Export News

Export News

08-04-2024

08-04-2024

Mexico's export sector plays a pivotal role in driving economic growth and

fostering international trade partnerships. As we explore the export landscape

of Mexico in the first quarter of 2024, it becomes evident that the country

offers a diverse range of products catering to various industries and consumer

markets worldwide. Understanding Mexico's export profile and trade trends is

essential for businesses seeking to capitalize on emerging opportunities and

navigate global challenges effectively.

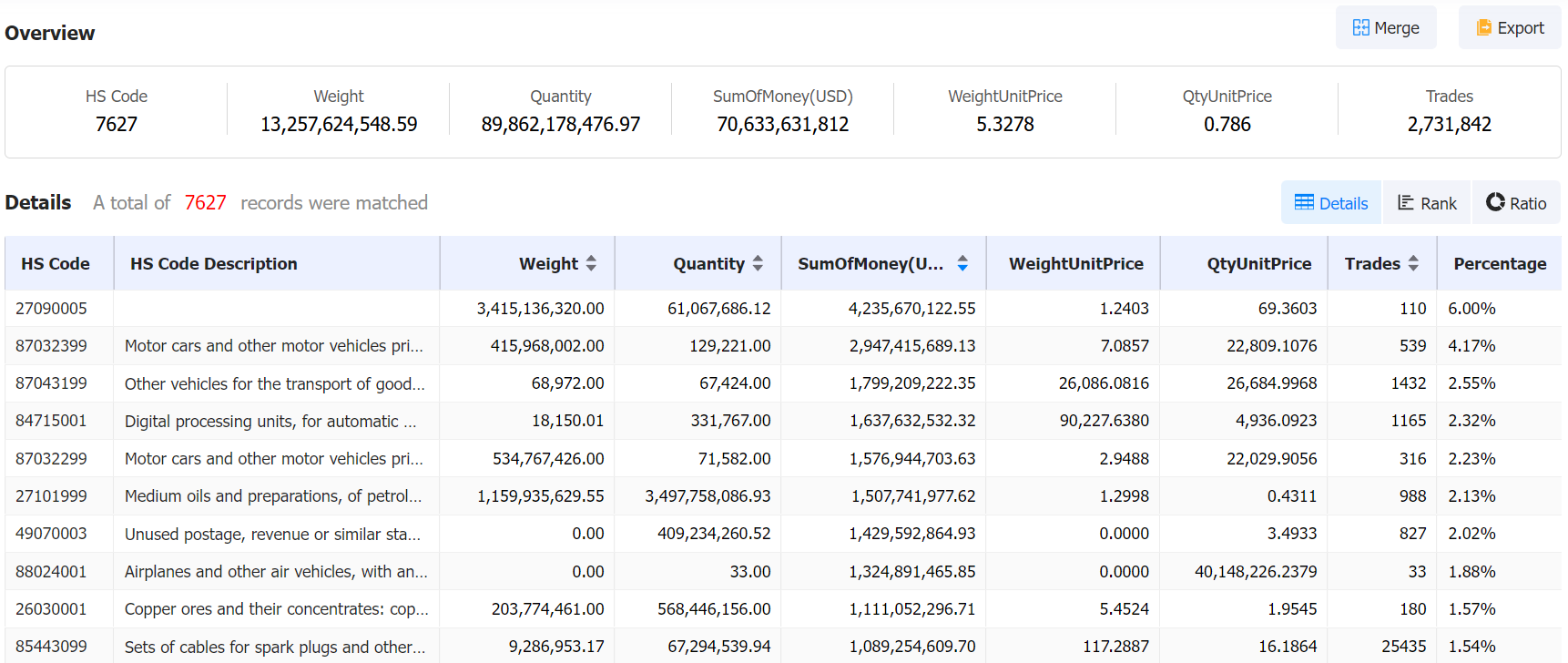

Shippment Data from Tendata

1. Petroleum Oils: A Cornerstone of Mexico's Export Economy

Petroleum oils represent a cornerstone of Mexico's export economy, accounting for 6% with a value of $4235.67 million in 2024 Q1. Mexico boasts significant reserves of petroleum, making it a prominent exporter of crude oil and refined petroleum products. Leveraging its strategic position in the energy market, Mexico continues to supply petroleum oils to various countries, driving revenue and fostering economic growth. Despite fluctuations in global oil prices, Mexico remains resilient in its petroleum exports, offering stability and reliability to its trading partners.

2. Motor Vehicles: Driving Mexico's Export Growth

Motor vehicles emerge as a key export commodity for Mexico, with multiple HS codes representing different categories. Motor cars and other vehicles designed for the transport of persons, along with vehicles for the transport of goods, contribute substantially to Mexico's export revenue. The automotive industry plays a crucial role in Mexico's economy, with a robust manufacturing sector and strategic trade agreements enhancing its global competitiveness. By producing high-quality vehicles and leveraging cost-efficient production processes, Mexico continues to strengthen its position as a leading exporter of motor vehicles, catering to diverse consumer preferences worldwide.

3. Digital Processing Units: Embracing Technological Advancements

Mexico's export portfolio extends beyond traditional commodities, encompassing technological products such as digital processing units. With a share of 2.32% valued at $1637.63 million in 2024 Q1, digital processing units highlight Mexico's commitment to embracing technological advancements and innovation. The country's growing expertise in electronics manufacturing, coupled with favorable trade policies, positions it as a competitive player in the global market for digital devices and components. By investing in research and development and fostering partnerships with tech companies, Mexico can further enhance its export capabilities in the digital technology sector.

4. Airplanes and Aircraft: Soaring Heights in Aerospace Export

Mexico's aerospace industry demonstrates significant growth potential, with exports of airplanes and other air vehicles contributing to its economic prosperity. With a share of 1.88% valued at $1324.89 million in 2024 Q1, Mexico showcases its prowess in aerospace manufacturing and engineering. The country's strategic location, skilled workforce, and supportive regulatory environment attract leading aerospace companies seeking cost-effective production solutions. By nurturing talent and fostering innovation hubs, Mexico can capitalize on the rising demand for air travel and expand its footprint in the global aerospace market.

5. Copper Ores and Concentrates: Harnessing Natural Resources

Copper ores and their concentrates represent a valuable export commodity for Mexico, highlighting the country's abundance of natural resources. With a share of 1.57% valued at $1111.05 million in 2024 Q1, copper exports underscore Mexico's mining industry's significance. The country's rich mineral deposits and advanced mining technologies enable it to extract and export copper ores efficiently. By investing in sustainable mining practices and infrastructure development, Mexico can ensure the long-term viability of its copper exports while minimizing environmental impact.

Analyzing Trade Trends and Market Opportunities

Mexico's export landscape in the first quarter of 2024 reflects its resilience and adaptability in navigating global market dynamics. While traditional sectors such as petroleum and automotive continue to drive export growth, emerging industries like technology and aerospace present new opportunities for diversification and innovation. By leveraging its strengths in manufacturing, natural resources, and technological capabilities, Mexico can further enhance its export competitiveness and establish stronger trade partnerships on the global stage.

Utilizing Tendata for Market Analysis and Customer Acquisition

In the increasingly competitive landscape of international trade, leveraging data-driven insights is essential for businesses to identify market trends and opportunities effectively. Tendata offers a comprehensive database for analyzing export-import trends, identifying potential markets, and connecting with prospective buyers. By harnessing the power of Tendata, businesses can gain valuable insights into Mexico's export market, identify strategic opportunities for market entry or expansion, and enhance their import-export operations for sustainable growth and success.

Conclusion

As Mexico continues to strengthen its position as a key player in the global export market, understanding its export trends and market dynamics is essential for businesses seeking to thrive in today's competitive environment. By capitalizing on its diverse export portfolio, embracing technological advancements, and leveraging data-driven insights, Mexico can further expand its export capabilities, foster sustainable economic growth, and solidify its position as a leading exporter on the world stage.

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship