Export News

Export News

03-09-2024

03-09-2024

Southeast Asia, with a population exceeding 650 million, is a region where over half of the population is under 30 years old. The rapid economic growth in this region means that millions of young people in Southeast Asia are increasingly able to experiment with newer and more trendy consumer products. This creates a vast potential market for foreign trade, waiting to be explored.

Southeast Asia consists of 11 countries: Indonesia, Vietnam, the Philippines, Singapore, Malaysia, Thailand, Brunei, Laos, Myanmar, Cambodia, and East Timor. In recent years, the most popular markets have been Indonesia, the Philippines, and Vietnam. Today, we will focus on these three markets.

01. Indonesia

Indonesia, the largest economy in ASEAN, has maintained a consistent economic

growth rate of 5%. Agriculture, industry, and services all play vital roles in

the national economy, making Indonesia one of the most important and dynamic

markets in Southeast Asia for foreign trade.

With a population of 270 million, Indonesia is the fourth most populous country in the world, and its median age of 30 years provides a large workforce and a young consumer base, supporting broad market demand. Rich in natural resources, Indonesia ranks tenth globally in coal reserves, is the world's leading exporter of thermal coal, and has significant oil and nickel reserves, laying a solid foundation for energy and manufacturing industries.

As the largest archipelagic country, composed of 17,508 islands, Indonesia's unique location offers vast marine resources and excellent transportation conditions, facilitating the marine economy and foreign trade. Additionally, the government actively promotes economic reforms and infrastructure development, improving the investment environment and attracting substantial domestic and foreign investment. Indonesia's diversified industrial structure enhances economic stability and resilience, making it a crucial market for foreign trade.

The market potential in Indonesia is evident and should not be overlooked by those engaged in foreign trade.

According to Chinese customs data, from January to July 2024, bilateral trade between China and Indonesia amounted to $80.498 billion, a year-on-year decrease of 1.7%. China's exports to Indonesia totaled $41.524 billion, up 10.5% year-on-year, while imports from Indonesia reached $38.975 billion, down 8.3%.

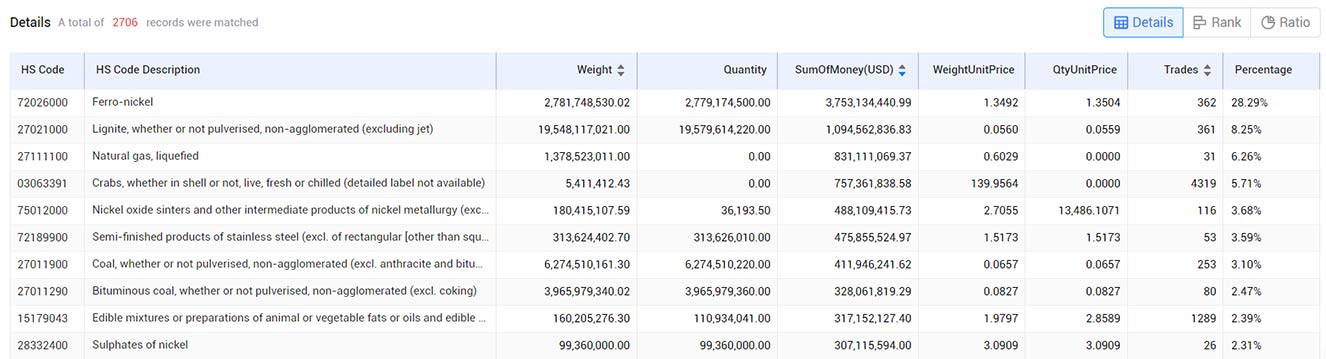

Tendata shows that in the first seven months of 2024, nickel pig iron dominated Indonesia's nickel product exports to China, with exports reaching 726,000 tons in July alone. Other nickel products, such as ferronickel and high-grade nickel, also saw strong exports.

In July, Indonesia's total nickel exports to China amounted to 877,000 tons, accounting for 91.88% of China's nickel imports, far surpassing other countries and once again demonstrating the close cooperation between China and Indonesia in the nickel resources sector. This close relationship highlights the significant opportunities for foreign trade in this market.

>>>Get A Free Demo From Tendata<<<

Indonesia's Top 20 Export Categories to China, Jan-Jul 2024

02. Vietnam

The Vietnamese market has shown strong economic growth and significant

development potential in recent years. As an important economy in Southeast

Asia, Vietnam offers abundant natural resources and a large consumer market, and

it continues to improve its policy environment, creating favorable conditions

for businesses to expand internationally, particularly in foreign trade.

Let's first look at two key data points.

(1)Economic Growth

The COVID-19 pandemic caused significant disruptions to the global supply chain, leading to historical economic downturns in many major economies, with negative GDP growth becoming common. However, in 2020, Vietnam managed to achieve nearly 3% GDP growth, making it one of the few Asian economies, along with China, to post positive growth. That year, China's GDP growth was 2.3%, slightly lower than Vietnam's 2.9%.

In 2023, Vietnam's GDP reached $433.7 billion, ranking 35th globally and fifth in ASEAN, just behind Indonesia, Thailand, Singapore, and the Philippines. With a real growth rate of 5.1%, Vietnam ranked 8th globally and 2nd in ASEAN, making it an attractive market for foreign trade.

(2)Export Growth

According to Chinese customs data, from January to July 2024, bilateral trade between China and Vietnam amounted to $145.067 billion, up 17.3% year-on-year. China's exports to Vietnam reached $91.171 billion, an increase of 18.2%, while imports from Vietnam totaled $53.86 billion, up 15.7%.

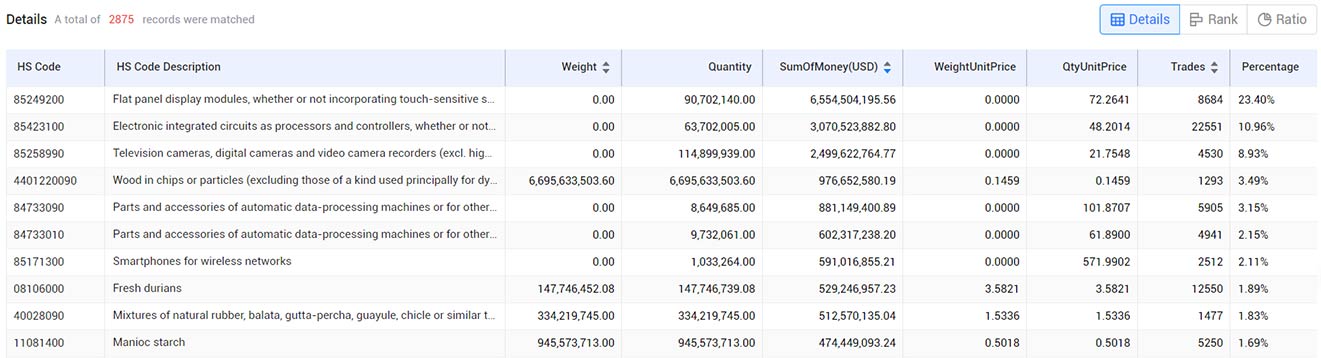

Tendata's data on Vietnamese imports shows that in the first seven months of this year, China remained Vietnam's largest import market, with a diverse range of goods, including machinery, electronic components, fabrics, footwear, and raw materials for textiles. These figures underscore Vietnam's importance as a key destination in foreign trade.

>>>Schedule A Demo From Tendata<<<

Categories of goods exported from Vietnam to China, January-July 2024

03. Philippines

The Philippines is ASEAN's third-largest economy, with its economy growing by

5.6% in 2023, outpacing major Asian economies like China (5.2%), Vietnam (5.0%),

and Malaysia (3.8%). Its nominal GDP reached $436.6 billion.

With a population of over 112 million, the Philippines is the 13th most populous country in the world and the second most populous in Southeast Asia. The country has a large, young population, and high population density. Most young people choose to live and work in major cities, where they have strong purchasing power and a significant impact on the market. The combination of a young population and a thriving e-commerce industry makes the Philippines an attractive market in Southeast Asia for foreign trade.

According to Kepios data, the Philippines had 86.98 million internet users as of January 2024, with an internet penetration rate of 73.6%. From January 2023 to January 2024, the number of internet users in the Philippines increased by 1.8 million, or 2.1%. This high level of internet penetration presents significant opportunities for foreign trade, especially for digital products and services.

Many Chinese entrepreneurs have already recognized the potential of the Philippines and have established businesses there. They see the Philippines as a stepping stone to expand into other Southeast Asian countries, much like opening new markets and expanding their business footprint. For them, the Philippines is not just a platform for growth but also a bridge to broader markets, making it a strategic focal point for foreign trade.

According to Chinese customs statistics, from January to July 2024, bilateral trade between China and the Philippines amounted to $41.155 billion, a decrease of 1.7% year-on-year. China's exports to the Philippines totaled $30.486 billion, down 1.6%, while imports from the Philippines reached $10.669 billion, down 2.2%.

Tendata's data shows that from January to July 2024, the Philippines mainly imported products from China, including mechanical and electrical products, steel, high-tech products, textiles, plastics, and toys. This trade flow highlights the Philippines' role as a significant partner in foreign trade.

>>>Get Global Import Export Data Online<<<

Categories of Philippine Exports to China, January-July 2024

How Can Exporters Tap into the Southeast Asian Foreign Trade Market?

Tendata offers exclusive import and export data for Indonesia, the Philippines, and Vietnam, helping you gain deeper insights into the Southeast Asian market, identify its demands and growth points, and efficiently develop clients, making it an essential tool for foreign trade.

01. Quickly Identify Key Markets

Wondering which countries have the highest demand for your products? With Tendata's iTraderSaaS platform, you can simply enter your product's name in English to instantly see market trends, analyze popular import countries, and assess transaction quantities, weights, and values. This feature is particularly valuable for foreign trade professionals.

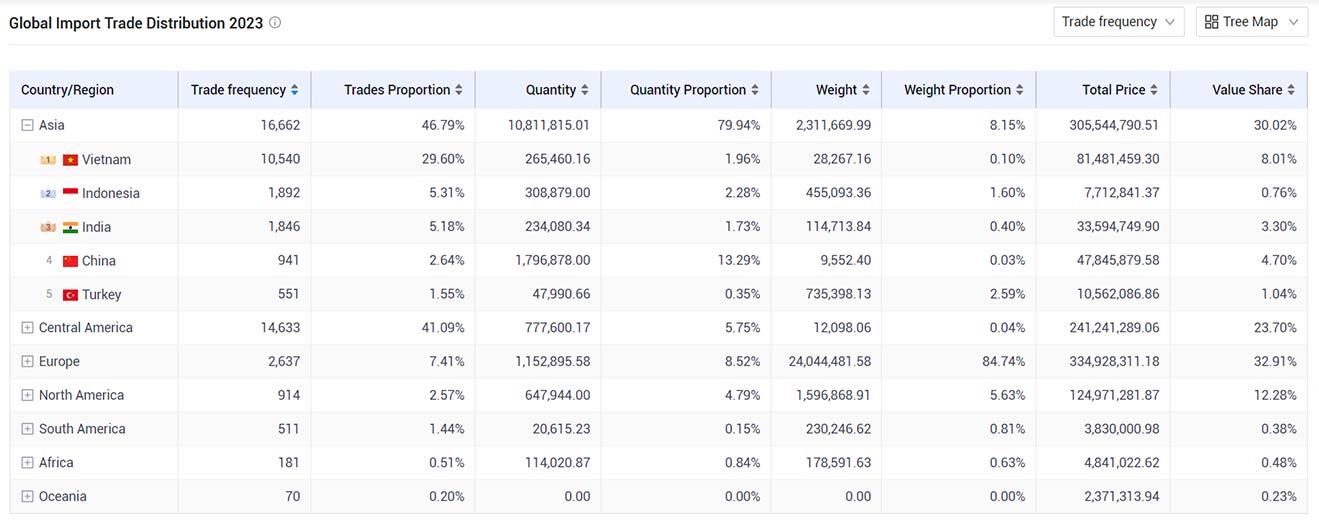

For example, in the global die casting mold import market, Tendata data analysis reveals that Vietnam, Indonesia, India, and Turkey are becoming popular import destinations, offering new opportunities in foreign trade.

>>>Contact Tendata Now<<<

Analysis of the share of global importing countries

02. Improve Quotation Success Rates

Pricing is a common challenge in foreign trade. Finding the right balance between leaving room for negotiation and staying close to the client's ideal price can be tricky.

Tendata's iTraderSaaS platform allows you to track quarterly average price fluctuations across different export countries. This helps you anticipate market trends and provides solid data to inform production and sales decisions, enhancing your competitiveness in foreign trade.

By comparing the average price changes across different quarters, you can identify seasonal fluctuations and long-term trends, aiding in predicting future prices and supporting procurement decisions, which are crucial for foreign trade success.

>>>Click to Check More Import And Export Information from Tendata<<<

03. Efficiently Discover Valuable New Clients

Using Tendata's iTraderSaaS platform, you can simply input product keywords to instantly access a list of buyers, including high-value clients with significant recent purchasing activity. This allows you to focus resources on key customer acquisition and retention efforts, streamlining your foreign trade operations.

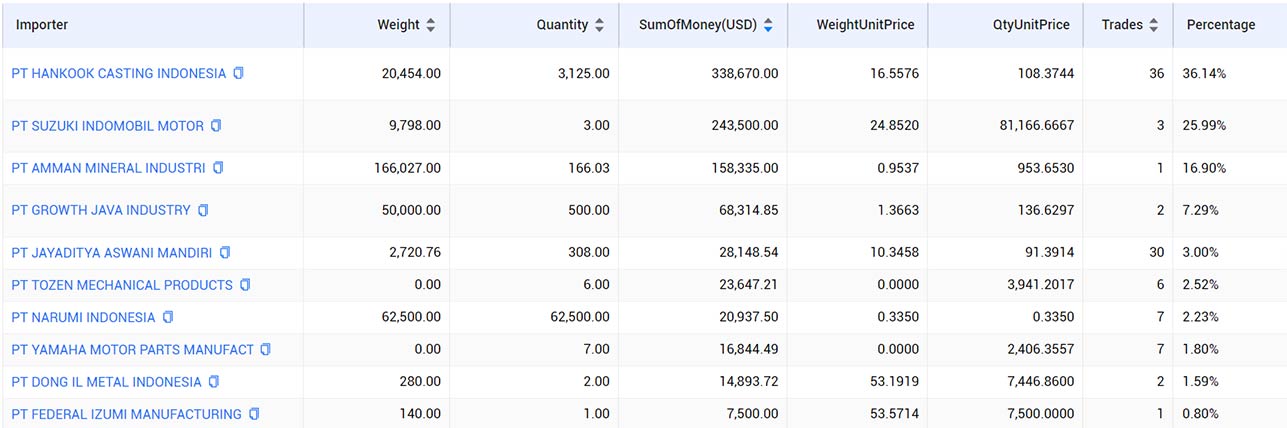

Indonesia Precision Buyers List

>>>Click to Request A Free Demo - Quick Find Potential Customers<<<

With Tendata, you can continuously track and analyze competitors' transaction records and monitor their trading activities. This enables you to keep abreast of any changes in your competitors' operations, helping you identify opportunities and avoid risks, which is vital for thriving in the competitive world of foreign trade.

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship