Export News

Export News

09-12-2024

09-12-2024

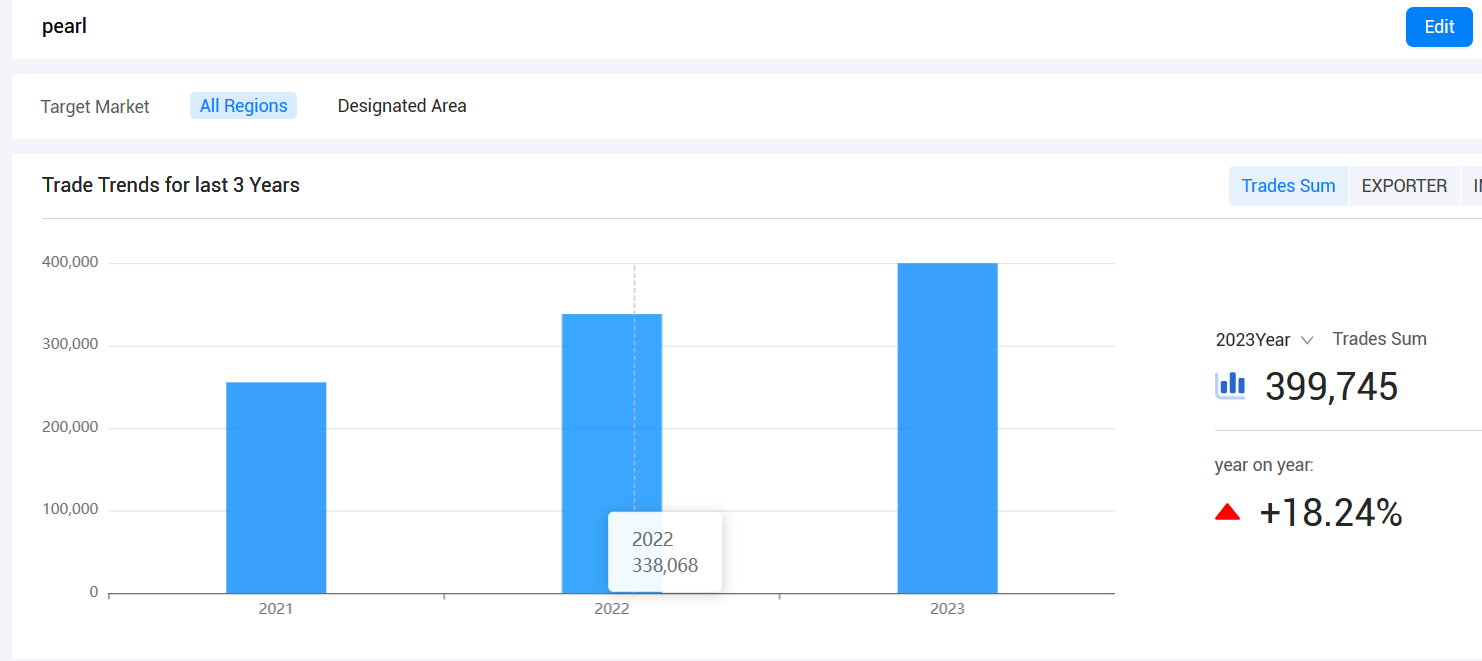

Pearls, often seen as symbols of luxury and sophistication, have been traded for centuries. The global pearl exports market is dominated by a few key players who lead the cultivation and export of natural and cultured pearls. These countries not only supply raw pearls but also polished and finished products that are sold in high-end jewelry markets.

In 2023, the total global pearl exports value was estimated to be around $1.4 billion. This figure includes natural pearls, cultured pearls, and finished pearl jewelry, with the majority of exports coming from a select few countries. The pearl industry is highly concentrated, with a few countries controlling the lion's share of global pearl exports. Tendata will lead you into insights on pearl export market in 2023.

Top Pearl Exporting Countries in 2023

1. Japan – $450 million

Japan is one of the world’s largest exporters of cultured pearls, particularly Akoya pearls, which are prized for their quality and luster. The country has maintained a leadership position in the pearl trade for decades, thanks to its technological advancements in pearl cultivation.

Cultured Pearls: 75% – The vast majority of Japan’s pearl exports are cultured pearls, particularly Akoya pearls used in fine jewelry.

Finished Jewelry: 15% – Japan also exports finished pearl jewelry, including necklaces, earrings, and rings.

Natural Pearls: 10% – Although less common, Japan also exports some natural pearls, though they represent a small proportion of the total.

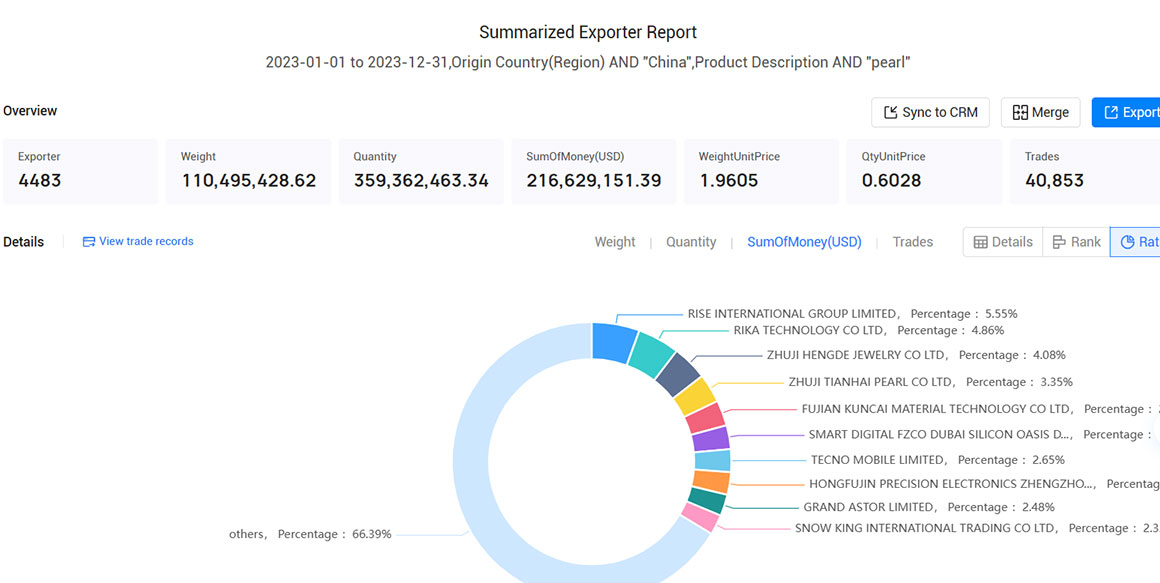

2. China – $350 million

China is a major player in the global pearl exports market, particularly in freshwater pearls, which are cultivated in lakes and rivers. The country has rapidly expanded its pearl farming industry in recent years and is now one of the world’s largest producers and exporters.

Freshwater Pearls: 65% – China dominates the market for freshwater pearls, which are used in a wide range of jewelry products.

Cultured Pearls (Saltwater): 25% – China is also a significant exporter of cultured saltwater pearls, especially South Sea and Tahitian pearls.

Finished Jewelry: 10% – China exports a significant quantity of pearl jewelry, both locally crafted and for global distribution.

>>Learn More About Global Pearl Exports<<

3. French Polynesia – $150 million

Tahitian pearls, known for their exotic black color, are predominantly produced in French Polynesia. The country is a leading exporter of high-end cultured black pearls, which are highly sought after in international luxury markets.

Tahitian Pearls: 90% – Tahitian pearls account for almost all of French Polynesia’s global pearl exports. These pearls are typically darker in color, with hues ranging from black to green, blue, and purple.

Finished Jewelry: 10% – A small percentage of exports come in the form of finished jewelry, where the pearls are set in necklaces, bracelets, and earrings.

4. Australia – $200 million

Australia is renowned for producing South Sea pearls, which are larger and more lustrous than many other types of cultured pearls. These pearls are highly prized in the jewelry world for their size and exceptional quality.

South Sea Pearls: 85% – The majority of Australia’s pearl exports are South Sea pearls, typically white or golden in color, produced in the waters off the coast of Western Australia.

Finished Jewelry: 10% – Australia also exports a significant amount of pearl jewelry, mainly consisting of South Sea pearls.

Natural Pearls: 5% – Australia still harvests a small quantity of natural pearls, although these represent a tiny fraction of total exports.

5. India – $100 million

India’s pearl industry is focused largely on cultured pearls, particularly freshwater varieties, with the country being an important exporter to international markets.

Freshwater Pearls: 60% – India is one of the leading exporters of freshwater pearls, which are mainly cultivated in lakes and rivers across the country.

Finished Jewelry: 25% – India also exports a significant amount of finished pearl jewelry, including necklaces, bracelets, and rings.

Cultured Pearls (Saltwater): 15% – Although smaller in volume, India also exports saltwater cultured pearls, particularly those from the southern coastal regions.

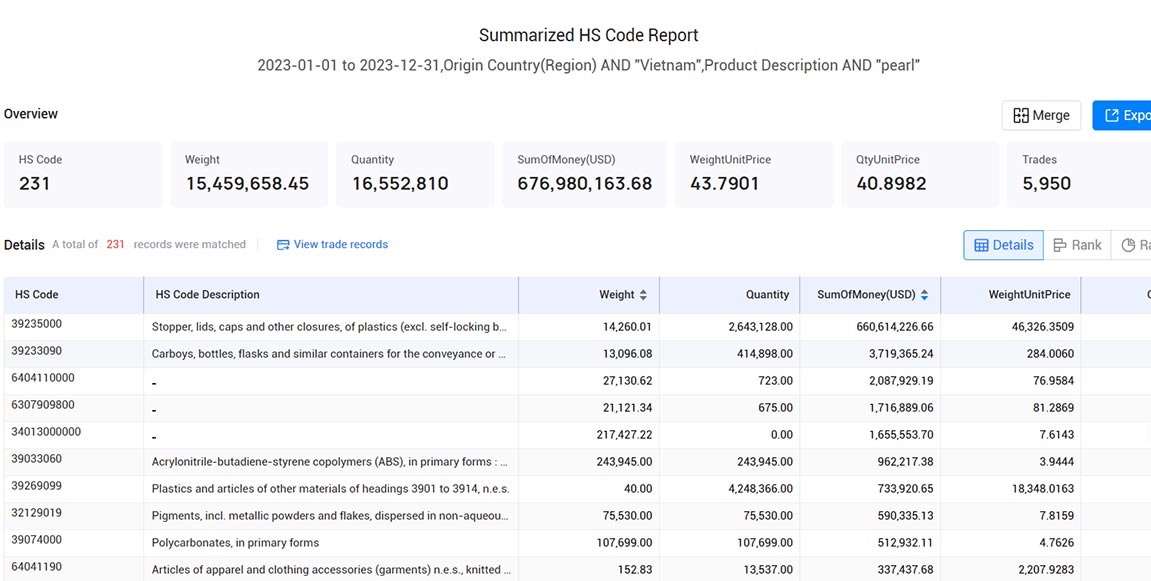

6. Vietnam – $50 million

Vietnam has been gaining recognition as an emerging player in the global pearl exports market, particularly for freshwater pearls and cultured saltwater pearls.

Freshwater Pearls: 70% – Freshwater pearls are the dominant export product, mainly used in affordable jewelry.

Cultured Pearls: 20% – Vietnam also exports cultured pearls, particularly those produced in saltwater farms.

Finished Jewelry: 10% – A small portion of Vietnam’s pearl exports consists of finished jewelry.

>>Click to Access HS Code Report<<

Major Pearl Export Partners

1. United States – $300 million

The U.S. is one of the largest importers of pearls and finished pearl jewelry, sourcing pearls from countries like Japan, China, and French Polynesia. The U.S. pearl jewelry market is particularly lucrative, with high demand for fine jewelry featuring Tahitian, South Sea, and Akoya pearls.

2. Japan – $200 million

As one of the largest consumers of pearls, Japan imports pearls from its own farms but also from other countries. It is particularly known for importing high-quality pearls for use in its luxury jewelry industry.

3. United Arab Emirates – $120 million

The UAE is a significant market for high-end pearls, particularly for luxury jewelry, often serving as a transit point for pearls destined for other markets in the Middle East and Europe.

4. Italy – $110 million

Italy’s luxury jewelry industry imports pearls, particularly those of high quality, such as South Sea and Tahitian pearls, for its high-end jewelry lines.

5. Hong Kong – $80 million

Hong Kong is a key market for pearls, serving as a major trading hub for pearls from around the world, particularly freshwater and South Sea varieties.

>>Contact Tendata for Online Free Demo<<

Conclusion

The global pearl exports market remains a robust and thriving industry, with key players like Japan, China, and French Polynesia leading the charge. The pearl industry is characterized by a variety of types, from freshwater to the more luxurious Tahitian and South Sea pearls. In 2023, the total global pearl exports reached approximately $1.4 billion, with major export markets in the U.S., Japan, and the UAE continuing to drive demand for high-end pearl jewelry.

Tendata offers valuable tools for exporters looking to optimize their strategies and expand their reach in a growing global market. With strong demand across different regions and a variety of pearl products in high demand, the future of the global pearl exports market looks bright, with abundant opportunities for growth and success.

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship