Export News

Export News

13-09-2024

13-09-2024

In 2023, the total value of diamonds exported globally reached $98.9 billion. This represents a decline of -13.3% from 5 years earlier, when diamond exports were valued at $114 billion in 2019. Compared to the previous year, there was a notable reduction of -24.8% from $131.5 billion in 2022.

The top 5 diamond-exporting countries are India, the United States, Hong Kong, the United Arab Emirates, and Belgium. Together, these leading exporters were responsible for more than two-thirds (70.4%) of the world's diamond exports in 2023.

From a continental perspective, Asia was the largest exporter of diamonds, accounting for $54.9 billion, or 55.4% of the global total. North America followed with an 18.8% share, while Europe contributed 14.6%. Smaller shares were held by Africa (10.8%), Oceania, led by Australia (0.2%), and Latin America (0.1%), excluding Mexico but including the Caribbean.

For classification purposes, the Harmonized Tariff System (HTS) code prefix for unmounted and unset diamonds is 7102.

Top 15 Countries by Diamond Export Value in 2023

The following are the 15 countries with the highest dollar value of diamond exports in 2023:

1. India: $18.2 billion (18.4% of total exports)

2. United States: $16.8 billion (17%)

3. Hong Kong: $14.6 billion (14.8%)

4. United Arab Emirates: $10.3 billion (10.4%)

5. Belgium: $9.7 billion (9.8%)

6. Israel: $6.6 billion (6.6%)

7. Botswana: $4.3 billion (4.4%)

8. Russia: $2.2 billion (2.2%)

9. South Africa: $2.1 billion (2.1%)

10. Mainland China: $1.93 billion (2%)

11. Angola: $1.88 billion (1.9%)

12. Canada: $1.7 billion (1.7%)

13. Namibia: $1.6 billion (1.6%)

14. Switzerland: $1.4 billion (1.4%)

15. Thailand: $1.3 billion (1.3%)

These top 15 countries collectively accounted for 95.6% of the global diamond exports in 2023.

Among these leading exporters, Namibia and Hong Kong showed notable growth in their diamond export volumes since 2022, with increases of 20.5% and 4.2%, respectively. Conversely, countries experiencing significant declines include Russia (down -53.1%), the United Arab Emirates (down -47.8%), Botswana (down -40.1%), Israel (down -39.6%), and Belgium (down -26.7%).

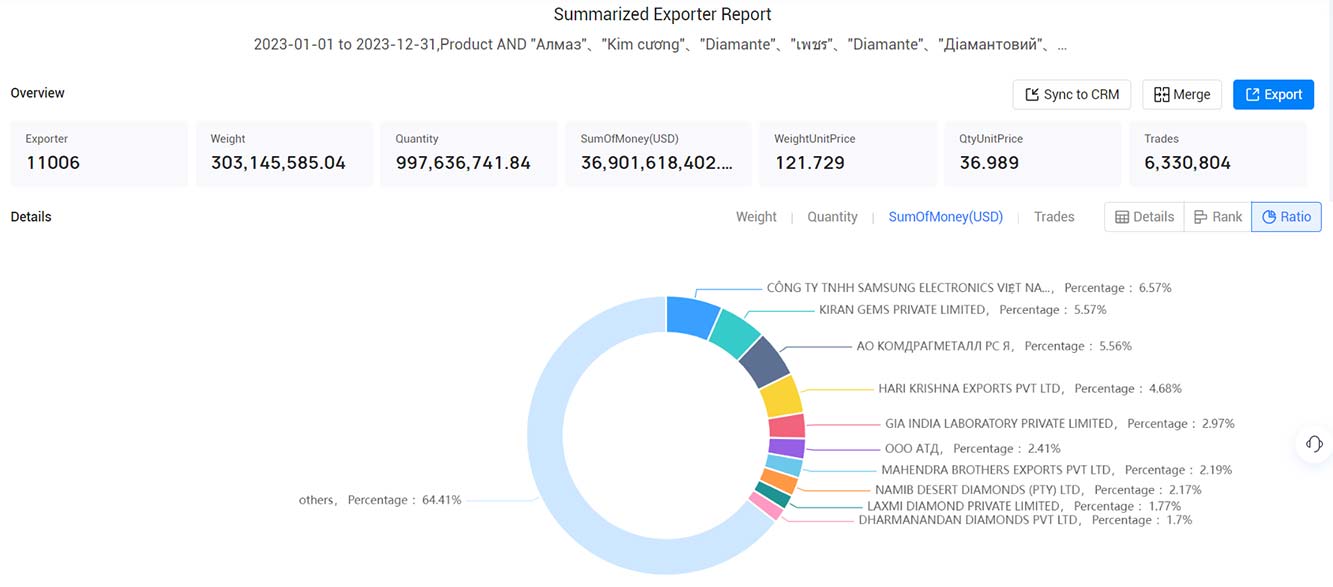

Leading Diamond Exporting Companies

Based on the Tendata Diamond Exporters Report, the following companies were prominent players in the global diamond trade in 2023:

1. CÔNG TY TNHH SAMSUNG ELECTRONICS VIỆT NAM THÁI NGUYÊN: 6.57%, $2.4 billion

2. KIRAN GEMS PRIVATE LIMITED: 5.57%, $2.1 billion

3. АО КОМДРАГМЕТАЛЛ РС Я: 5.56%, $2.05 billion

4. HARI KRISHNA EXPORTS PVT LTD: 4.68%, $1.73 billion

5. GIA INDIA LABORATORY PRIVATE LIMITED: 2.97%, $1.1 billion

6. ООО АТД: 2.41%, $889 million

7. MAHENDRA BROTHERS EXPORTS PVT LTD: 2.2%, $810 million

8. NAMIB DESERT DIAMONDS (PTY) LTD: 2.17%, $800 million

9. LAXMI DIAMOND PRIVATE LIMITED: 1.78%, $655 million

10. DHARMANANDAN DIAMONDS PVT LTD: 1.7%, $627 million

This data provides a comprehensive overview of the global diamond export landscape, highlighting key trends, leading exporters, and major companies involved in the industry.

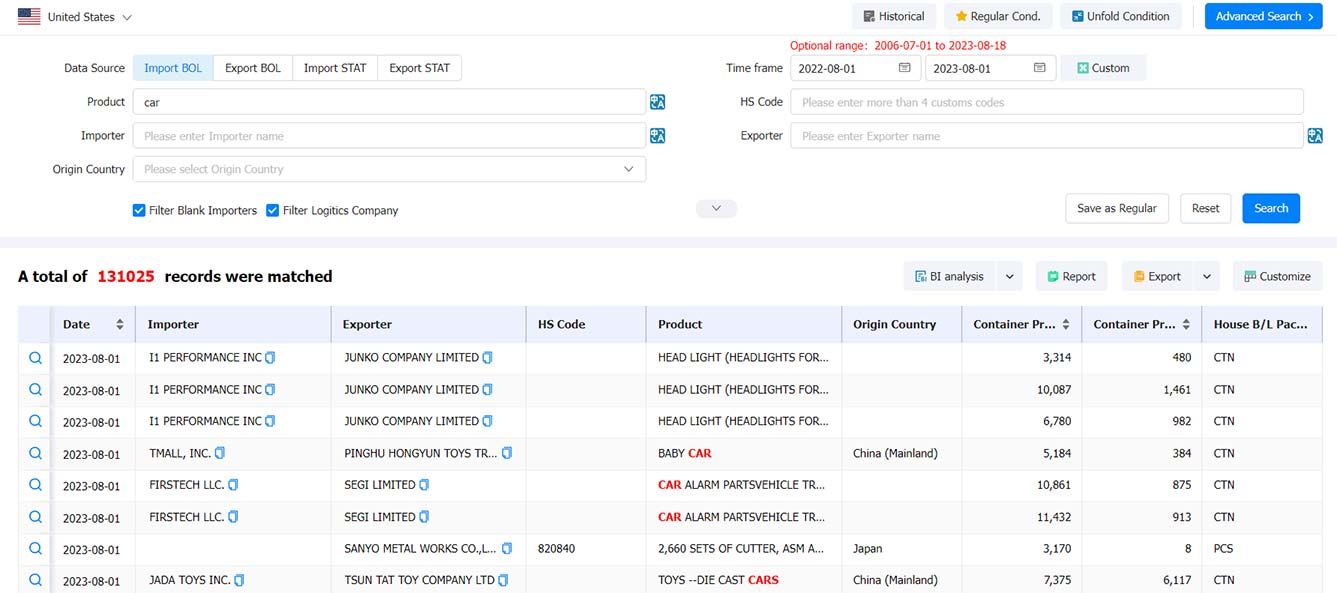

1. Establishing a Customer Resource Repository by Country

Creating a customer resource repository is akin to your own work record sheet. Begin by utilizing trade tracking functionality to compile a list of all customers from a particular country. Next, perform specific analyses based on factors such as each purchaser's procurement volume, purchase cycle, product specifications, and supplier systems (with emphasis on examining the diversity or singularity of their supply channels; preferably retaining customers with diversified suppliers, as those relying on a single supply channel may be harder to develop). Lastly, filter out the potential high-quality customers constituting 30% of this country's total, and record them in your customer resource repository, allowing flexible categorization by country, time, customer name, follow-up steps, phone numbers, emails, and other contacts. (>>>Click to Start Developing Customers for Free<<<)

2. Creating a Customer Resource Repository by Peer Companies

Have a solid understanding of peer companies' English names (including full names, abbreviations, etc.). Utilize the global networking capability of suppliers to generate a list of all clients associated with peer companies within the system. Following this, perform essential analyses on these clients based on factors like procurement volume, procurement cycle, product models, and others. Ultimately, identify and record the key customers of your targeted peer companies in your customer resource repository. (>>>Click to Start Developing Customers for Free<<<)

3. Cataloging New Customers from Each Country

For newly emerging customers from specific countries, use the trade search function to select the country, set the date range and limit product names or customs codes. Check "Newest," and the search results will display high-quality customers that emerged most recently in that country within the designated timeframe. Since these customers are newly established, with recent procurement transactions, their supplier stability might be unsteady. Therefore, prioritize following up with these new potential buyers. Lastly, record all these new prospects in your customer resource repository. (>>>Click to Start Developing Customers for Free<<<)

All three strategies for utilizing customs data to develop customers can be tailored to your company's actual needs. Depending on market conditions, industry specifics, strategic requirements, etc., find the approach that suits you best, with the sole aim of classifying and organizing your premium customers. Once you've found suitable customers, the next step is to contact them precisely, employing various methods such as phone calls, emails, and online chats.

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship