Export News

Export News

26-02-2024

26-02-2024

Dairy Overview

· In the 2022/23 fiscal year, Australia's dairy product exports decreased by AUD 96.5 million (-3.0%), reaching AUD 3.07 billion, the third-highest recorded value to date.

· Record average export prices drove strong export values, characterized by a reduction in quantity.

· Global price slowdown and increased global production, combined with high Australian farm milk prices, are expected to result in a decline in Australia's dairy product export value for the 2023/24 season.

· Australia remains a net exporter of dairy products, ranking as the world's fifth-largest dairy product exporting country, constituting 4% of global trade.

Trade Performance in 2022/23

The trade performance of Australian dairy products in the 2022/23 fiscal year indicates an export total of USD 30.7 billion, a 3.0% decrease from the record USD 31.7 billion in the previous season but still the third-highest level recorded. In stark contrast, the total quantity of Australian dairy product exports slightly exceeded 400,000 tons, marking the lowest level in nearly 28 years. Meanwhile, Australia's milk production for the 2022/23 fiscal year was 8.14 billion liters, reaching the lowest total production level in almost 30 years. This constrained Australia's export surplus and propelled local farm milk prices to historic highs. Despite the impact of declining domestic production on exports, robust global dairy prices partially offset this effect, with global dairy prices reaching a 15-year high in the 2022/23 fiscal year, supporting the increase in export value.

Across various dairy product categories, there was a trend of low production but high-value exports. Powdered milk exports totaled just over 175,000 tons, the second-lowest level since 1995/96. However, the average export price reached a record level of USD 7,480 per ton, with a total value of USD 1.3 billion, the fourth-highest level on record. The export values of cheese and skimmed milk powder (SMP) in the 2022/23 fiscal year both reached the second-highest levels in nearly 28 years. However, the export quantities of cheese and SMP (approximately 128,000 tons each) were the second and fourth-lowest levels since 1995/96. The only dairy product showing an upward trend was whole milk powder (WMP). The average export price of WMP increased by 28.1% year-on-year, reaching a historic high of USD 9,095 per ton. However, WMP production reached the lowest level in nearly 28 years, totaling only 21,000 tons, with an export value of USD 192 million, the lowest since at least 1995/96.

Major Export Markets

Regarding major export markets, the ranking of Australia's top five dairy product export markets remained unchanged year-on-year. In fact, there has been no new market entering the top five for over 12 years. In the 2022/23 fiscal year, Japan and China were the only countries among the top eight dairy product export markets that experienced year-on-year growth.

China maintained a significant advantage in the Australian dairy product export market, ranking first for the sixth consecutive year. In the 2022/23 fiscal year, China purchased dairy products worth USD 1.11 billion, accounting for 36% of the total export value. This was a 1.1% increase from the previous year's record of USD 1.1 billion. In terms of value, skimmed milk powder represented 55% of Australia's dairy product imports to China. However, the increase in dairy product export prices did have some impact on China's imports, with milk imports declining by 56% year-on-year and solid food imports decreasing by 10%. Skimmed milk powder was the only dairy product to experience a year-on-year increase in sales, growing by 3.1% to a record 74,000 tons.

Japan became Australia's second-largest and most valuable dairy product market in the 2022/23 fiscal year, with a market share of 14%. Except for China and Japan, no other country has held the top two positions in over a decade. Despite the growth in demand for Australian dairy products in China, Japan's demand remained stable. Exports of dairy products to Japan grew by 9.5% year-on-year, reaching AUD 423 million. This was primarily driven by increased export value of cheese, accounting for 93% of the total value. However, export prices reached a historic high again, offsetting the lowest export volume in the past 20 years. Meanwhile, fresh milk imports to Japan decreased by 76% year-on-year, and solid food imports decreased by 13%. The average export price increased by 25%, resulting in an 11% year-on-year increase in cheese exports to Japan, reaching USD 395 million.

Indonesia has been Australia's third-largest and most valuable dairy product export market for the past ten quarters. In the 2022/23 fiscal year, the total value of Australian dairy products purchased by Indonesia was USD 251 million, a 2.8% decrease from the previous quarter's historic high. The average export price for all commodities reached historic highs, leading to a 42% year-on-year decrease in dairy product exports to Indonesia. Skimmed milk powder has consistently been the highest-value dairy product exported to Indonesia, and this did not change in the 2022/23 fiscal year, with skimmed milk powder accounting for 58% of the total value of dairy product exports to Indonesia. Although the total value of skimmed milk powder exports to Indonesia decreased by 7%, the export volume decreased by 27%.

Singapore and Malaysia followed a similar theme as the top five dairy product export markets. The total value of dairy product exports to Singapore decreased by 19%, reaching USD 168 million, a 17-year low. Malaysia's exports decreased by 25%, reaching USD 151 million, the lowest level in the past five years. In terms of quantity, Singapore's purchases of solid dairy products decreased by 35%, and liquid dairy product purchases decreased by 16%. Compared to the previous year, Malaysia's consumption of solid dairy products decreased by 36%, and liquid dairy product consumption decreased by 34%.

Outlook for 2023/24

It is expected that in the 2023/24 quarter, the total value of Australian dairy product exports will decrease. Exports are projected to decrease by approximately 20% year-on-year, approaching the 10-year average of USD 2.5 billion. The 2022/23 season was characterized by an increase in dairy product exports and a decrease in export value, with the outlook for the next season being less optimistic. Australian milk production is expected to decrease year-on-year, limiting the available export surplus. This means that dairy product exports will be similar to or lower than the previous quarter. The decrease in local production in 2022/23 resulted in historically high Australian farmgate milk prices. The reduction in global production pushed global dairy product prices to a 15-year high, but also maintained demand for Australian dairy product exports. It is expected that increased production in the European Union, the United States, and Argentina in 2023 will lead to global dairy product prices falling below average levels. As consumer purchasing power is weakened by inflation and the cost of living, export demand remains relatively subdued. Meanwhile, due to the small size of domestic inventories resulting from processor competition, Australian farmgate milk prices remain close to historic highs. Some export consumers' preferences for Australian products will continue to drive demand, especially for high-end products such as fresh milk, cheese, and butter. However, the high cost of Australian dairy products will affect export competitiveness. Global price downturn, sluggish export demand, and high Australian prices may lead to a decline in dairy product exports in the 2023/24 fiscal year.

Finding Australian Dairy Product Exporters

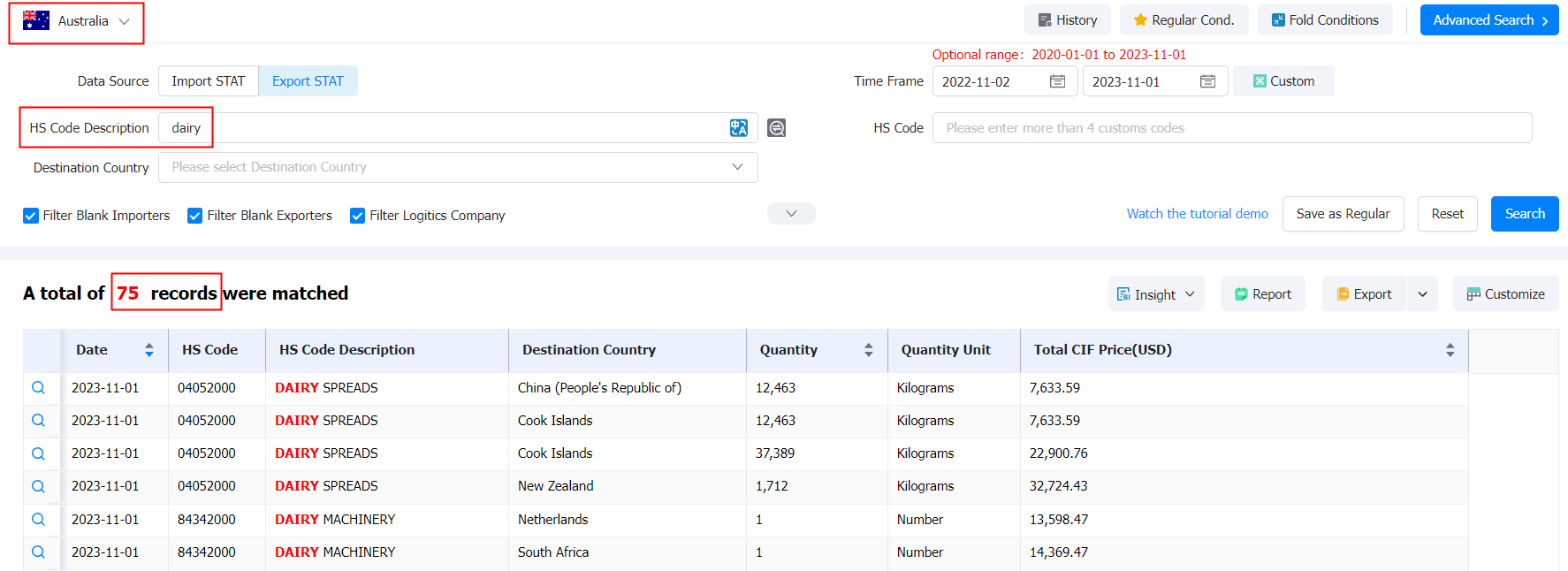

To use shipment data to find Australian dairy product exporters, you can follow these steps:

1. Use a Professional shipment data Platform: Utilize a professional shipment data platform, such as Tendata, which typically provides global trade data. On these platforms, select Australia as the trading country and input the specific product (e.g., dairy products) for your search. This will offer detailed information about Australian dairy product exporters.

2. Specify Product and HS Code: When querying shipment data, specify the exact dairy products you are interested in and understand the relevant Harmonized System (HS) code. This enhances the accuracy of your search, ensuring you obtain data directly related to your needs.

3. Filter Export Data: Use the filtering functionality on the shipment data platform to narrow down the search results to Australian export data. You can select specific time ranges, export products, exporter regions, and other criteria to refine the information further.

4. View Exporter Information: Shipment data platforms typically provide detailed information about exporters, including company names, contact details, export quantities, destination countries, and more. By examining this information, you can understand the scale and activities of Australian dairy product exporters.

5. Contact Exporters Directly: Once you have identified potential exporters through shipment data, reach out to them directly. This can be done through phone calls, emails, or social media. Use the information provided by the shipment data platform to connect with Australian dairy product exporters and inquire about potential collaborations.

By combining these methods, you can gather comprehensive information about Australian dairy product exporters and select partners that align with your requirements. Ensure you use reliable shipment data sources and thoroughly understand the background and business activities of exporters to make informed decisions.

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship