Export News

Export News

11-05-2024

11-05-2024

Based on Tendata's Japan export data, in 2023, Japan exported products worth $717.6 billion globally. Compared to $752.1 billion in 2022, this amounted to a year-on-year decrease of -4.6%.

Japan's Top International Trade Partners

The latest Tendata Japan export data shows that 73.2% of Japan's export products were purchased by importers from the following countries: the United States (20.2%), Mainland China (17.6%), South Korea (6.5%), Taiwan (6%), Hong Kong (4.5%), Thailand (4.1%), Germany (2.7%), Singapore (2.6%), Vietnam (2.4%), Australia (2.3%), India (2.2%), and Indonesia (2%).

Tendata Japan export data indicates that, from the perspective of Mainland China, 56.4% of Japan's exports were sold to Asian countries, while 23.5% were sold to North American importers. Japan also exported an additional 13.4% of goods to Europe. A smaller proportion of buyers came from Oceania, primarily Australia and New Zealand (3%), Latin America (2.4%), followed by Africa (1.4%).

Top 10 Export Products from Japan

Based on two-digit HTS codes, Tendata's Japan export data shows that the top 10 exports accounted for 74.9% of its global shipment value:

1. Automobiles: $156.7 billion (21.8% of total exports)

2. Machinery including computers: $129.8 billion (18.1%)

3. Electrical machinery, equipment: $101.8 billion (14.2%)

4. Optical, technical, medical apparatus: $36.2 billion (5%)

5. Iron and steel: $30.6 billion (4.3%)

6. Plastics and plastic products: $23.6 billion (3.3%)

7. Precious metals and stones: $18.5 billion (2.6%)

8. Organic chemicals: $14.8 billion (2.1%)

9. Mineral fuels including oil: $12.8 billion (1.8%)

10. Other chemicals: $12.5 billion (1.7%)

Automobiles were the only product category among the top ten exports to see growth, with a 14.6% increase since 2022. The category with the largest decline among Japan's top ten exports was miscellaneous chemicals, down -12.7% year-on-year.

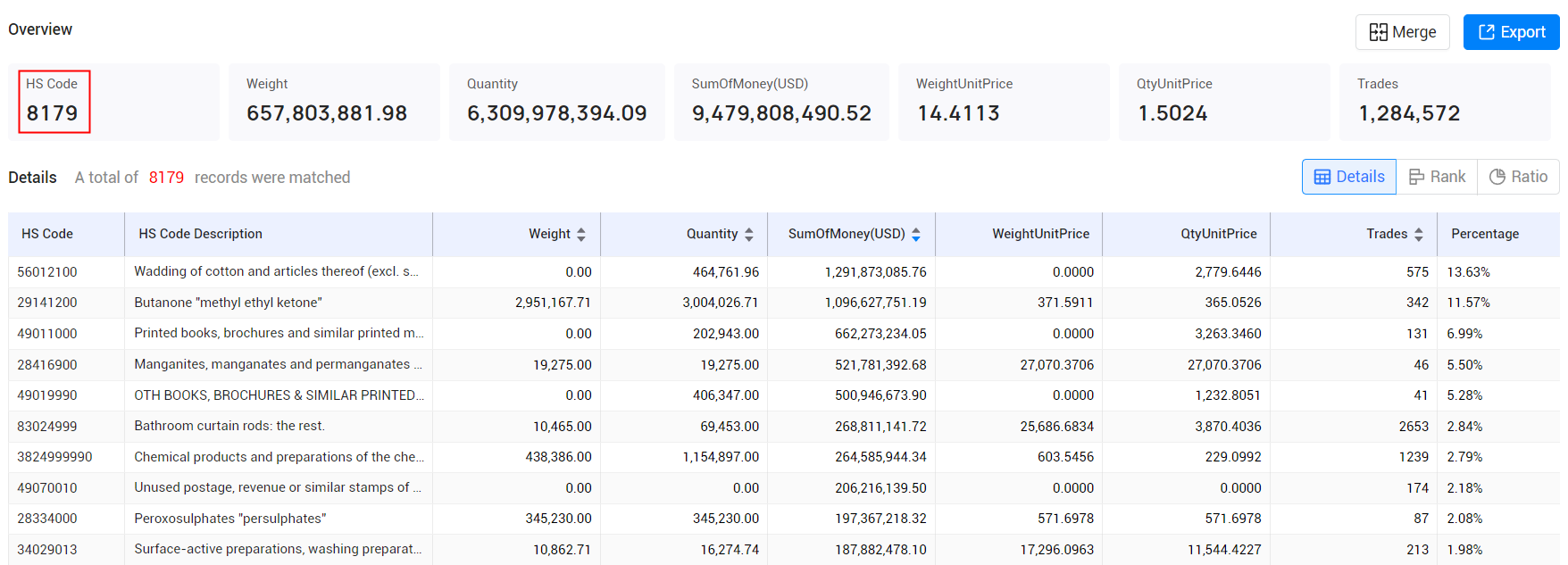

Tendata's Japan export data reveals that, at a more detailed HS code level, the top 10 specific export products from Japan were:

1.HS Code:56012100(13.63%, $1291.87 Million):Wadding of cotton and articles thereof (excl. sanitary towels and tampons, napkins and napkin liners for babies and similar sanitary articles, wadding and articles thereof impregnated or coated with pharmaceutical substances or put up for retail sale for

2.HS Code:29141200(11.57%, $1096.63 Million):Butanone "methyl ethyl ketone"

3.HS Code:49011000(6.99%, $662.27 Million):Printed books, brochures and similar printed matter, in single sheets, whether or not folded (excl. periodicals and publications which are essentially devoted to advertising) + detailed label not available +

4.HS Code:28416900(5.5%, $521.78 Million):Manganites, manganates and permanganates (excluding potassium permanganate)

5.HS Code:49019990(5.28%, $500.95 Million):OTH BOOKS, BROCHURES & SIMILAR PRINTED MATTER, WTR/ NOT IN SINGLE SHEETS

6.HS Code:83024999(2.84%, $268.81 Million):Bathroom curtain rods: the rest.

7.HS Code:3824999990(2.79%, $264.59 Million):Chemical products and preparations of the chemical or allied industries, incl. those consisting of mixtures of natural products, n.e.s: other : other : other : other

8.HS Code:49070010(2.18%, $206.22 Million):Unused postage, revenue or similar stamps of current or new issue in the country in which they have, or will have, a recognised face value; stamp-impressed paper; banknotes; cheque forms; stock, share or bond certificates and similar documents of title: U

9.HS Code:28334000(2.08%, $197.37 Million):Peroxosulphates "persulphates"

10.HS Code:34029013(1.98%, $187.88 Million):Surface-active preparations, washing preparations, incl. auxiliary washing preparations and cleaning preparations (excl. those put up for retail sale, organic surface-active agents, soap and organic surface-active preparations in the form of bars, cakes

Customs data contains a vast amount of information, and extracting relevant customer contact information can be time-consuming, with results not always meeting expectations. Is it truly the case, or is it because customs data is being used incorrectly, resulting in wasted effort and time?

Utilizing customs data for customer development can be achieved by precisely characterizing all buyers and their procurement systems in the target market. This allows for the quick identification of the most compatible customers, discerning their credit systems and procurement information, determining high-quality customers and profit margins, enhancing development efficiency, and improving overall effectiveness.

In customs data, one can observe the suppliers of buyers. Some of these suppliers are trade companies and also potential customers. In-depth analysis can be conducted on these trade companies, and key customers can be selected for focused development. Information such as buyer contacts, trade partners, procurement cycles, and purchase volumes can be obtained. While customs data may lack contact information due to being derived from bill of lading information, Tendata iTrader provides not only customs data but also business and internet data. This allows for the direct extraction of contact information and positions based on buyer names, making customer development through customs data seamless. (>>> Click To Get Free Demo for Customs Data From 90+ Countries) For new customer development using customs data, three strategies are available for consideration.

1. Establishing a Customer Database by Country:

Building a customer database is akin to maintaining a work record. Start by using trade tracking features to compile a list of all customers in a country. Analyze each buyer's purchase volume, procurement cycle, product specifications, and supplier system. Finally, filter out 30% of the potential high-quality customers from this country and record them in your customer database, allowing flexible settings by country, time, customer name, follow-up steps, contact phone, email, contact person, etc. (>>> Click For Free Customer Development)

2. Establishing a Customer Database by Peer Companies:

Have a clear understanding of the names of peer companies (including full names, abbreviations, etc.). Use the global supplier network feature to gather all customers of these peers in the system. Analyze these customers based on purchase volume, procurement cycle, and product models. Finally, filter out key customers from your targeted peers and record them in your customer database. (>>> Click For Free Trial Application)

3. Identifying Newly Appeared Customers in Each Country:

Utilize the trade search function to select a country, set date ranges, limit product names or customs codes, and check "latest." The search results will display high-quality customers that have recently appeared in that country during the specified time period. Since these customers are newly emerging, they may have unstable supplier relationships, requiring focused follow-up. Record these new potential buyers in your customer database. (>>> Click For Free Demo Application)

These three approaches for customer development using customs data can be implemented based on the actual needs of the company. Considering market conditions, industry characteristics, strategic requirements, etc., find a method that suits your preferences. The ultimate goal is to establish and organize a categorized archive of high-quality customers. Once suitable customers are identified, the next step is to make precise contact through various channels such as phone calls, email communication, online chat, etc.

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship