Trade Trends News

Trade Trends News

12-11-2024

12-11-2024

Import data reveals that Santa will deliver fewer Christmas trees, toys, and decorations to the U.S. this season than in previous years. Retailers, including Walmart (WMT.N), expect reduced sales of seasonal products as they prepare for a modest holiday season.

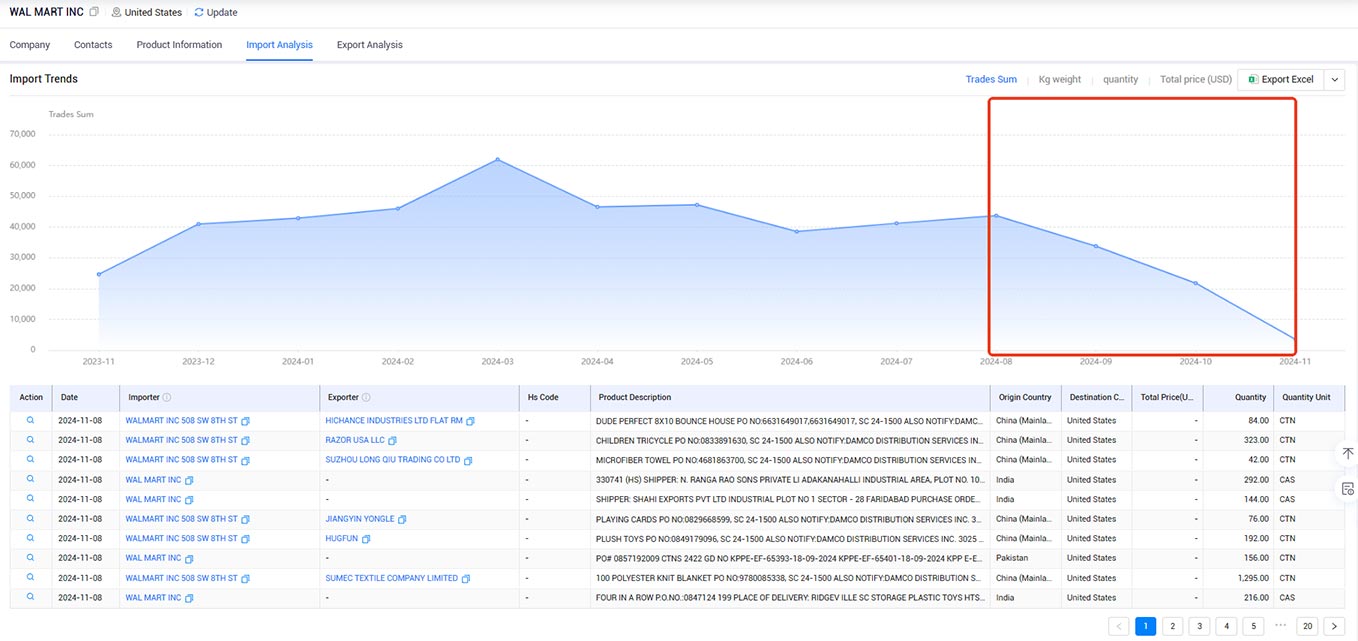

According to import data from the U.S., Walmart, the world's largest retailer, has significantly reduced its Christmas imports. In the 12 months ending September 30, Walmart shipped at least 340,000 kilograms of goods labeled "Christmas" to the U.S.

In the same period ending September 2023, Walmart nearly tripled its shipments of Christmas items, reaching approximately 980,000 kilograms. By comparison, in 2022, Walmart imported over 1.9 million kilograms of Christmas products, including reindeer ornaments and Grinch plush toys.

A Walmart spokesperson stated that import data from bills of lading "only partially reflects our purchasing strategy, as it excludes data from market sources, national brands, and domestic importers for private labels." Walmart executives are expected to provide a holiday season outlook when they report third-quarter earnings on November 19.

Walmart investor Sizemore Capital Management notes that Walmart regularly reviews consumer spending patterns, including credit card data. Chief Investment Officer Charles Sizemore observed, "They've conducted consumer research and concluded that holiday season sales may not be particularly strong."

While seasonal import data excludes electronics, apparel, or other general merchandise, the trend is “very clear,” Sizemore added. “If Walmart's orders are down, they anticipate slower sales.”

Retail consultant and former Target Corp. (TGT.N) executive Gerald Storch shared that retailers "expect holiday sales growth to be lower this year" and are planning accordingly.

"Consumers have less discretionary spending," Storch explained, adding that while total U.S. consumer spending may be increasing, "some commentators confuse total consumer spending (including necessities like housing or healthcare) with discretionary spending."

U.S. retail sales increased in September, supporting the view that the economy maintained strong growth in the third quarter.

DA Davidson analyst Linda Bolton Weiser remarked that this year's consumer environment is "far from robust," with Walmart's toy prices averaging $40.16 this season, down 10% from last year.

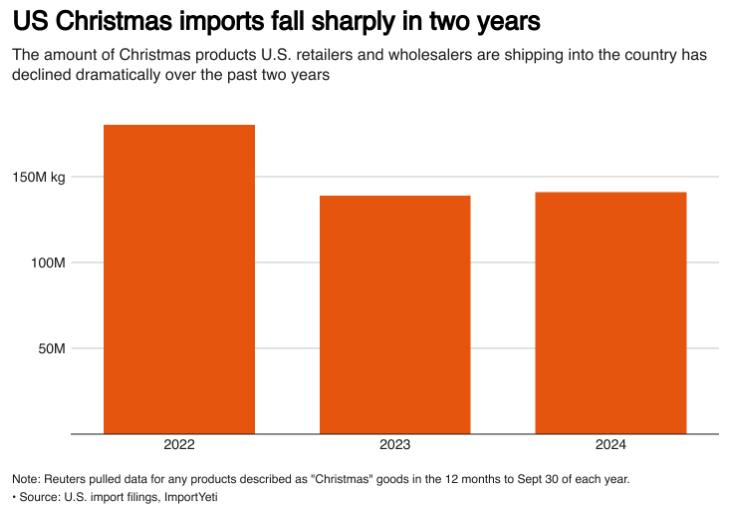

All U.S. companies, including retailers Walmart and Dollar General (DG.N), have imported similar weights of Christmas-related goods this year, but these weights represent a reduction of at least 20% compared to 2022, according to import data.

In the 12 months ending September 30, 2024, U.S. companies imported approximately 141 million kilograms of goods labeled "Christmas" on their import data documents, a declaration required when bringing goods into the country.

During the same period in 2022, companies imported roughly 180 million kilograms of Christmas goods, reflecting a 22% decrease this year.

The National Retail Federation (NRF), led by Walmart U.S. executive John Furner, projected in October that holiday spending in the final two months of this year would increase by only 2.5–3.5%, marking the slowest growth rate since 2018, when holiday sales rose 1.8%. U.S. retailers are also expected to hire fewer seasonal workers this holiday period.

Retailers usually place orders for Christmas imports months in advance, and these items arrive throughout the year.

Big retailers, such as Walmart, aim to avoid excess inventory as seen in recent holiday seasons. Overstocking is highly costly, and investors view it as a negative sign for retail companies.

Retailers typically purchase goods wholesale from third-party sellers and suppliers, "ordering cautiously to keep lean inventories without the need for markdowns to clear excess stock," explained Dana Telsey, an analyst with Telsey Advisory Group.

To clarify, import data only reflects goods imported to the U.S. Retailers also source items from domestic suppliers and local importers.

Craig Johnson, president of retail consulting firm Customer Growth Partners, noted that it's challenging to draw conclusions solely from holiday import data. “A reduction in imports of Christmas decorations and toys doesn't necessarily mean a sluggish season,” Johnson stated. He expects U.S. holiday sales to grow by 4% this year, slightly lower than last year's 4.1% increase.

Do you want to know more about Import Data? Follow Tendata for the latest news on the global economic landscape and import-export data worldwide.

Tendata iTrader boasts customs data from over 100 countries, commercial data from 198 countries, and a database of 130 million plus buyers. Tendata iTrader processes a rolling 10 billion daily trade data, enabling swift and intelligent filtration of contact details for 121 million executives and decision-makers, including emails, phone numbers, social media, and more. Additionally, Tendata iTrader can simultaneously display company directories, product images, and website links, while offering 17 visual reports. This assists foreign trade enterprises in pinpointing and analyzing markets accurately, helping you swiftly identify the precise purchasers and suppliers you need. (>>>Click to Apply for Free Trial<<<)

Step One: One-Click Search for Your Global Prospects

Tendata iTrader seamlessly integrates customs data from 100+ countries, commercial data from 198 countries and regions, and internet data from 141 countries. A single search yields global target clients in 0.01 seconds without waiting. (>>>Click to Find Global Buyers<<<)

Step Two: Rapid Analysis to Identify Your Target Clients

The comprehensive customer information provided by Tendata iTrader assists us in analyzing detailed buyer information and furnishing extensive personal contact details of executives. This information is a highly valuable sales asset.(>>>Click to Analyze Your Target Clients<<<)

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship