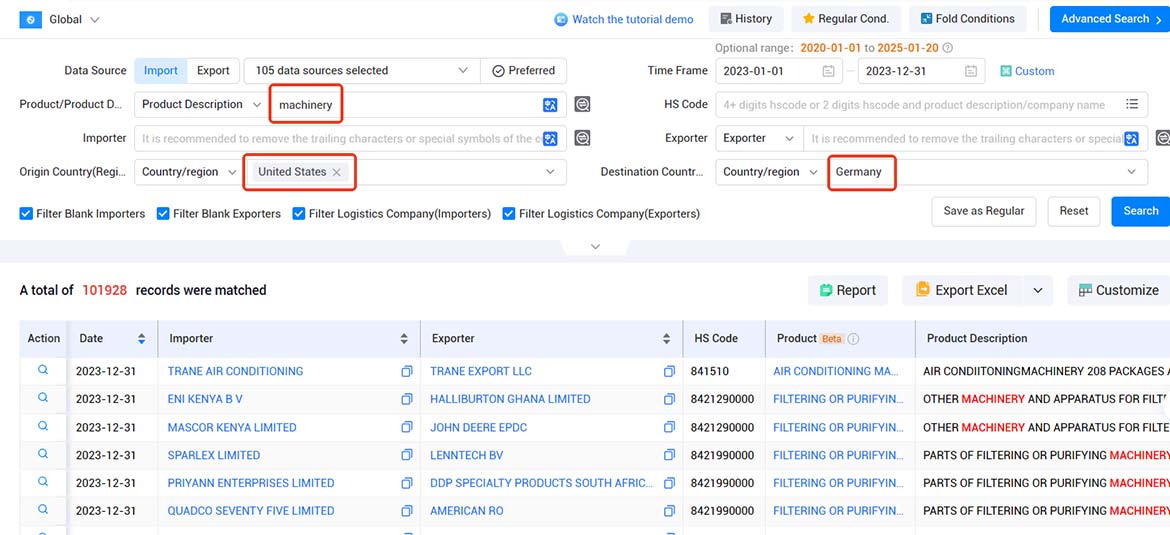

5. Germany – $67 billion

Germany is a critical market for U.S. technology and industrial goods.

Machinery: 26% – Industrial machinery and power generators.

Electrical Equipment: 21% – Electrical circuits, semiconductors, and transformers.

Aerospace Products: 18% – Aircraft parts, jet engines.

Pharmaceuticals: 10% – Medicinal preparations, vaccines.

Mineral Fuels: 8% – Petroleum and natural gas.

>>Contact Tendata to Get Online Free Demo<<

6. South Korea – $60 billion

South Korea's demand for U.S. technology and automotive goods makes it a vital export market.

Machinery & Electronics: 30% – Telecommunications equipment, semiconductors.

Vehicles: 22% – Cars and automotive parts.

Aircraft: 12% – Aircraft, aircraft engines.

Chemicals: 9% – Organic chemicals and plastics.

Agricultural Products: 7% – Soybeans, pork, and dairy products.

7. United Kingdom – $55 billion

The UK remains a major trade partner with a focus on pharmaceuticals, machinery, and aerospace.

Pharmaceuticals: 30% – Medicinal products and vaccines.

Aircraft & Parts: 18% – Aircraft, engines, and aerospace components.

Electrical Equipment: 12% – Semiconductors and computer parts.

Machinery: 10% – Power generation machinery and industrial equipment.

Mineral Fuels: 8% – Petroleum and refined products.

8. Netherlands – $50 billion

The Netherlands serves as a hub for U.S. goods entering the EU market.

Machinery: 35% – Industrial machinery, including engines and pumps.

Electrical Equipment: 20% – Semiconductors, batteries, and other electronics.

Chemicals: 15% – Organic chemicals and pharmaceuticals.

Aircraft & Parts: 12% – Aerospace products and engines.

Mineral Fuels: 8% – Petroleum products, especially natural gas.

How Tendata Supports Exporters in the U.S.

Tendata offers America's largest export players the tools they need to better understand their competitors, track consumer trends, and predict shifts in demand across diverse global markets. This data-driven approach is particularly important in sectors such as manufacturing, agriculture, and technology—industries that dominate America's largest export volumes and America's largest export markets.

Market Intelligence: Tendata offers real-time analytics on global trade patterns, allowing businesses to pinpoint emerging export markets. For instance, companies can track demand spikes in regions like Mexico, where manufacturing industries rely heavily on U.S. components, or analyze the trade dynamics in America's largest export markets.

Competitive Analysis: With Tendata’s competitive benchmarking tools, businesses can track competitor performance in key export markets, helping them refine their product offerings, adjust pricing strategies, and fine-tune their supply chains for maximum efficiency.

Risk Management: The world of international trade can be unpredictable, from fluctuating tariffs to shifting consumer preferences. Tendata helps companies identify and mitigate risks by offering predictive analytics, so U.S. exporters can make smarter, more calculated decisions.

Conclusion

As America's largest export markets continue to grow in importance, it's crucial for U.S. businesses to embrace the power of data. With Canada and Mexico representing a significant portion of America's largest export trade flows, now is the time for U.S. businesses to leverage data and build stronger, more profitable relationships with these key markets. Tendata equips companies with the insights they need to not only navigate the complexities of international trade but also thrive in an increasingly competitive global marketplace.

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship