Export News

Export News

26-02-2024

26-02-2024

Australia's iron ore mining sector, with an export value of $129.17 billion in 2023, has experienced substantial growth in revenue over the past five years. Iron ore prices saw a significant rise, contributing to the sector's revenue increase at an annualized rate of 8.1%, reaching an estimated total of $1,241 billion by 2022-23. The surge in iron ore prices was driven by strong demand from China and disruptions to Brazilian iron ore production due to COVID-19 before and during the pandemic. However, a decline in iron ore prices in 2022-23 led to a 16.2% decrease in annual iron ore export revenue.

Australia's coal mining, generating an export value of $91.7 billion in 2023, is a key player in steel production and energy. Australia, as one of the world's lowest-cost producers, dominates as a major coal-exporting nation. The sector relies heavily on Australia's high-quality coal reserves, contributing significantly to Australia's export revenue. Black coal dominates most activities, while some brown coal is used for domestic power generation in Victoria.

The export value for Australia's liquefied natural gas (LNG) production is $90.2 billion in 2023. The industry has seen rapid growth in production and capacity due to project development. Australia's LNG exports have risen from 20 million tons in 2010-11 to 80.9 million tons in 2022-23. Over the five years ending in 2022-23, LNG export revenue has grown at an annualized rate of 20.7%, reaching $90.3 billion.

Australia's petroleum and natural gas extraction sector reported an export value of $87.8 billion in 2023. The sector's revenue has experienced significant fluctuations due to changes in oil and gas prices, exchange rates, annual production volumes, and domestic and export demand for oil and gas. Over the past decade, production has consistently increased, while global oil and gas prices have seen substantial volatility.

The export value for Australia's gold and other non-ferrous metal processing in 2023 is $34.9 billion. The refined gold production for 2023-24 is projected to total 283.5 tons, slightly lower than the 293.0 tons in 2018-19. Despite strong gold demand, production has decreased due to border closures and restrictions, resulting in a decline in refining volumes. The surge in gold prices and lithium hydroxide production surpassing the decrease in refined gold production have resulted in robust export revenue growth. Over the five years ending in 2023-24, industry revenue is expected to grow at an annualized rate of 18.1%, reaching $52.9 billion. The significant increase occurred mainly in 2022-23 due to the rapid expansion of lithium hydroxide processing. With the decline in gold prices, the growth rate is expected to drop to 2.7% in 2023-24.

Australia's grain cultivation sector reported an export value of $25.7 billion in 2023. Australia's grain cultivation is export-oriented, producing wheat, barley, canola, and other grains and oilseeds. Fluctuations in income over the past five years have been influenced by weather conditions, global grain prices, and instability in crop supply. For the five years ending in 2022-23, income is projected to grow at an annual average rate of 17.3%, estimated to reach $27.7 billion. Due to Russia being a major producer of fertilizers and the conflict between Russia and Ukraine, fertilizer prices sharply rose in 2021-22, leading to a decline in industry profitability during this period.

Australia's meat processing sector reported an export value of $19.1 billion in 2023. The industry experienced a period of decline, with fluctuations in production due to the COVID-19 pandemic and occasional labor shortages restricting operations. Despite a significant downturn in exports to China in 2020-21 due to decreased demand, demand in export markets remained strong. Australian meat exporters found new markets, particularly in South Korea. However, just as export revenue recovered in 2021-22, increased import competition led to a shortfall in revenue for that year.

The export value for Australia's battery materials mining in 2023 is $16.4 billion. The significant increase in revenue from battery materials mining is attributed to battery manufacturers attempting to secure supplies to meet the growing demand. The continuous growth in demand for electric vehicles, particularly in China, has prompted global automakers to offer more electric vehicles. This has led to an increasingly tight supply of battery materials, driving demand for Australia's battery materials. Overall, over the past five years, industry revenue has grown at an annualized rate of 55.9%, reaching $16.9 billion. This growth was particularly pronounced in 2022-23, with a 198.6% increase driven by the soaring lithium export prices.

Australia's copper mining reported an export value of $8.2 billion in 2023. Over the five years ending in 2023-24, copper mining revenue is expected to grow at an annualized rate of 3.8%, reaching an estimated $9.8 billion. This robust growth is attributed to the rise in copper prices and strong demand from China for copper used in construction, communication, and manufacturing. With global copper demand increasing and production weakening, copper prices have risen. Highly developed economies, such as Japan, are also supporting demand growth by increasing domestic production. Australia is one of the world's major copper mining countries, ranking only behind Chile, Peru, China, the Democratic Republic of the Congo, and the United States.

Australia's lithium and other non-metallic mineral mining reported an export value of $8.1 billion in 2023. Over the five years ending in 2023-24, lithium spodumene ore (lithium ore) has become the dominant product in the lithium and other non-metallic mineral mining industry. While lithium spodumene ore is primarily exported to China for further processing, major mining companies have begun using it domestically to refine lithium hydroxide. Over the past five years, especially in the three years leading up to 2023-24, lithium spodumene ore production has increased. Although production has grown significantly, the surge in demand is primarily driven by price, as strong demand in the Chinese electric vehicle market and low lithium inventories drive world prices higher.

How to Utilize Customs Data to Understand the Australian Export Market?

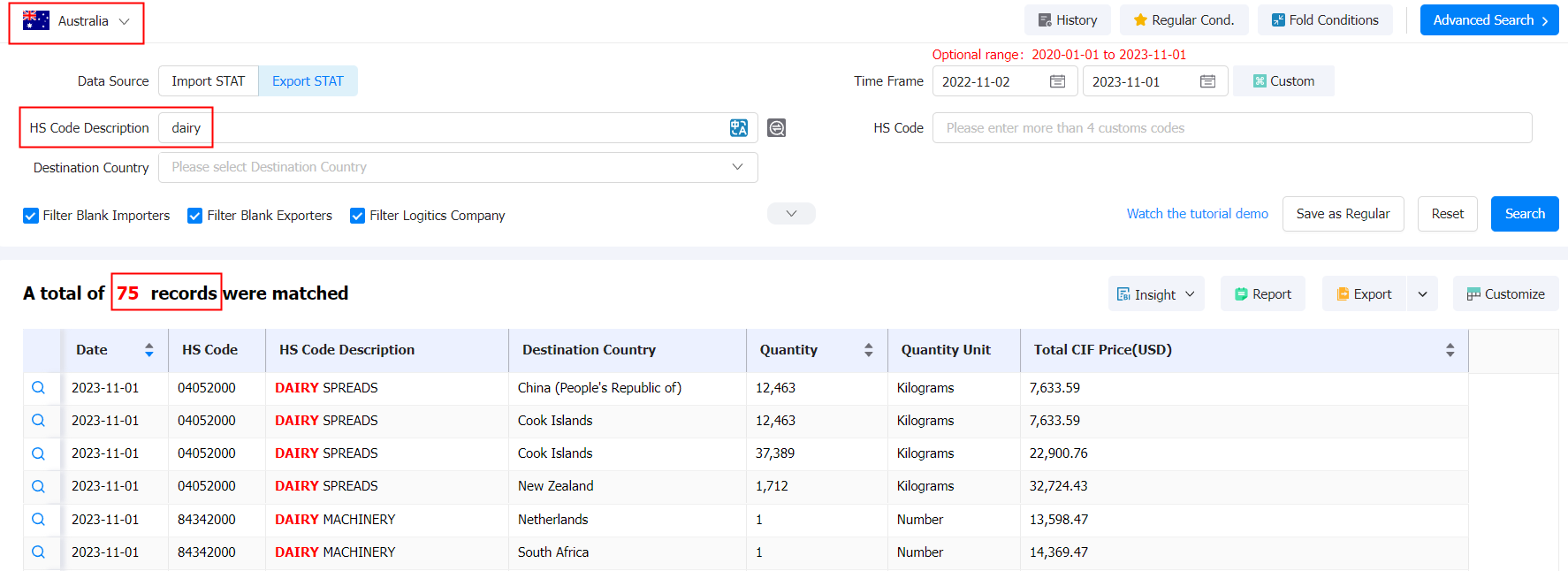

1. Choose an Appropriate Customs Data Platform: Utilize professional customs

data platforms, such as Tendata. These platforms typically provide trade data on

a global scale, including Australia's import and export scenarios.

2. Specify Your Interested Products and Industries: Identify the specific products or industries you want to understand. Australian export data is usually classified based on the Harmonized System (HS) code, an international product nomenclature. You can search for relevant HS codes to obtain more accurate data.

3. Select a Time Range: Choose the time frame of interest to examine Australian export data for specific periods. You can opt for annual, quarterly, or monthly data, adjusting according to your research needs.

Filter Export Destinations: Use the filtering features of the customs data platform to narrow down results to Australian export data. Choose specific countries or regions to discover where Australia exports its products the most.

4. Analyze Export Quantity and Value: Examine the quantity and value of Australian exports. Understand which products have the highest export volumes, identify key export destinations, and assess Australia's position in the global market.

5. Consider Trends and Changes: Analyze historical Australian export data to understand market trends and changes. Explore how demand from different countries or regions has evolved, and assess whether Australia is entering new markets or losing existing market share.

6. Focus on Trade Partners and Competitors: Investigate Australia's primary trade partners and competitors. Understand which countries are significant trade partners for Australia and whether products from other countries pose strong competition.

7. Obtain Detailed Information: Australian export data often provides detailed information about exported products, including specifications, value, quantity, weight, etc. This detailed information can help you gain deeper insights into the market.

8. Combine with Other Data Sources: Integrate Australian export data with other economic indicators, industry reports, and additional data sources to obtain a more comprehensive market understanding.

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship